Five questions on the pension charges cap

Some people have been charged thousands to get their pension freedom savings

How much are pension charges? Why does there need to be a cap?

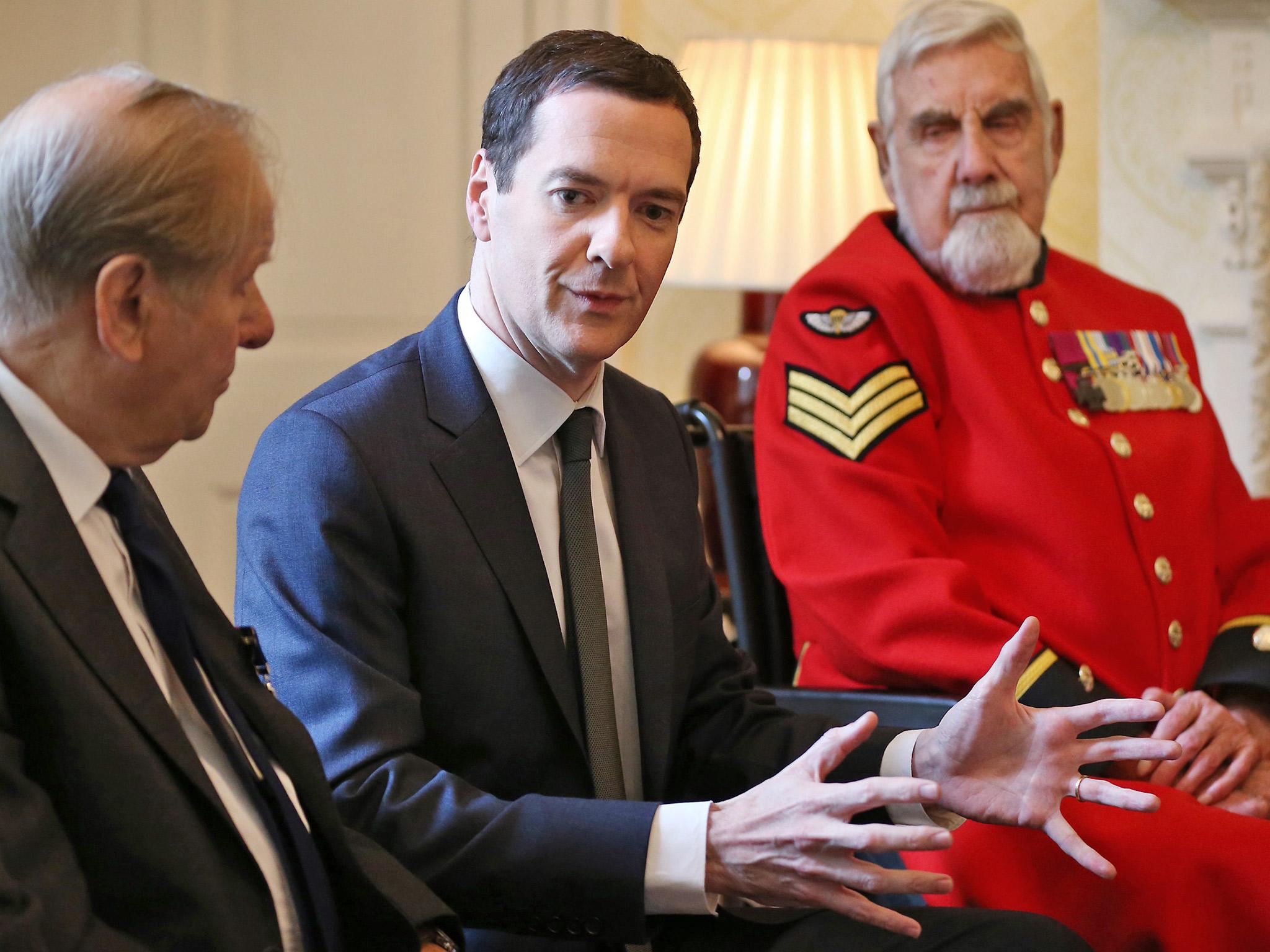

They’re excessive, according to the Chancellor. George Osborne told the House of Commons on Tuesday: “The Government isn’t prepared to see people either ripped off or blocked from accessing their own money by excessive charges.” Financial Conduct Authority investigations revealed that 670,000 consumers aged 55 or over faced an early exit charge. Of these, 66,000 faced charges above 10 per cent.

What does he plan to do about it?

He’s going to force the City watchdog (the FCA) to ensure firms don’t rip off consumers with extortionate exit charges on those taking advantage of pension freedoms. “We’ve listened to the concerns … and we will change the law to place a duty on the FCA to cap excessive early exit charges for pension savers,” he said. “We’re determined that people who’ve saved responsibly can access their pensions fairly.”

When will it happen and what will the cap be?

We don’t know yet but it is likely to be by this summer.

What did campaigners say?

The move was widely welcomed. Tom McPhail, head of retirement policy at Hargreaves Lansdown, said: “Hundreds of thousands of pension investors currently face charges and restrictions if they want access to the pension freedoms or to transfer their money to a new pension arrangement. In some cases these penalties can run to hundreds or even thousands of pounds. This kind of financial bondage has no place in the 21st century.” Nutmeg chief executive Nick Hungerford said: “Early exit charges are often unnecessary, and a sly way to make money from customers.”

What will happen next?

The new duty, introduced through legislation, will form part of the response to the Government’s “Pension Transfers and Exit Charges” consultation. The Government will shortly publish its formal response to the consultation.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments