Martin Shkreli: The drugs industry claim the CEO who raised drug prices is the exception - he isn't

The major pharmaceutical and biotech industry groups have portrayed Shkreli's actions as totally repugnant and the work of just one company - here's why that is wrong

Three millennia ago in ancient Greece, a plant called autumn crocus was used to treat gout. A pill form of the active ingredient, colchicine, has been used to treat the illness in the United States since the 19th century.

But six years ago, a clinical trial showed the drug's safety and efficacy and URL Pharma was granted the exclusive marketing rights for a drug that had previously sold for 9 cents a tablet. The price shot up to $4.85 — a more than 5,000 percent increase.

Sound familiar?

This week, a roiling controversy was ignited after Turing Pharmaceuticals chief executive Martin Shkreli hiked the price for his drug Daraprim by a mind-boggling 4,000 percent. The major pharmaceutical and biotech industry groups have portrayed Shkreli's actions as totally repugnant and the work of just one company, acting alone, with a flippant young chief executive who doesn't reflect the broader values, practices, or trends of other companies.

But it's not, as the colchicine case shows. Here's why:

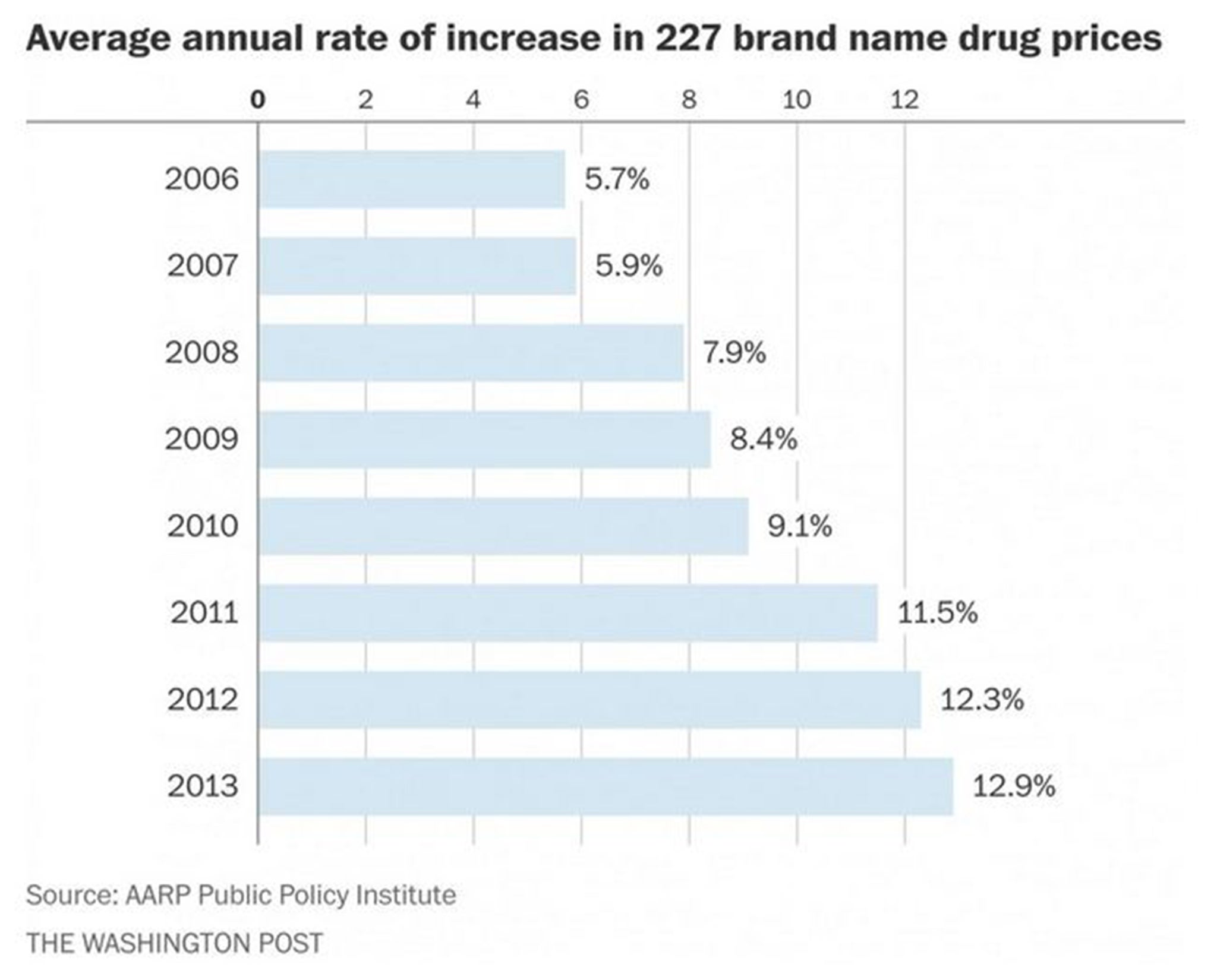

1) Brand-name drugs are getting more expensive.

Brand-name drugs have been getting steadily more expensive, far outpacing inflation according to a study by the AARP Public Policy Institute. So while Shkreli's price increase was over-the-top extravagant, the overall trend for other brand name drugs is in the same direction: up.

The question then becomes this: Is the outrage over Shkreli simply because of the magnitude of the price hike? Pharmaceutical companies widely appear to feel comfortable raising the price of their drugs some. But are the justifications for those increases really any different at their core? Is a quiet creep of prices ethically superior to a leap, announced by a warning shout?

“What if it had been 15 or 50 or 100 or 200 percent?” said Steven Pearson, president of the Institute for Clinical and Economic Review. “It reflects the structure we have created, somewhat consciously and somewhat unconsciously, that gives manufacturers tremendous leeway in the U.S. to set prices and expect insurers and patients to pay if they want the drug.”

2) Even among generic drugs, a class of medicines that is saving us money, some prices are going through the roof.

For example, tetracycline, an antibiotic discovered in 1948, cost 5 cents for a 500 milligram capsule back in November of 2013, according to a Medicaid database on the prices pharmacies pay to acquire drugs. Nearly two years later, it's coming in at $11 a pill — a nearly 2,200 percent increase. Clomipramine, an antidepressant developed in the 1960s used to treat obsessive-compulsive disorder, cost 22 cents per pill in November 2012. Now, it's $8.17 — a 3,600 percent increase.

Generic pharmaceuticals have been enormously successful, saving an estimated $1.2 trillion between 2003 and 2012. An AARP analysis shows that generic drug prices, in contrast to brand name drug prices, have fallen over the years — a four percent drop in 2013 over the previous year. But drug shortages, lack of competition, and other factors have led some generic prices to increase dramatically, and the AARP analysis found that the rate of decrease has slowed.

“To a certain extent, this [Daraprim] was a confluence of the oldness of the drug and the condition of the end-of-life AIDS patients” who need the drug, said Aaron Kesselheim, an associate professor of medicine at Harvard Medical School. “It kind of all combined to make this case the one the Internet decided to pick up on, but there are plenty of other cases, where this happened.”

3) When researchers calculate how much a drug is really worth, it's often a fraction of the list price.

Pearson heads the Institute for Clinical and Economic Review (ICER), a non-profit research group that is doing something surprisingly novel: trying to figure out if drugs are worth their price tag. That quest is an illustration of the rather astonishing fact that we can't even really tell if drug prices are too high. Occasionally, a drug hike is so blatantly obvious that it strikes a nerve, as Daraprim did. But in general, we don't really know if most drugs are priced too high, too low, or just right.

A draft report from ICER on a pair of exciting new cholesterol-lowering drugs recently approved found that although their list price is $14,000, they should cost about two-thirds less. Only when a 46 percent discount was applied to a pricy Hepatitis C treatment, Harvoni, did it become a good health care value — at about $40,000 per year. A recent study by a different set of researchers examined a cancer drug that's not yet approved, and found the price should be set at $563 to $1,309 for a three-week cycle. That's thousands of dollars less than many new oncology drugs.

4) This didn't happen overnight.

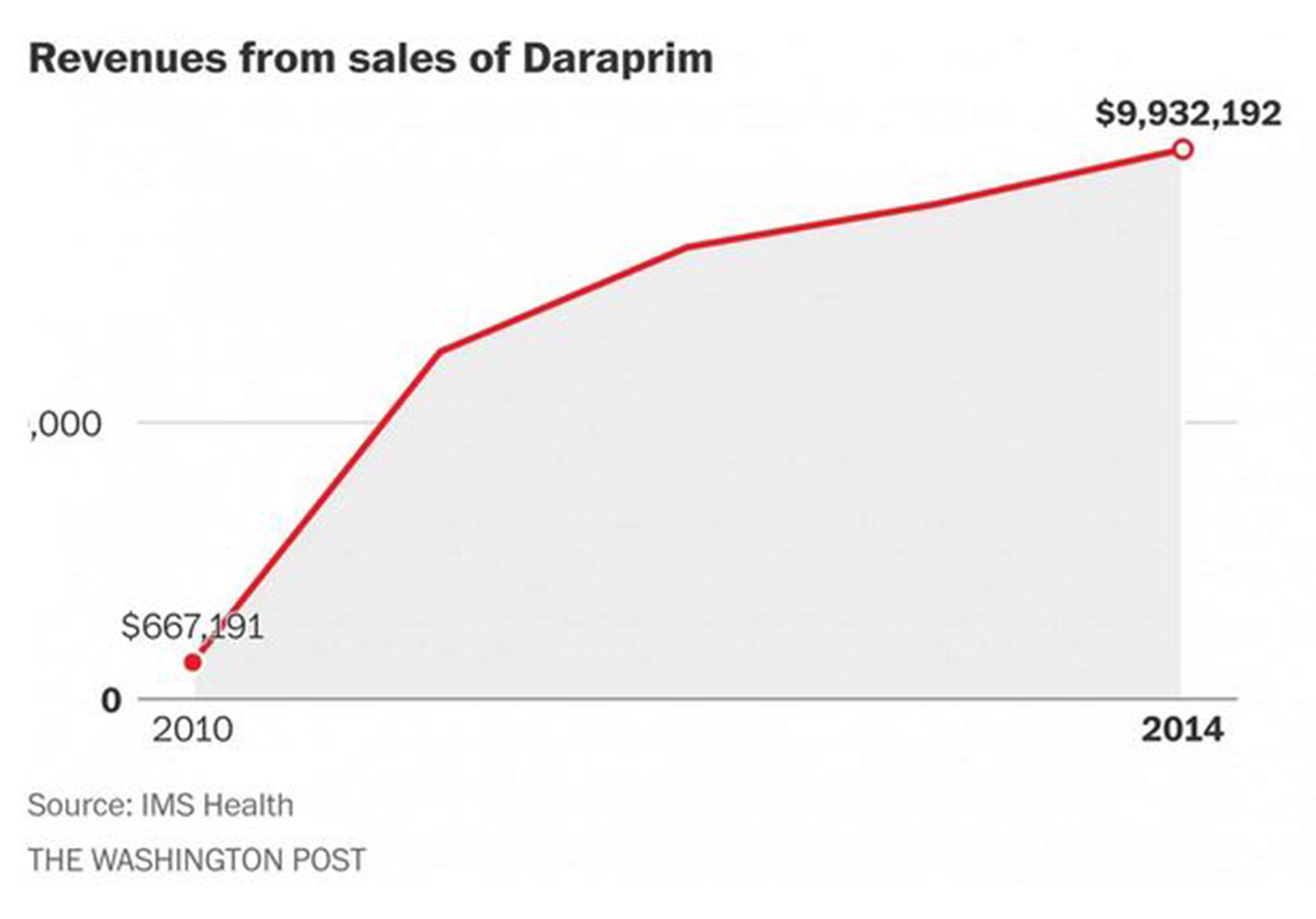

In 2010, Amedra Pharmaceuticals bought the rights to abendazole, an off-patent drug used to treat intestinal parasites. At the time, the average wholesale price of the drug was $6 a day. By 2013, it was $120 — a nearly 2,000 percent increase. An analysis in the New England Journal of Medicine found that Medicaid spending on the drug went through the roof, from less than $100,000 in 2008 to more than $7.5 million in 2013.

Amedra had also acquired Daraprim in 2010 and raised the price of that drug, albeit much more gradually than Shkreli, who acquired it in August.

“Amedra's business may be to corner a niche market for a pharmaceutical agent,” Kesselheim and colleagues wrote. “Manufacturers of generic drugs that legally obtain a market monopoly are free to unilaterally raise the prices of their products.”

High drug prices occur for a variety of reasons, and a high price isn't inherently a bad price. Just as we are willing to pay more for products that are higher quality in other parts of life, a medicine that saves a life is valuable. We want companies to develop cures.

The trouble is this: right now, we can't tell why prices are high, or even if they are high. New drugs that come on the market are often expensive because, companies say, they need to recover the cost of the innovation that led to the breakthrough. When monopolies exist, either because a new drug is the first to treat an illness or an old drug just doesn't have competitors, drug prices may also be high. The problem is that we have created a system where it's pretty hard to draw a hard line between the prices that are high for a good reason and the ones that are not.

Rather than vituperate the celebrity villain du jour, many economists think it's time to have a serious consideration of how drug prices reflect their value. The drug industry trade group keeps reminding the public that drug spending has been holding steady for years, at about 10 percent of the total health-care pie. They point to that as evidence that drugs are a special area of the health care industry, unlike almost any other sector, where competition occurs and prices actually go down over time.

But Pearson said many people believe drug spending has held steady because of a massive and successful push to get people to use cost-saving generic drugs.

“That created the financial cushion to absorb the increasing prices of new drugs,” Pearson said. “Now we’re at the exciting or terrifying time that we’ve maxed that out; now we’re going to get these higher prices and we can’t turn around and find an easy way to save money somewhere else.”

What Shkreli did was unusual, for a number of reasons. But he isn't as much of an outlier as the drug industry would like us to think.

Copyright: Washington Post

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks