Budget 2016: The winners and losers

While wealthy married pensioners had the most to celebrate, the Budget offered little for society’s lowest earners

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.There are millions of potential winners from the Budget announcement. You simply need to be a taxpayer to – at least on the face of it – be better off as a result of George Osborne’s further tinkering with the tax system.

In short, he has raised the tax thresholds, which means you can earn more money that you pay no tax on. For middle-income earners, Mr Osborne has raised the 40 per cent threshold for the first time in years.

However, the changes won’t come into effect until April 2017, which means you’ll have to wait another year to benefit from the rise in the basic-rate tax threshold to £11,500 and the rise to £45,000 before you have to pay 40 per cent tax.

HM Revenue & Customs reckons the changes will give an average tax saving of £56 to a basic-rate taxpayer and £233 saving to a higher-rate taxpayer from April 2017.

But the changes, allied with the new handout from the lifetime Isa, could give middle-earners aged under 40 an effective boost of £1,125 a year to put towards a property deposit or pension.

David Kilshaw, private client services partner at EY, explains how: “The rise in the personal allowance will reduce the tax bill for those paying a higher rate, saving them £200. The increase in the higher-rate threshold alone will save the higher-rate taxpayer £300. For a middle-earner who receives £1,000 of other income from property or from trading, there could be a further saving of £400.”

For those under 40, that £900 could become £1,125 if invested in a new Lifetime Isa, he pointed out.

Other handouts that could boost your income include a halving in the Severn Bridge toll, which is great news if you are a regular visitor to Wales.

But the sweet-toothed and smokers have been hit with a 2 per cent above inflation rise in tobacco duty from 6pm last night and a new sugar tax on soft drinks from 2018.

Meanwhile, most households will be hit by the extra 0.5 per cent added to insurance premium tax. Rough calculations suggest that will add just under a tenner to the average household with car cover and home insurance.

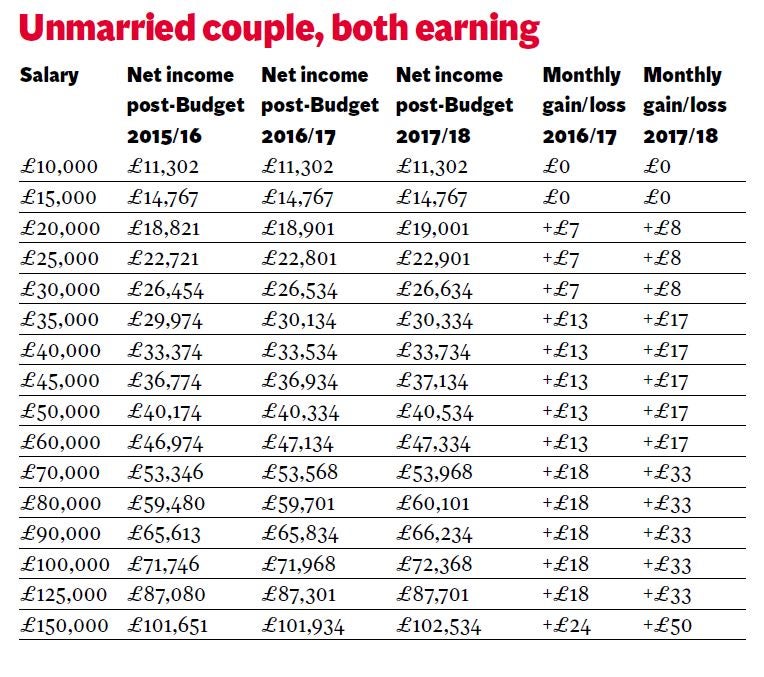

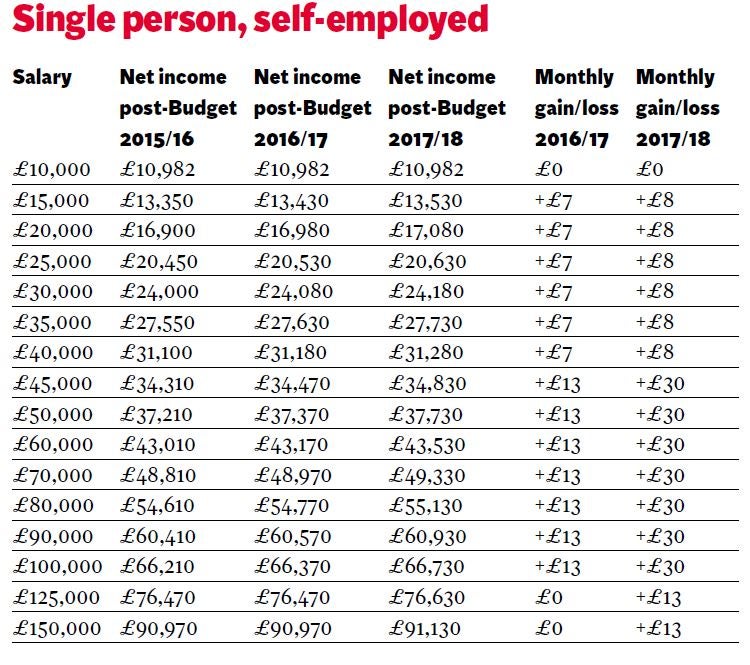

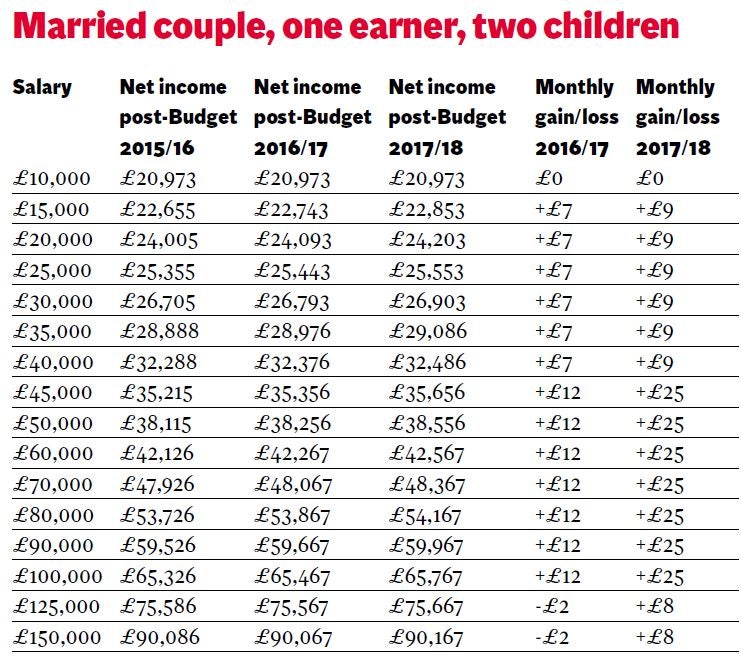

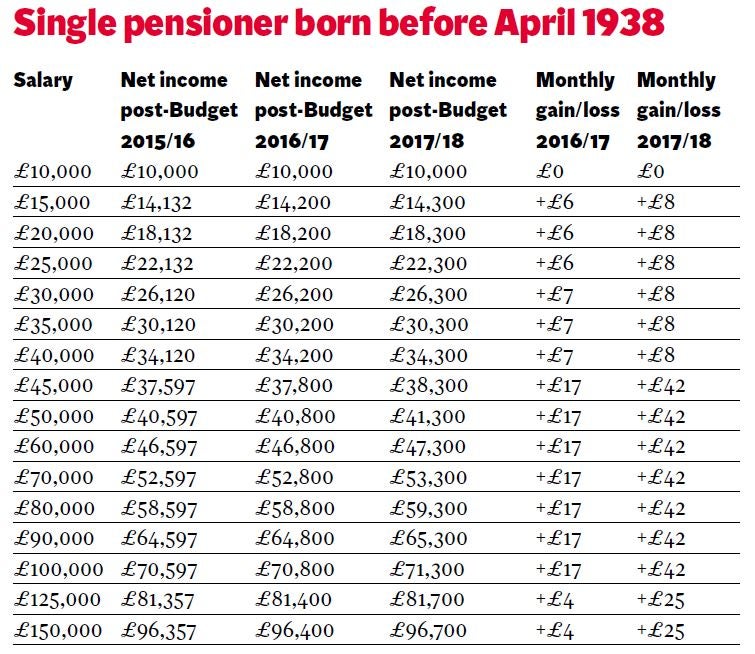

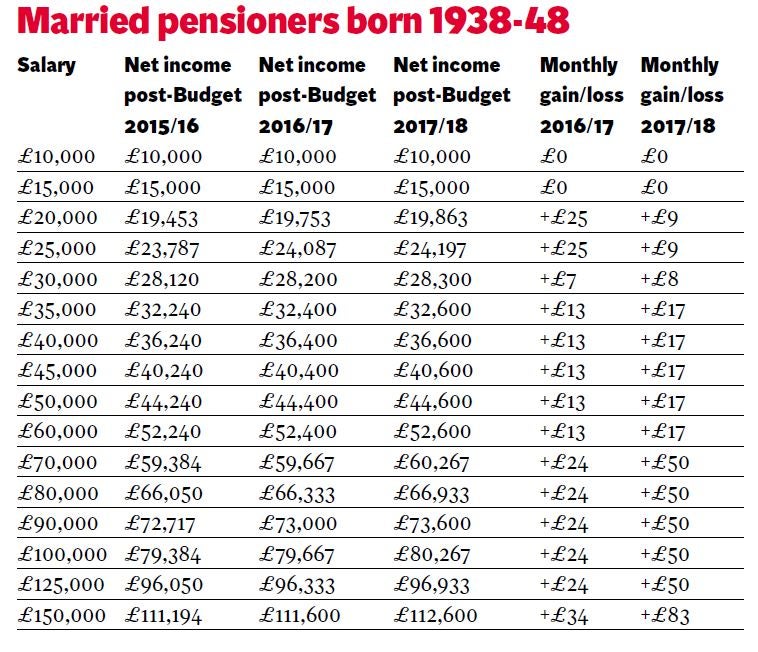

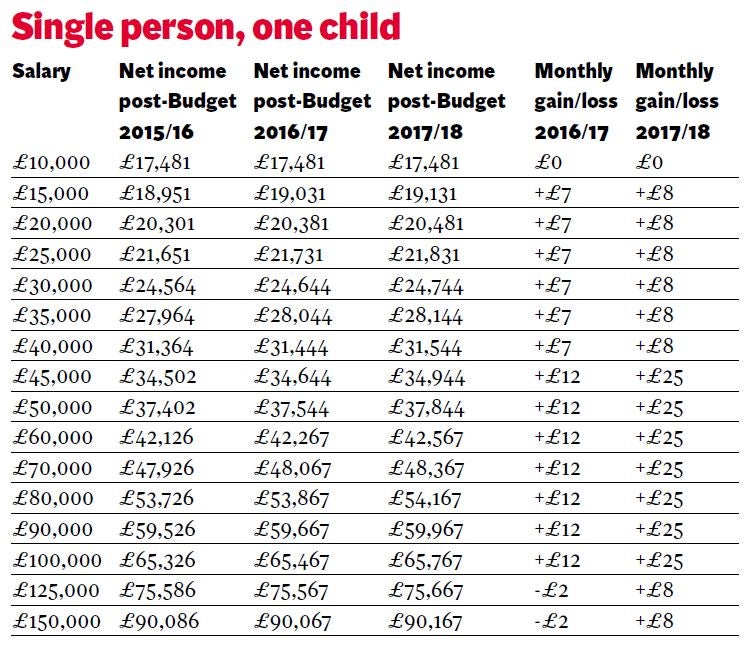

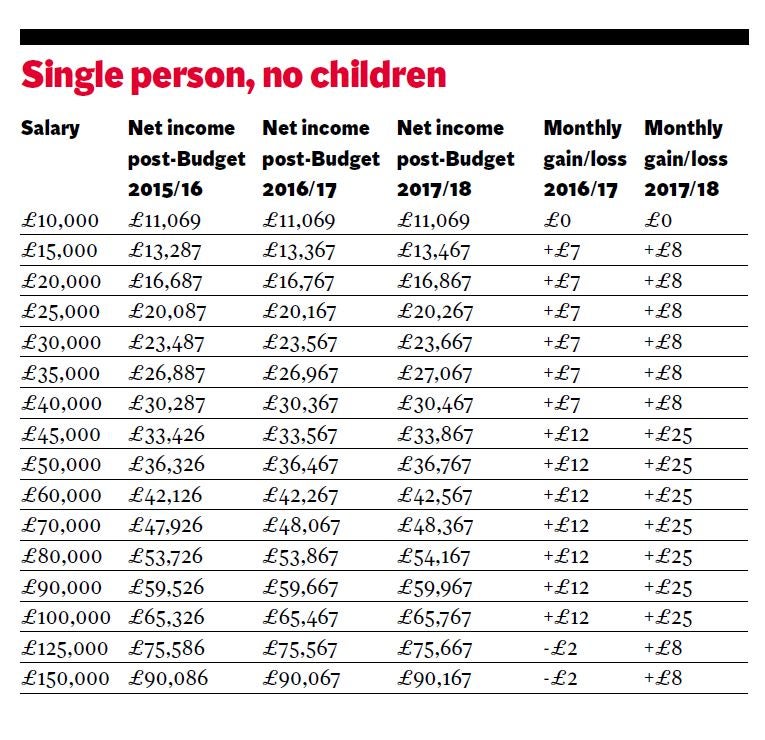

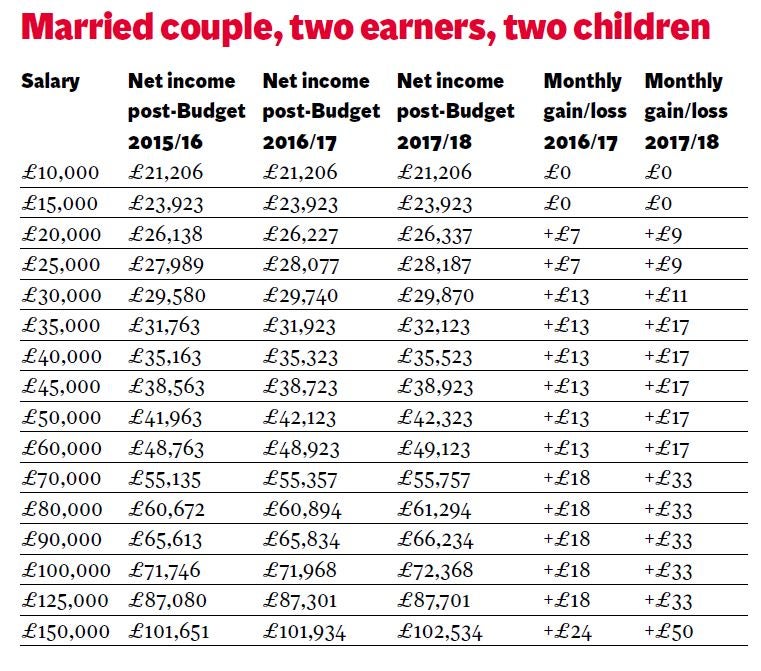

Our tables reveal the specific amounts by which you may be better or worse off in the coming two years as a result of the Budget changes.

Well-heeled married pensioners born between 1938 and 1948 can claim to have gained the most, albeit they will be £34 better off a month in the next tax year and £83 better off a month in the 2017/18 tax year. That means a spending boost of £408 followed by £996 in the next two years. But that’s only if their income tops £150,000.

The poorest, as usual, have been handed no spending boost at all for the next two years, with those pensioners born between 1938 and 1948 who earn less than £20,000 having not a single penny more to look forward to. That’s an annual spending boost of absolutely nothing over the next two years, which means they’ll be £1,404 worse off than high-earners of the same age.

There’s a similar pattern across our tables. For instance, a high-earning married couple with two children who both earn will get a £24 monthly boost in the 2016/17 tax year, followed by a £50 boost the following year. That adds up to a total £888 extra while a similar couple earning less than £20,000 has again been handed nothing by the Tory Chancellor.

With some of our other case studies, it’s middle-earners who will welcome the bigger boost to their pay from next year and the year after. For instance, a married couple with two kids and one earner taking home £45,000 a year will get a monthly boost of £12 next year and £25 the year after.

That’s an extra £144 in 2016/17 and a further £300 the following year. If they earned more than £125,000 they’d only be £48 better off in the next two years while if they earned less than £15,000 they would, probably unsurprisingly, have zero spending power added to their purses in the next 24 months.

There are similar patterns with single self-employed people, single pensioners born before 1938, and single people with one or no children.

In all cases, those earning £45,000 or more are getting the biggest income boost, while the poorest, as usual, are getting nothing but a metaphorical slap in the face from the Budget announcements.

What about actual losers? In our examples, only high-earners taking home £125,000 a year or more will be hit, and only for next year.

So a single person with no children or one child, or a married couple with two kids and one earner, will all end up with £2 less in their pay packet a month next year. That’s a £24 hit over the 12 months.

But that’s balanced out by the fact they’ll be given an £8 increase the following year, which, while not as generous as some of our other examples, will still leave the high-earners £72 better off in the 2017/18 tax year. That’s a net gain of £48 in the next two years, which leaves them gaining more than low earners.

Tax tables

Assumptions used in the tax tables published here, which have been provided by London chartered accountants Blick Rothenberg (1) Where both members in a couple earn, the income is split two-thirds to one-third. (2) All earners work 30 or more hours. (3) No investment income received. (4) All children under 16. (5) Tables include tax credits (Working and Child tax credits and Child Benefit where applicable) (6) No pension contributions or Gift Aid payments. (7) Estimates based on announcements in the Budget in line with previous increases (Consumer Price Index/Retail Price Index) for 2016/17, when there are no published rates, thresholds or allowances. (8) Tables do not include blind person’s allowances. (9) Married couples do not include Married Couples Allowance

Tables completed by Paul Haywood-Schiefer ATT, Blick Rothenberg LLP

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments