Biggest scams of 2024 revealed after one in five consumers fall victim to ‘ever-evolving’ tactics

The cost of a purchase scam claim last year was £650 on average

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.New research suggests almost one in five consumers have been the target of a money scam in the past year, with an average claim cost of £650 those hit by purchase scams in particular.

A wide range of types make it ever-more difficult for some consumers to stay aware of what the latest approaches of scammers are, with Barclays reporting the top ten most reported scams from 2024 included approaches as diverse as claiming to be HMRC, romance scams and advance fee requests.

The report signals the “ever-evolving methods” used by fraudsters as a key reason that over half of Brits are struggling to stay vigilant to every possibility of attacks.

While purchase scams fell to relatively low individual amounts, other types were far more costly.

Investment scams accounted for a third of all claims in monetary terms, with the average claim being for a total of £15,564. January was the peak for scams across the year, with more than half of those in the month being investment-based scams.

Research conducted by Censuswide in December showed 18 per cent of consumers acknowledged falling victim to a scam of some description last year, with a vast majority of those - 93 per cent - saying the event originated online in one way or another.

Social media and other technology platforms remains a breeding ground for scams of all types, with the rise of artificial intelligence now bringing up the prospect of new and difficult ones to indentify.

Barclays Fraud and Scams expert Kirsty Adams called for finance and technology organisations to come together to help reduce the success rates of such fraudulent activity. “The variety of scam tactics and channels continued to evolve considerably this year, but it’s clear that there are a number of enduring scam trends; the majority of scams started on social media once again, purchase scams continue to be the most reported scam type, and consumers demonstrated they are overwhelmed by the scam risks posed to them and their loved ones,” she said.

“Looking ahead to 2025, we’re hopeful we will see progress in the fight against fraud, in the form of cross-industry collaboration. It is only by joining forces that we can tackle this epidemic.”

The top ten scam types recorded and reported by Barclays, which have either seen clients fall victim to them or been targeted by them, was topped by fake deliveries. Over half of all respondents noted having been affected by them.

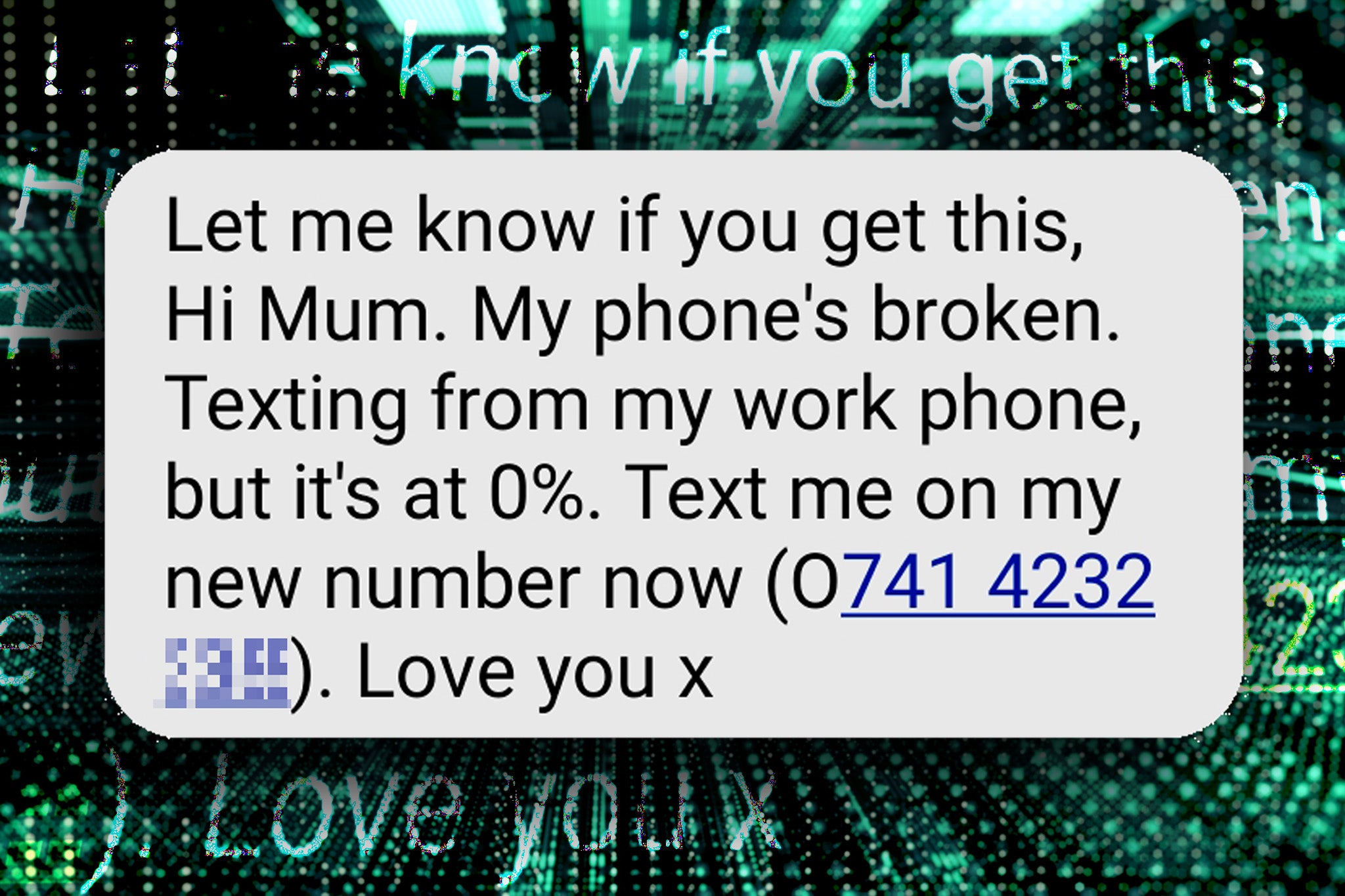

HMRC scams came second, ahead of purchase scams and online marketplace scams. The ‘Hello Mum’ Whatsapp message approach made up the top five, with each of those noted by a more than one in three respondents.

Investment scams, advance fees, ticketing scams, parking scams and romance scams also featured in the top ten.

“Falling victim to a scam is not something to be ashamed of; it can happen to anyone, so we want to arm people with information and advice on how to stay scam safe,” added Ms. Adams, who highlighted the best ways to avoid being scammed remained to never disclose personal details, verify companies getting in touch and to never be rushed into decisions, payment or discussing information.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments