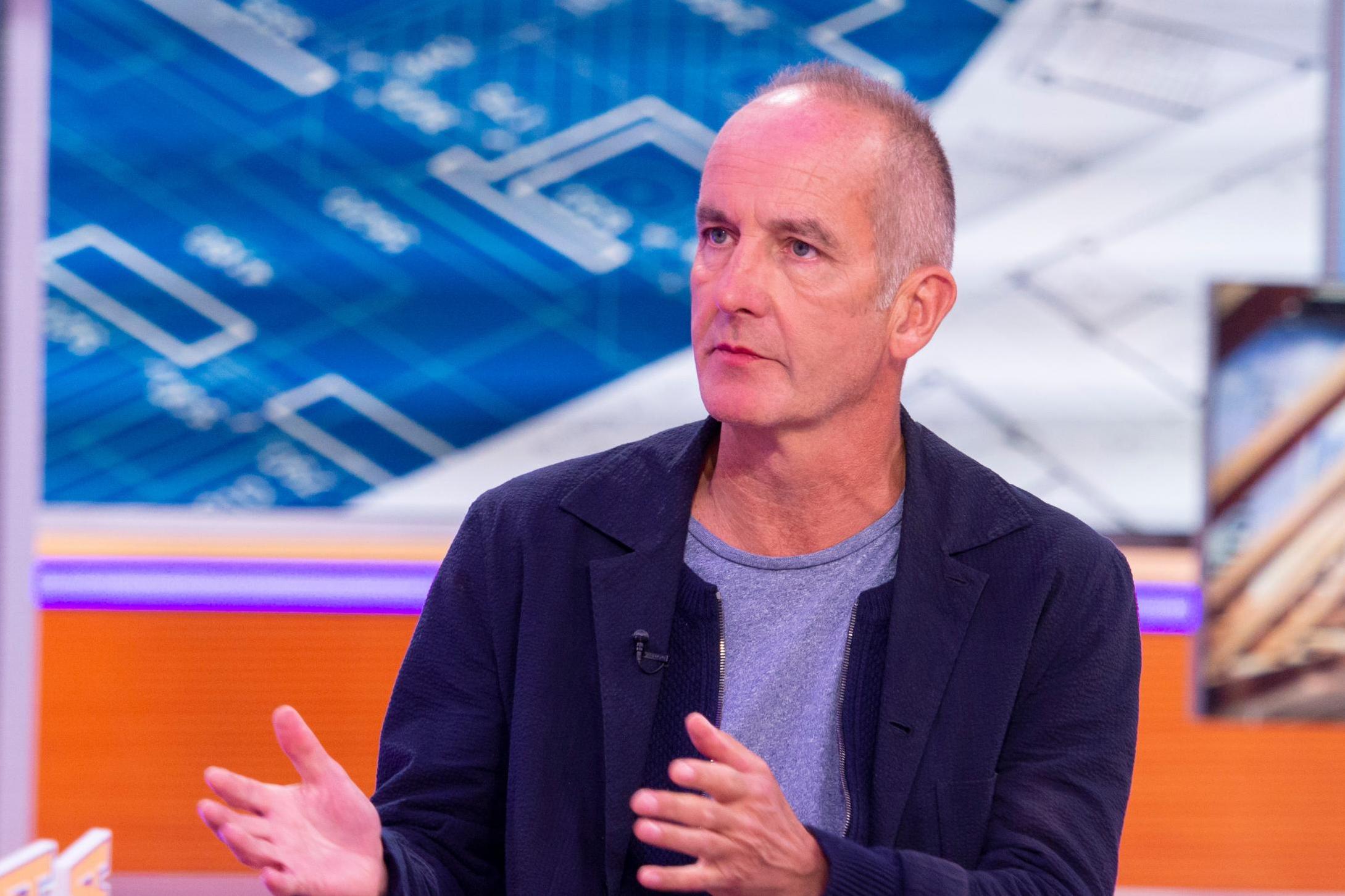

Grand Designs' Kevin McCloud reveals the one place never to buy a property

The TV presenter has hosted the popular Channel 4 show since 1999

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.If anyone has insider knowledge on the property market, it’s Kevin McCloud, who has been showing Brits how to build their dream homes for almost two decades on Channel 4’s popular TV show Grand Designs.

Now, the Bedfordshire-bred presenter has divulged one of his trade secrets, revealing the one place he would never advise purchasing a home.

According to McCloud, prospective buyers should avoid investing in a property that is on a floodplain at all costs “unless your house is specifically build to mitigate that.”

A floodplain is an area of low-lying land adjacent to a river or stream that is incredibly vulnerable to flooding during periods of high rainfall, which can cause severe damage to a home such as mold and sewage contamination.

Speaking to Express.co.uk, the 32-year-old MBE explained that having a home in an area that is susceptible to flooding can have an adverse effect on your lifestyle and may significantly compromise your financial security due to the high cost of post-flood repairs.

A recent study found that floods are now more likely due to climate change and that the majority of England’s floodplains (90 per cent) are not fit for purpose, putting even more homes at risk.

According to the Environment Agency, areas in the UK that are particularly vulnerable to flooding include Ludlow, Canterbury, Whitstable and Chelmsford.

The property expert did offer some helpful alternatives for those looking to buy a home and suggested looking for houses with low to zero energy bills so as to live as sustainably as possible.

“It’s great financial resilience in your life and on a community-wide level it’s resilience to climate change,” he told the news site, going on to tout the benefits of making eco-friendly property investments.

“When I invest I invest in renewable an ethical portfolios.

“They may at the moment be yielding on par with conventional non-ethical investment but my belief is that in the future as the effects of global warning and climate change become more obvious to us all, these investments will start to make real sense and the same goes for a house.

“Why would you spend more on a house that costs you £1,000 a year to heat? It’s just a waste of money.”

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments