Bitcoin: Latest price record is irrelevant compared to ‘quiet revolution’ of cryptocurrency, experts say

‘Daily price movements are of little consequence,’ one market expert says

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

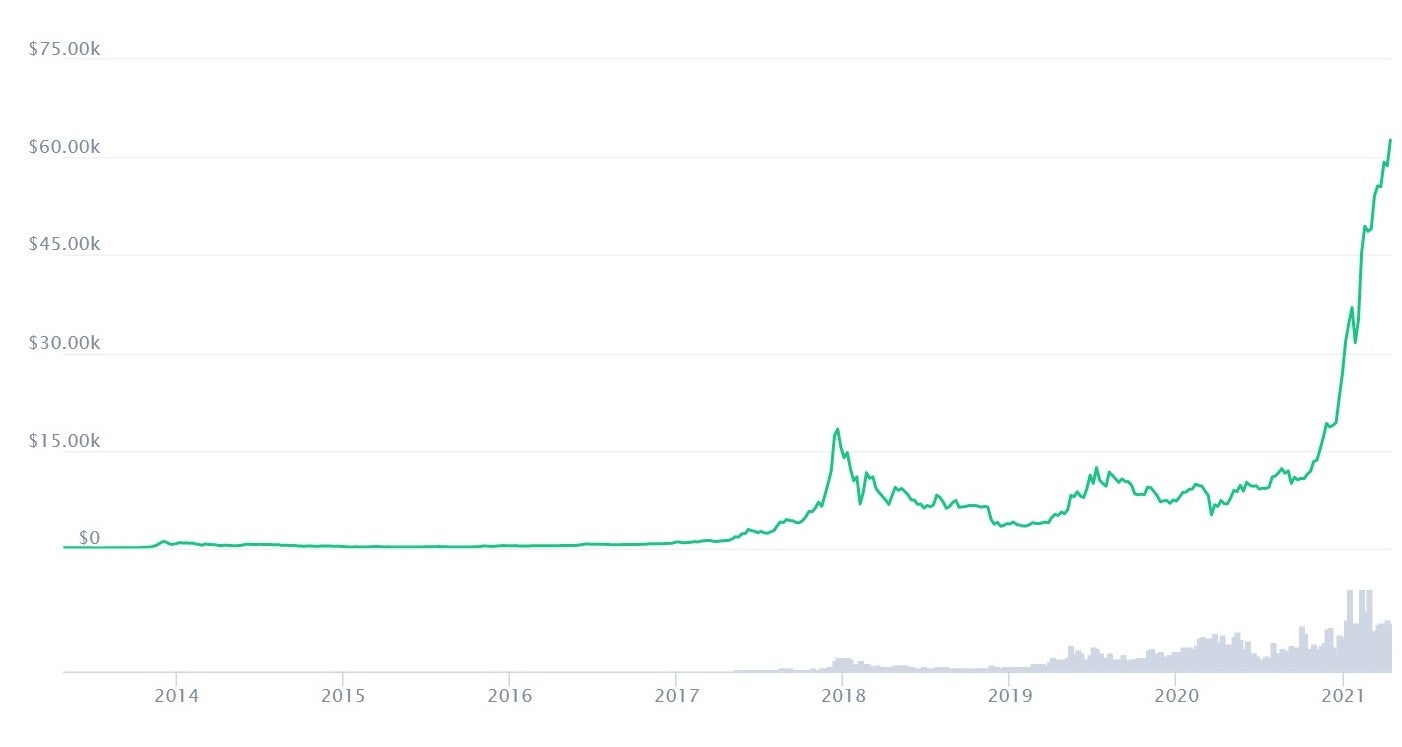

Your support makes all the difference.Exactly one month after hitting its last all-time high, bitcoin has once again reached new heights by climbing above $63,000 for the first time in its history.

Ethereum, the world’s second most valuable cryptocurrency, also saw new record highs on Tuesday, while several others experienced similar price surges.

The gains pushed the overall cryptocurrency market above $2 trillion (£1.45tn) – more valuable than Facebook and Tesla combined – with some analysts predicting that the price rallies are far from over.

But with popular payments platforms like PayPal and Visa integrating crypto payments, as well as major technical innovations to bitcoin’s own network, the price is just one part of a far broader narrative involving the disruption of the entire financial industry.

The beginning of this latest bull run can be traced back to last March, when the full implications of the coronavirus pandemic first began to be realised.

After an initial price crash, bitcoin rose from below $5,000 to above its previous all-time high of $20,000 in December. It has since peaked above $61,500, according to CoinMarketCap’s price index, and is currently trading at around $61,000.

Some have attributed these massive gains to broader economic uncertainty brought about by international lockdowns and the shutting down of large parts of the economy to contain the deadly virus.

Bitcoin’s finite supply - only 21 million will ever exist - has seen investors increasingly refer to it as a form of “digital gold”, that functions as a safe-have asset during periods of turmoil. Institutional investors have poured billions into the cryptocurrency, while simultaneously people have been removing their funds from exchanges for longer-term offline storage.

At the same time, governments around the world have been issuing stimulus packages and other measures aimed at pumping money into the economy in order to save jobs and businesses. This has led some market analysts to warn that such inflationary tactics will cause traditional currencies to lose their value relative to more commodities with limited supplies like bitcoin.

“With a sharp debasement of fiat currencies, investors are increasingly losing confidence in savings and are rapidly waking up to the fact that bitcoin is better at being gold than gold,” Stephen Kelso, head of capital markets at ITI Capital, told The Independent.

“There are many reasons for this. As a digital asset, bitcoin is cost-effective and easier to access than gold in a vault, which leaves investors at the mercy of rising real interest rates. Additionally, bitcoin allows direct access to its owners without dependency on intermediaries like administrators or asset managers, potentially in different jurisdictions.”

Such sentiment could continue to push the price of bitcoin even higher over the coming months, which will consequently see ethereum and other cryptocurrencies mirror its fortunes through their own market movements.

In the longer term, the underlying technology could see this growth sustained through its ability to transform the financial system through radically more efficient payments and transactions through its peer-to-peer network.

“An ongoing pandemic may be furthering a safe haven narrative for bitcoin, particularly in emerging markets where bitcoin is gaining traction,” said Paolo Ardoino, chief technology officer of leading cryptocurrency exchange Bitfinex.

“While this particular all-time high will make headline, daily price movements are of little consequence in comparison to the quiet revolution that is blockchain technology... This rally could possibly herald bitcoin’s first meaningful encroachment into the legacy financial system and credit card industry.”

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

17Comments