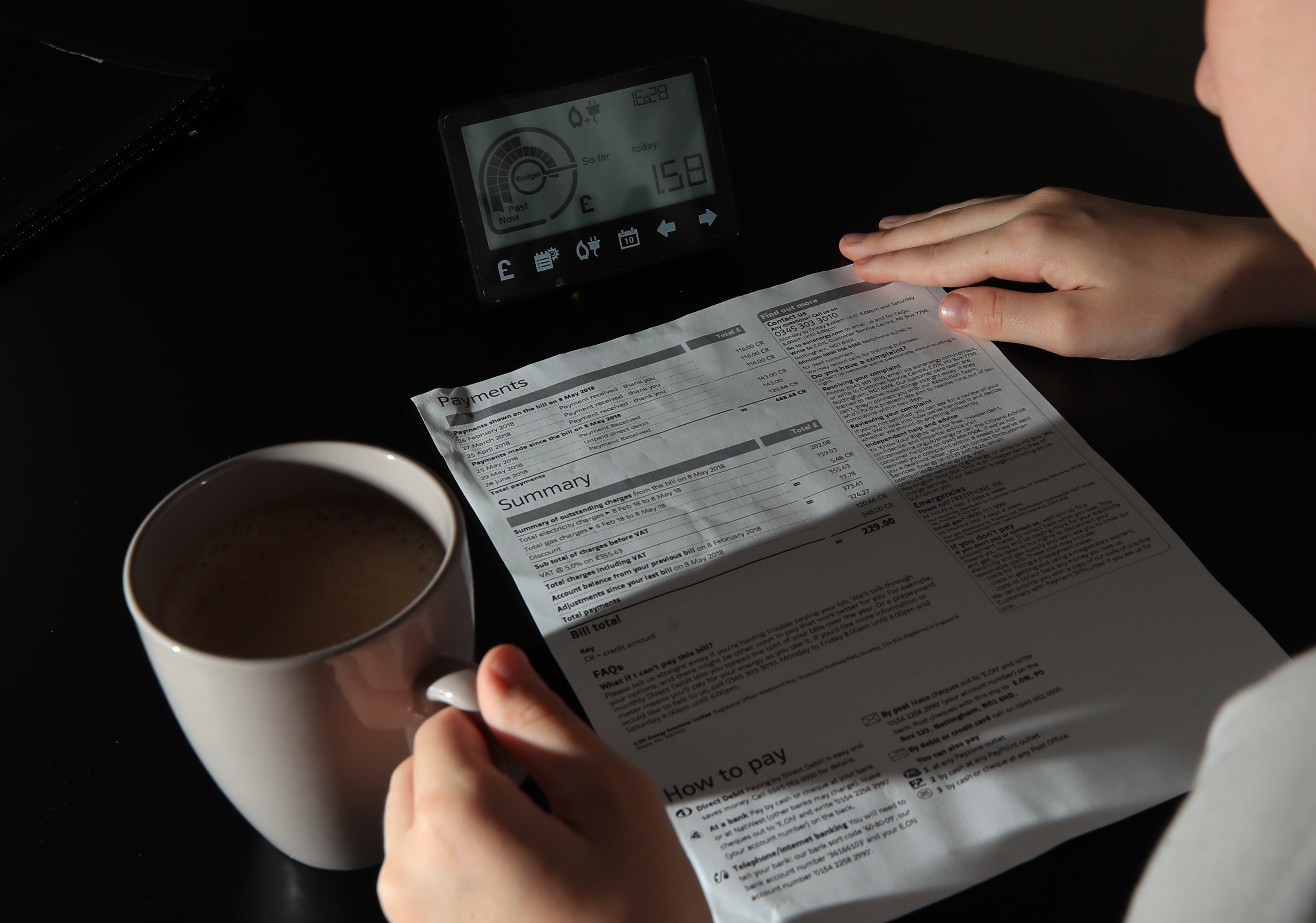

Energy bills could be higher than mortgage payments next year, say experts

Many people are set to see their disposable incomes shrink significantly in 2023 with utility bills catching up with mortgages.

Households could see their fuel bills cost more than their monthly mortgage payments next year as energy prices skyrocket, energy consultants have warned.

Many people are set to see their disposable incomes shrink significantly in the new year with some seeing the cost of their utility bills catching up with, or overtaking, their mortgage.

Energy prices could spike at as much as £6,823 per year for the average household from next April, according to the latest forecast by energy consultancy Auxilion, which amounts to about £569 a month.

In comparison, the average bill in October 2021 was £1,400 a year.

Homeowners with fixed-rate mortgages pay £741 a month on average, according to the latest data from trade body UK Finance, compiled in December.

That means homeowners could see just a £172 difference in the cost of paying their mortgage and heating their home.

For those with a standard variable rate (SVR) mortgage, the figures are even starker.

The average SVR mortgage monthly repayment, which borrowers can be transferred to once their fixed or tracker mortgage deal comes to an end, amounts to £516, UK Finance said.

That means that some households could end up paying £53 more on their utility bills than their mortgage as runaway energy prices overtake the cost of owning a home.

It’s becoming increasingly clear that skyrocketing prices will swallow up all of the help that has been announced so far

Meanwhile, people tied to a tracker mortgage, which directly track the Bank of England’s base rate, will see around £50 added to their typical costs, according to calculations by the trade body.

And renters are set to face even more drastic mounting costs amid the cost-of-living crisis.

Rents have spiralled over the past few years and the average monthly cost of a newly let property reached £1,166 in July, or £2,008 for Greater London, according to figures from estate agents Hamptons.

Such rapid price growth means that the average two-bed home, at £1,068pcm, now costs what the average three-bed cost just 16 months ago. While the average one-bed, at £929pcm, is now worth what the average two-bed cost two years ago, Hamptons said.

The combined effect of higher mortgage repayments or monthly rent and surging bills could put some people under serious financial pressure in the months ahead.

Several high street banks have set aside hundreds of millions of pounds to prepare for an increase in customers defaulting on their loan repayments.

Lloyds Banking Group said it had put aside £377 million to cover loan losses, while Barclays reported it set aside £341 million in July as the economic outlook worsened.

Charities have warned that many people could face hardship during the colder months of the year when they may be forced to choose between “eating or heating”.

Citizens Advice said that a quarter of people in the UK will not be able to afford to pay their energy bills in October based on current forecasts, jumping to a third of people in January when prices will soar higher.

It said its analysis took into account the energy rebate and cost-of-living payments offered by the Government, showing that the support on offer does not go far enough to protect households from spiralling costs.

Dame Clare Moriarty, chief executive of Citizens Advice, said: “Every single day at Citizens Advice we’re already helping people in the most heart-breaking circumstances, trying to scrape together enough to feed their kids and keep the lights on. This will get far, far worse unless the Government acts.

“It’s becoming increasingly clear that skyrocketing prices will swallow up all of the help that has been announced so far.”

Furthermore, disability charity Scope said that disabled people are likely to be harder hit when October’s energy price hikes come into force.

“Scope has been inundated with calls from disabled people who have been forced to make dire cutbacks on personal care, hygiene, food and energy because of rampaging inflation,” said Tom Marsland, policy manager at Scope.

“This is having a devastating impact on disabled people’s lives, and the support from Government just won’t touch the side.”

Scope said it had heard from people who are forced to stop heating their homes to power lifesaving equipment and others who are skipping meals so their children can eat, the charity told the PA news agency.

It also noted that referrals to its disability energy support service had increased five-fold between February and July, compared to the same period last year, partly because of rising costs.