10 ways to protect your financial interests

Some of the best ways to make sure your finances are in order

Smart investment opportunities, clever insurance approaches and high-tech financial innovations — we provide a run-down of the innovative and lucrative financial opportunities you should have on your radar.

Get smart with your investments

Smart Alpha portfolios — powered by J. P. Morgan Asset Management — is a new investment solution for Nutmeg, the UK’s largest digital wealth manager. These Smart Alpha portfolios combine Nutmeg’s core investment principles, ETF and fractional investment capability, with the in-house, multi-asset knowledge and experience of one of the world’s leading investment houses. This approach provides clients with access to both an additional long-term asset allocation strategy and a truly intelligent way to access J.P. Morgan Asset Management’s stock selection expertise. Smart Alpha portfolios are available for Nutmeg’s personal pensions, stocks and shares ISAs, Junior ISAs, Lifetime ISAs and for general investment accounts. Capital at risk. Tax treatment depends on your individual circumstances and may change in the future.

Find out more about Smart Alpha portfolios

nutmeg.com/smart-alpha-portfolios

Make the most of your properties with short letting

If you’re thinking about relocating, are a frequent traveller or have a second home that’s often vacant, short-term rentals could provide a new source of income and possibly help you to take advantage of the increased freedom to work from anywhere. Under The Doormat has welcomed more than 12,000 guests since 2014 and fully manages more than 300 homes. The company provides homeowners with the comfort of knowing their home is occupied through short and mid lets of anywhere from three nights to six months. The dedicated homeowner team looks after you and your home through every step, in line with Under The Doormat’s Peace of Mind Pledge. The company offers market-leading insurance, guest vetting and personal check-ins for every stay, as well as a professional cleaning service, which is covered by its 10-Point Hygiene Promise. Sign up your home and get a complimentary chocolate hamper! Get in touch today by contacting myhome@underthedoormat.com.

Visit Under The Doormat to learn more

underthedoormat.com

Investing in the future of food

Faced with a growing world population and climate change, the food industry was under severe strain even before the onset of Covid-19. In the wake of the pandemic, there has been mass disruption to global supply chains and the future of consumer eating habits is set to change for good. The Pictet-Nutrition fund directs capital to companies that improve sustainability, access and quality of farming supply chains. The fund invests across the entire sector, from farm to fork. It takes a wholly positive approach, aiming to benefit from solutions, not problems — it doesn’t invest in commodities or speculate in shortages in food. Instead, it focuses on helping to secure the world’s future food supply and therefore represent sustainable, long-term opportunities for investors. Find out more about post-pandemic shifts in the food industry and investor opportunities today.

Discover sustainable investment opportunities

am.pictet/en/uk/global-articles/2020/expertise/thematic-equities/post-pandemic-shifts-in-food-industry

Turn your timeshare nightmare into a dream

Timeshare owners are being charged increasing maintenance fees for Timeshare resorts whilst being unable to use the accommodation due to Covid-19 travel restrictions. Claims Solution Group is the only company in the UK to offer guaranteed legal termination from all monetary and legal liability associated with your Timeshare. Claims Solution Group also offers direct claim opportunities via its in-house lawyers and specialist outside counsel across the EU. You and your family could benefit from alleviating your ongoing timeshare burden by taking the time to talk to one of our dedicated team of advisors about our legal Timeshare termination and direct claim services. Call 01887 820145 or email exits@claimssolutiongroup.com for a free no obligation consultation.

claimssolutiongroup.com

Make sure your money works hard for you

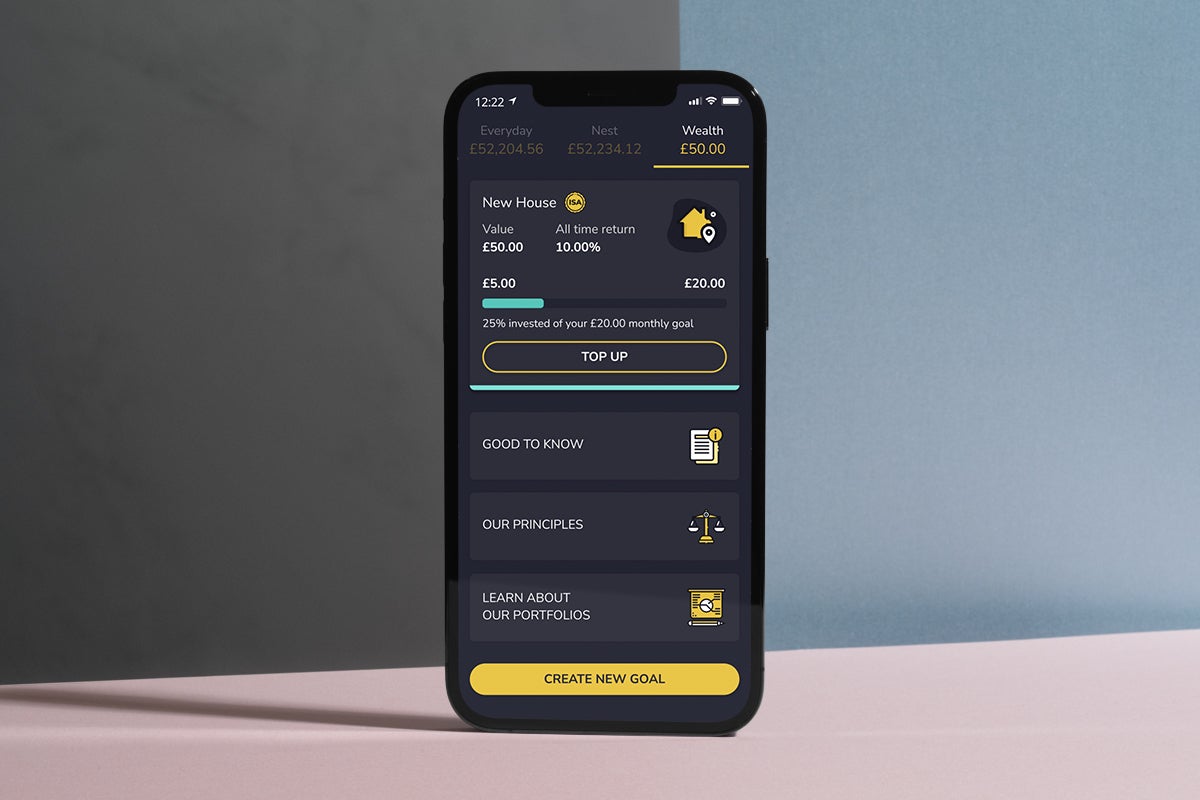

ikigai is the first digital wealth management solution in the UK to also offer everyday banking tools in a single app. The aim is to provide users with a holistic view of their money, ensuring they can invest well, save well, and spend well. ikigai empowers you to grow your wealth through goals-based investing, meaning you can align your money with your financial and personal goals — whether it’s the holiday of a lifetime, a new home, or time off for a career break. ikigai works with best-in-class technology and finance partners, while portfolios are managed using asset allocation guidance from BlackRock. Make sure your money is working harder for you and your goals. As with all investments, your capital is at risk.

ikigai.money

Protect cash flow by collecting late payments quickly

Cash flow is the life blood of any business. As companies look to navigate their way out of lockdown, it is essential that late payments are collected quickly to protect cash flow and to ensure post-pandemic growth. Guildways is a British and international debt collection specialist with over 25 years of experience. The team contacts late paying customers via telephone, letter and email, and because Guildways operates on a ‘no collection-no fee’ commission basis, it is a reduced-risk and cost-effective way to collect debts. In the past 12 months, Guildways collected over £48 million in over 100 countries for their clients. Their online case management system allows clients to track and manage individual cases in real-time. For more information, email info@guildways.com or call 03333 409000.

guildways.com

Boost your investment by avoiding unnecessary risk

The team at Oakmount & Partners has a simple aim; to optimise investment performance over the medium to long term without exposing customers to unnecessary risk. Offering compelling opportunities leading out to 2025 and beyond, the company’s goal is to achieve a greater rate of return on investment for its clients while maintaining the same high level of personal and professional service it has continued to deliver for over a decade. Oakmount & Partners provides premium-quality, asset-backed and secured investment opportunities with a strategic focus on clean energy, commodities, green mining, tech and IPOs. Contact the team for more information by calling 01279 874 392. Subject to status, T&C apply.

Visit Oakmount & Partners today

oakmountpartners.com

Car insurance without any hassle

Take the hassle out of shopping for the right car insurance this year with Asda Money. Compare cheap quotes with over 60 of the UK’s leading providers, to find great cover at a great price. Asda Money does all the hard work comparing prices for you — all you need to do is answer a few simple questions about you and your wheels. You can also enjoy up to 70% no claims discount, and if you do find a quote online that’s cheaper, Asda Money guarantees to beat it.

money.asda.com/insurance/car-insurance

How to claim back on mis-sold pensions

Have you or a family member been pressured to move your pension from a final salary, defined-benefit or company pension scheme? BringBack is an FSA-regulated Claims Management Company that will help you to reclaim what is yours if you’ve been misled into making detrimental decisions around your pension. It’s all too common to be advised to move your pension into high-risk investments, unaware of the fees and additional costs incurred. BringBack works with solicitors who specialise in pension compensation claims. Successful claims are passed back to you, minus a small fee for handling your claim and working on your behalf. Discover if you were mis-sold a pension and start your claim today.

BringBack.co.uk

Get expert help choosing the right investments

Stratiphy will help you create a portfolio of companies that meet your lifestyle and aspirations, making investments perfectly suited to your needs. Its analytics give simple, tailored buy and sell signals according to your preferences, empowering you to make informed investment decisions. A broad range of choices are considered, including environmental and social leaders, preferred industries and sectors, monthly budget and setting of important limits. The team is dedicated to conducting industry-leading analysis, whilst promoting long-term risk management and sustainable investing. Technology which was previously only available to investment banks can now be accessed in your pocket with Stratiphy. *Information only service, Stratiphy does not take deposits or provide investments, not FCA regulated.

Head to Stratiphy to get started

stratiphy.io

The past performance of an investment is not necessarily a guide to future performance. The value of investments or income from them may go down as well as up. You may not get back the amount you invested.