Fears grow for a year of squeeze

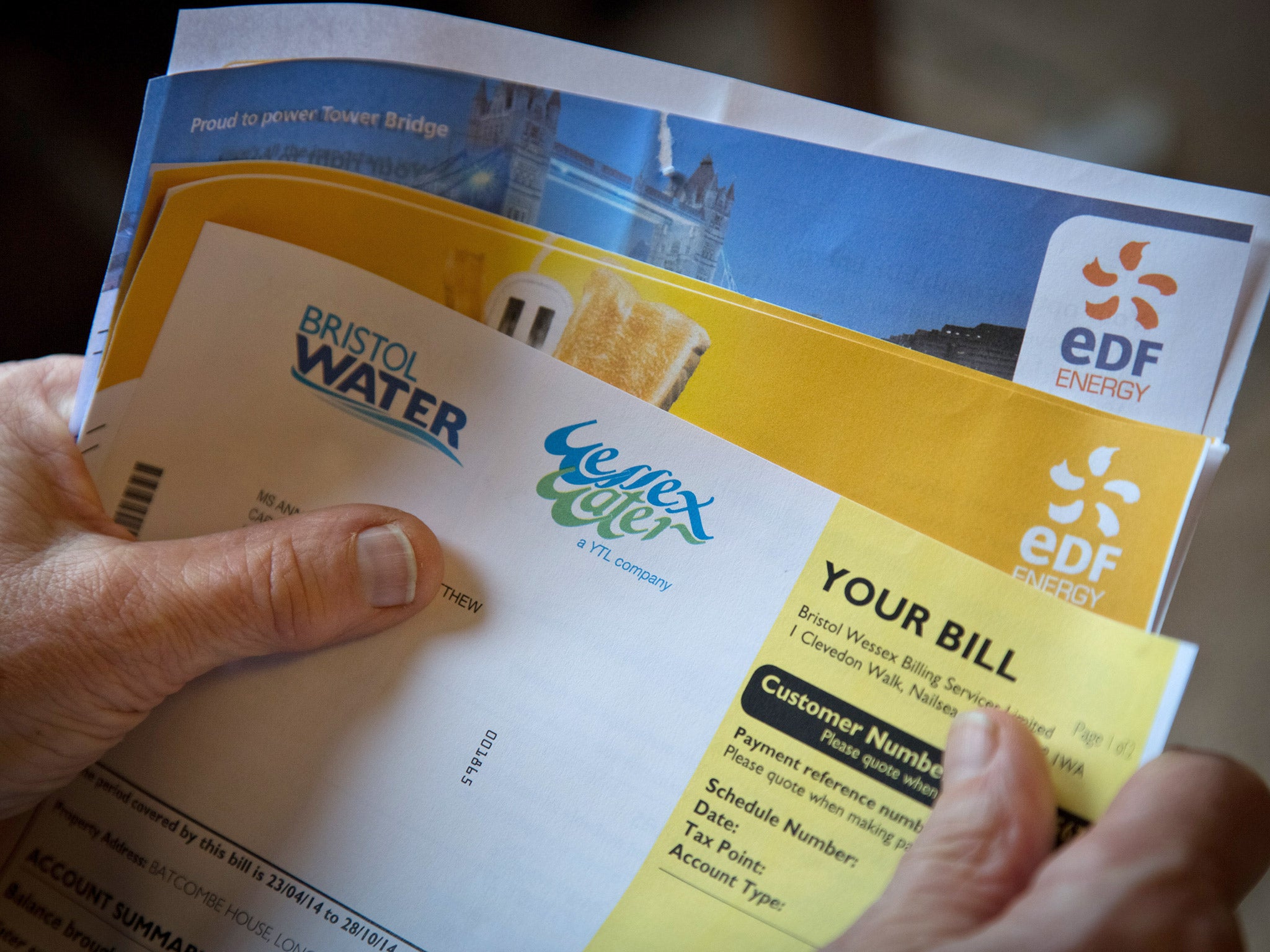

2016 was the year of soaring household bills. Should we be prepared for more of the same this year?

If you thought you were feeling the pinch in 2016 then you were right; household bills climbed by almost 10 per cent across the year. New research from comparethemarket.com has shown that, while bills dropped in 2015, they rose by an average of 9.7 per cent last year, meaning the average home now pays £2,223 on energy, motor and home insurance.

Some of those price rises are easily explained; car insurance rose by an average of £96 as insurance premium tax was hiked. However, some stick in the craw like the news that the average energy bill rose by almost £100 to £1,383 last year, despite a fall in wholesale costs.

Add to that any Christmas debt and many households will be starting the new year feeling like their household finances are worse off than before.

Simon McCulloch, director of the website comparethemarket.com, commented: “This rise in the cost of bills is pretty devastating news for consumers who will inevitably be feeling significantly harder up as we go into 2017. Despite the fall in wholesale energy prices, the falling pound, caused by the Brexit vote, has made importing energy more expensive. Inevitably, the higher costs are being passed straight on to the consumer, adding almost £100 to people’s annual energy bill.

“On top of this, the government’s increases in insurance premium taxes has meant average premiums have hit record highs and are showing no sign of slowing down.

Household bills aren’t the only rising costs. Already this year train fares have risen by an average of 2.3 per cent, the highest hike in three years. The campaign group Action for Rail reports that workers in some parts of the country will now be spending 14 per cent of their income on a monthly season ticket.

For renters, 2016 saw a slow in rent rises but many analysts predict that the cost of renting will climb much faster this year. John Goodall, CEO of Landbay, says: “The fall in rents is unlikely to last, and we expect the tide will turn in 2017.

“A new stamp duty levy, tighter affordability controls…and the removal of mortgage interest tax relief all look likely to restrict the supply of rental housing in 2017, and tenants will have little choice but to compete for what properties are on offer. As a result we expect rents to rise faster than the pace of inflation next year, with growth tripling to 3 per cent by the end of 2017.”

Testing stress

These rising costs do nothing for the state of the nation’s wellbeing. A recent survey from MoneySuperMarket showed that more than 11 million people -22 per cent of the population – say daily money worries are their main cause of stress.

Financially stressed adults report a range of emotional distress as a result, ranging from feeling panicky and overwhelmed to disappointed and exhausted. Worryingly, 41 per cent of UK adults believe that they will experience more financial anxiety in 2017, with just under a fifth citing the rising cost of living as the main reason for their stress – the other key reasons were Brexit fears, political uncertainty and benefit cuts.

The spectre of inflation also looms large on the horizon. Kevin Pratt, consumer affairs spokesperson at MoneySuperMarket, says: “Many pundits expect inflation to rise in 2017, perhaps as high as four per cent, so this New Year is definitely a good time to review your finances and work out whether you can make any changes to save money on your household bills.”

That’s the good news story in this; most households could save enough to offset rising costs by simply looking at their bills a bit closer.

Grabbing the bills by the horns

It’s probably the most commonly given financial advice but that is because it is true; many people could save hundreds of pounds a year by shopping around for their household bills but many simply don’t.

Loyalty – or should that be apathy – stops people from finding the best deals, even when they could save hundreds or potentially thousands of pounds. For example, if you’re on a standard tariff then you could potentially save hundreds by switching to a more competitive deal, even if you don’t change suppliers.

Homeowners on their lender’s standard variable rate could save by re-mortgaging to a cheaper rate and potentially even own their home sooner. And it’s all too easy to let insurance products roll on without comparing or switching, which can mean paying far more than is necessary.

Hannah Maundrell, spokesperson for the website money.co.uk, explains: “If you’ve stuck with the same company for years it’s likely they’re quite literally taking you for a ride. Loyal customers never get the best premiums so shop around. Even if you want to stay where you are it’s worth checking what you could pay for equivalent cover elsewhere and then using this to haggle your existing company down.”

And working harder to cut food costs can be a big, easy savings win. The campaign organisation Love Food, Hate Waste, estimates that the average household wastes £470 a year chucking out food that could have been eaten, rising to £700 a year for a family with children.

Staying on top of food waste by making meal plans and eating up leftovers would more than offset rising costs for a lot of households, without comparing and switching a single bill.

Simon McCulloch adds: “There is hope yet for bill-weary consumers, when you consider that the average person can save around £300 on their energy bills by switching and could also cut around £250 on average by changing motor insurance provider. After such a devastating increase in costs, it is essential that consumers take back control of their bills.”

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks