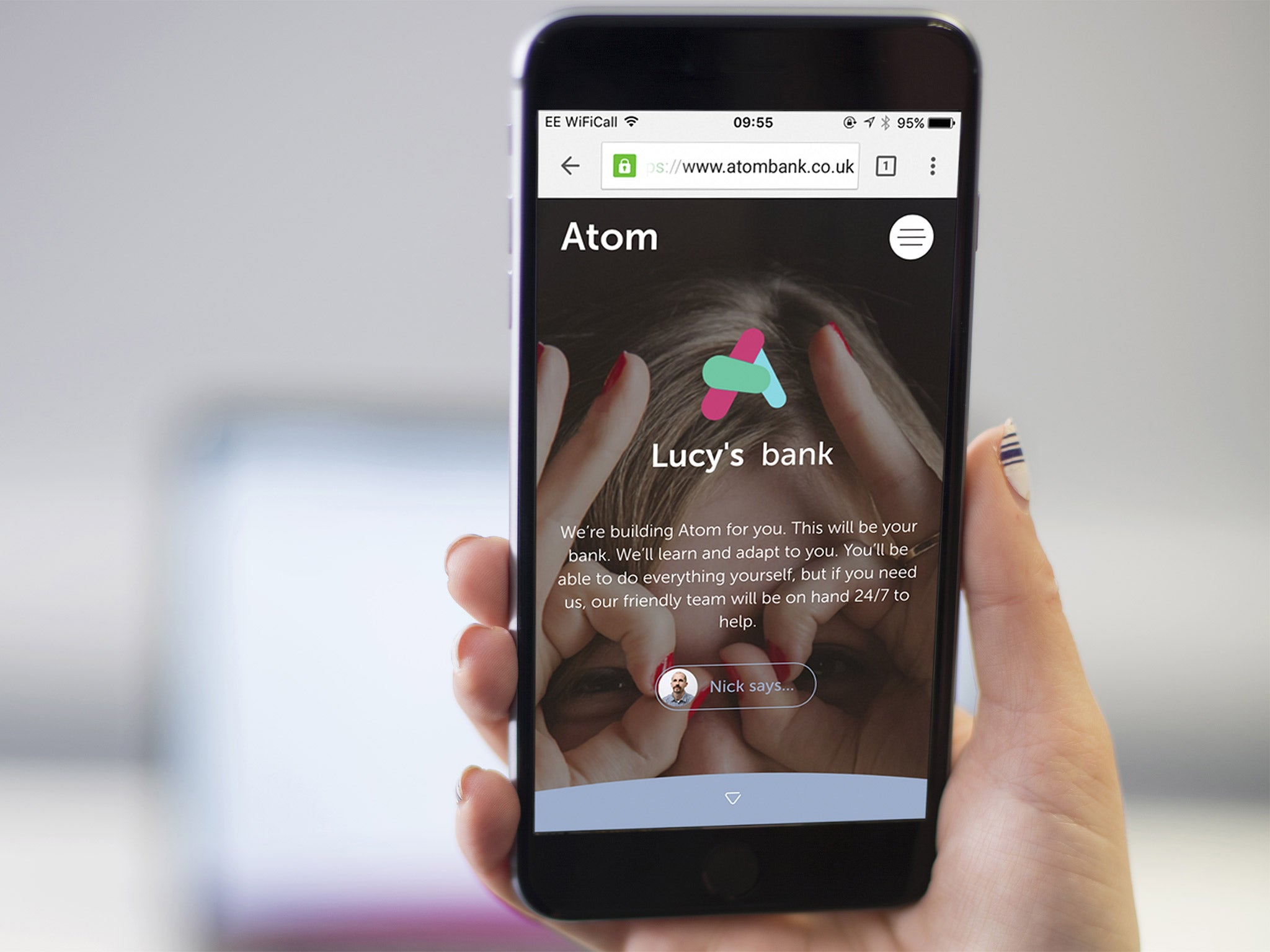

Atom app: Is this the future of banking?

Atom Bank offers a security system based on selfies, an app instead of branches, and design inspired by video games

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Atom, a company aiming to be the UK's only app-based bank, summed up its 2015 with, as you might expect, a set of numbers. Except they're not the kind of numbers you'd expect from a bank:

30,360 coffees drunk

1,500 table tennis games played

3 space-hopper races

As you may have guessed from these self-consciously wacky figures, Atom is keen to do away with tradition and bring some start-up-style informality to the banking process. Space-hoppers aside, Atom is setting up a bank with no physical branches and no cash machines, replacing them with an app.

The Atom app is designed to be personal, intuitive and fun with 3D graphics, voice recognition and security via selfies, and has been developed on a game-design platform called Unity. "As far as we know, there isn't another app in the banking world built in Unity," says Edward Twiddy, Atom's chief innovations officer. "It was first used by gamers because of the quality of the 3D graphics it can display. It provides the speed, responsiveness and functionality that gamers expect."

But how does this gaming sensibility transfer to a banking app? Many of the features are still under wraps until its launch later this year, including how its customers will actually get hold of their money. But on the company's website, the FAQ answers are nothing if not optimistic: "We're working on making this as easy as tying your shoe laces. By the time we launch we'll have in place all the regular payment services you'd expect of a bank, with a bias toward digital (of course!)." The site also lets would-be account holders know what services are "coming up": one-stop banking, business and personal, savings, loans and mortgages.

If a bank based on video-game software that's rather hazy about, you know, the money side (some reports say the bank will partner with bricks-and-mortar banks to allow its customers to pay in deposits and take out cash) sounds alarming, it's worth bearing in mind that Atom has not only won a banking licence, but has Mark Mullen, who previously ran HSBC's telephone-banking branch First Direct, at the helm.

Each user will get a personalised colour scheme that runs throughout the app, and even a personalised animated Atom "A" logo, which jumps about the screen in a sufficiently "gamey" way. You can even rebrand the bank itself, calling it, for example, by your own name. Thus Atom Bank becomes Adam's Bank or Charlie's Bank or King Hamster Face III's Bank or, presumably, whatever silly name you choose to give it. "We're trying to give you the chance not just to be in control but also to have a little bit of fun," Twiddy says. Did you get that it's supposed to be fun yet?

However, personalisation isn't just about fun. The app will learn how you like to use it and, over time, customise itself to your preferences, putting the features you use regularly in the foreground and shooing the untouched bits into the background. And that's not just a metaphorical background. This is where the 3D functionality comes in. Instead of the boring old scrolling screen where information disappears off the bottom or top into an unseen limbo of cyberspace, Atom employs a 3D carousel which you can spin to bring your chosen element into the foreground, and where the app automatically places your most-used features.

App-only philosophy aside, Atom's real appeal comes in its approach to biometrics, using face and voice recognition. On registering, customers take a selfie (smiling, of course – remember, this is fun) which can then be matched with selfies required to authorise future transactions. The user is asked to blink at random during the process to provide an extra fail-safe. It is the same software used at passport controls around the world and is far more secure than the one-in-10,000 chance of guessing a four-digit PIN. Not that Atom is leaving anything to chance. "We've employed a couple of identical twins who we put through the tests at random," Twiddy says, "and the app can tell the difference between these just from the face identification."

Combine this with its voice and fingerprint recognition and you get a tiered approach to security which can be light-touch or hefty– depending on the situation. "The security model is all about the layers," Twiddy says. "We'll ask you to step up through the layers – with anything novel or contentious we'll ask you to go through face, voice, PIN and fingerprint recognition."

So not only does Atom claim to be more fun than other online banking, it also claims to be more secure. And with selfies and voice recordings, even the security aspect sounds kind of, well… fun. Perhaps this is why Atom has set itself the hugely ambitious target of capturing five per cent of the UK retail banking market by 2020. Or perhaps it knows it is tapping into a market – the financial-technology or so-called "fintech" sector – that is set only to grow. A recent survey by the currency exchange service TransferWise found that 48 per cent of consumers expect to be using a technology provider for at least one financial service within five years' time, and that 32 per cent expect to use technology for more than half of their financial needs.

There is also the appealing financial model that comes with an app-only service. "HSBC has laid off thousands each year and still has a cost-income ratio of over 50 per cent," Twiddy says. "We'll operate at a cost-income ratio of half that. If we get this right, we'll blow a hole in pricing." No wonder they're having so much fun at Atom. With a profit margin like that, we'd all be space-hopping all the way to the bank.

Oh my dosh! Banking innovations

Britain is a world leader in "fintech" innovations. These are some of the other UK start-ups to look out for.

Splittable

Splittable helps renters in shared properties through making it easy to divide everyday payments such as household bills between a group of people.

StartJoin

StartJoin hopes to start a revolution in crowdfunding by using the first digital currency for such investing, called StartCoin.

ClearScore

Founded by Google's former UK managing director Dan Cobley, ClearScore aims to clear up the miasma that surrounds credit scoring by giving users free access to their credit reports and credit scores.

Squirrel

Squirrel is a personal-finance management tool that helps employees plan and manage their finances directly from their payroll. Users can even choose to have Squirrel hold their monthly salary and deliver it to them weekly.

Crypta Labs

Crypta Labs claims to be the only company in the world developing a Quantum Random Number Generator for use on smart devices. It will use a device's lens and light sensors to detect photon beams and count the photons to generate random numbers, thus upping the security level of mobile-based transactions.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments