What does the Budget mean for you?

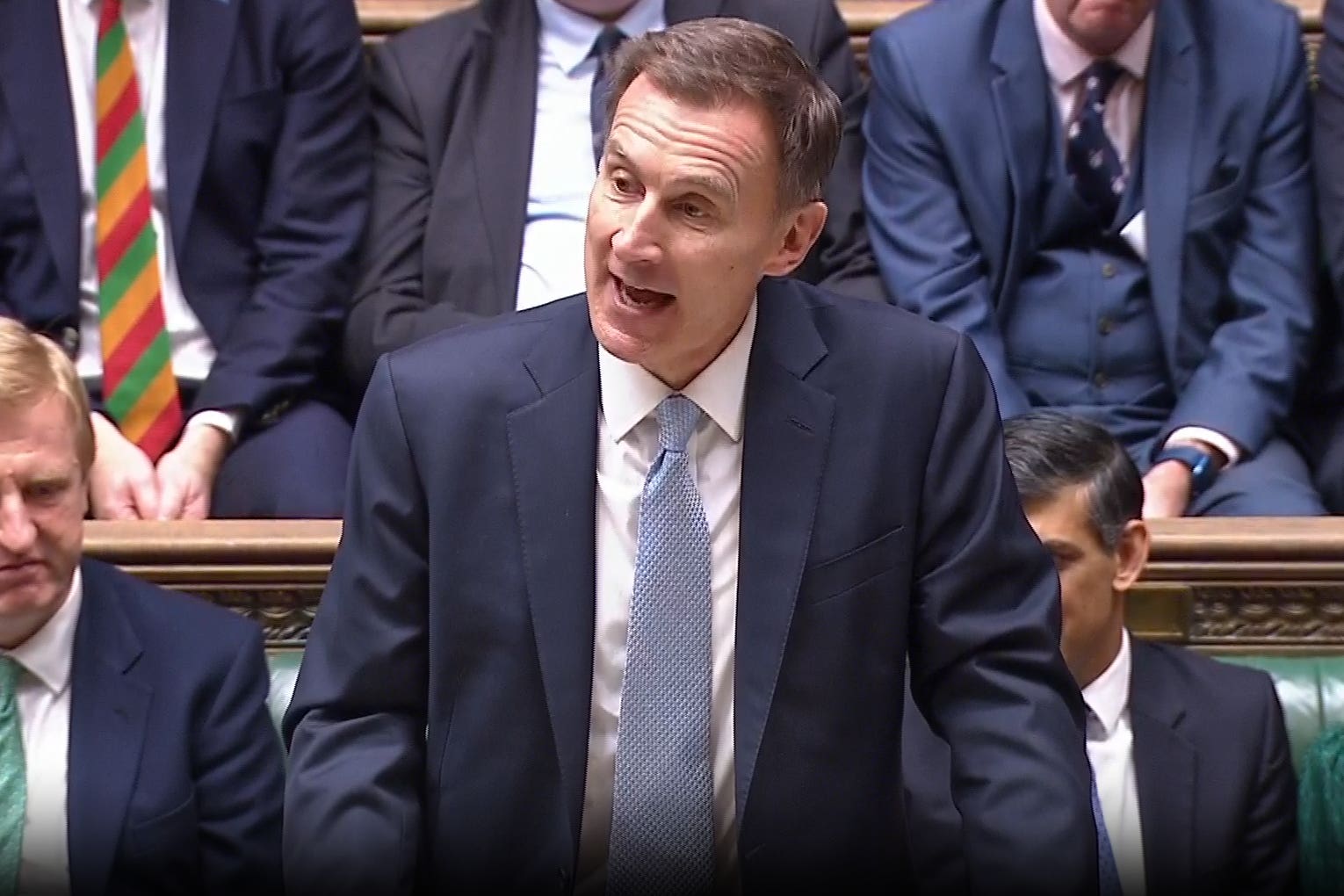

Jeremy Hunt has shared the Spring Budget but how will it impact you?

The UK’s Chancellor of the Exchequer Jeremy Hunt has unveiled his Spring Budget.

He plans for the Budget to revive both the economy and reverse the Conservatives’ opinion poll deficit, and said he was offering “permanent tax cuts” in what he believes is a “budget for long-term growth”.

The Budget touches on everything from rewarding small businesses, supporting motorists, alcohol duty, national insurance, culture and housing, just to name a few.

But what does this mean for you? Finance experts share everything you need to know…

Housing

For Brian Byrnes, head of personal finance at Money Box, the most important thing is what Hunt failed to say about housing.

“There was some speculation that he was going to make changes to the Lifetime ISA (LISA), and from our perspective, it was a missed opportunity because it can take up to a decade to save for a property in the UK,” said Byrnes.

“Martin Lewis tweeted earlier that Hunt has mentioned that he does want to make some improvements on the LISA, but would prefer to make those changes when property prices are definitely rising.

“The only other thing, which is a bit niche to investment properties, is that he has reduced capital gains tax on property sales. This is applied when you sell a house in the UK and make a profit off of it. You are required to pay a capital gains tax unless it’s your home. Overall, the Budget hasn’t affected much for homeowners.”

Businesses

According to Sara de la Torre, head of financial services at Dun & Bradstreet UK&I , the UK economy is made up of many small and medium-sized (SME) businesses, and a lot of these include sole traders. But as they continue to evolve and grow – thanks to the rise of tech – the government needs to do more to support them.

“The government needs to play a bigger role in encouraging innovation in this sector as they are directly linked to consumers. This will enable the UK to forge the next phase of economic growth,” said de la Torre.

During the Budget announcement, Hunt increased the threshold needed for businesses to register for VAT in the UK.

Andy Fishburn, the managing director of Virgin Start Up, added: “For the last seven years, the VAT threshold has been capped at £85,000, since it’s now been increased to £90,000, businesses will not need to add VAT to their businesses until it’s what they earn.

“At the moment, small businesses deliberately stay on the back threshold to avoid this, so this £5,000 threshold is welcome. It would have been nice if it went further to £100,000, especially because of inflation and the fact that many SMEs would have properly had to increase their prices over the last few years.”

Another announcement was the extension to the recovery loan scheme, which was produced off the back of the pandemic to help businesses grow.

“It’s been extended to 2026 now,” said Fishburn. “The scheme allows existing businesses to access funding more easily. The government have now made another £200 million available. It’s difficult to secure funding traditionally, especially from high street banks these days.

“Last year, 25,000 businesses went into administration and it’s been projected to increase to 30,000 this year. As the economy dries up more and more, businesses are being faced with the harsh reality of their futures.”

ISAs

Hunt also has announced a consultation on the introduction of a “Great British ISA.”

“The 20-page consultation paper has just been published, but everyone has an ISA allowance of £20,000 a year, and you can invest it into any stocks and shares of your choice. But what [Hunt] is proposing, is an extra £5,000 allowance that can only be invested in UK companies,” said Byrnes.

“He is concerned about the amount of money being invested into the UK’s stocks and shares, in comparison to American and European stocks.

“I think this is going to be relevant to a very small amount of people who can afford to regularly contribute to their ISAs – this isn’t really for everyday people who need to start saving and investing more generally.”

But for Byrnes, Hunt not making any changes that could further protect LISAs was another missed opportunity.

“We have more people who have started saving and investing because of it,” he said. “Especially younger and less affluent individuals.”

Pension

“At the moment, you get a new pension pot with every job you start. But now they [the government] are proposing for everyone to have one pension pot for life, that will follow you from job to job, and can be very beneficial.

“This means people will be able to know where their money is and what their pension is looking like. There is at least £26 billion of lost pensions in the UK, so this is a step in the right direction,” said Fishburn.

National Insurance

Although there will be more conversations around National Insurance tax post-election, Byrnes explained that Hunt announced a further 2% cut in addition to the 2% cut he announced during the Autumn Budget.

“It’s more money into people’s pockets, which would help in this cost-of-living crisis. But it’s also all about what people do with the extra money, as it could easily go into everyday savings. Ideally, it should be used in investments and savings,” he said.

Fishburn went on to say that “for those who are employed, it’s dropping from 12% to 10%, which means people are saving on average £450 a year – this is important.

“It’s also reduced what self-employed people pay too, from 8% to 6%, which works out about £350 a year on average, what a typical self-employed person will save on this cut.”

Bookmark popover

Removed from bookmarks