Fat is a class issue. Obesity is concentrated much more among poorer families, and among people from a Bame background, though hardly confined to them. The Covid-19 crisis has exposed the comorbidities and risks associated with carrying too much weight and having an unhealthy lifestyle.

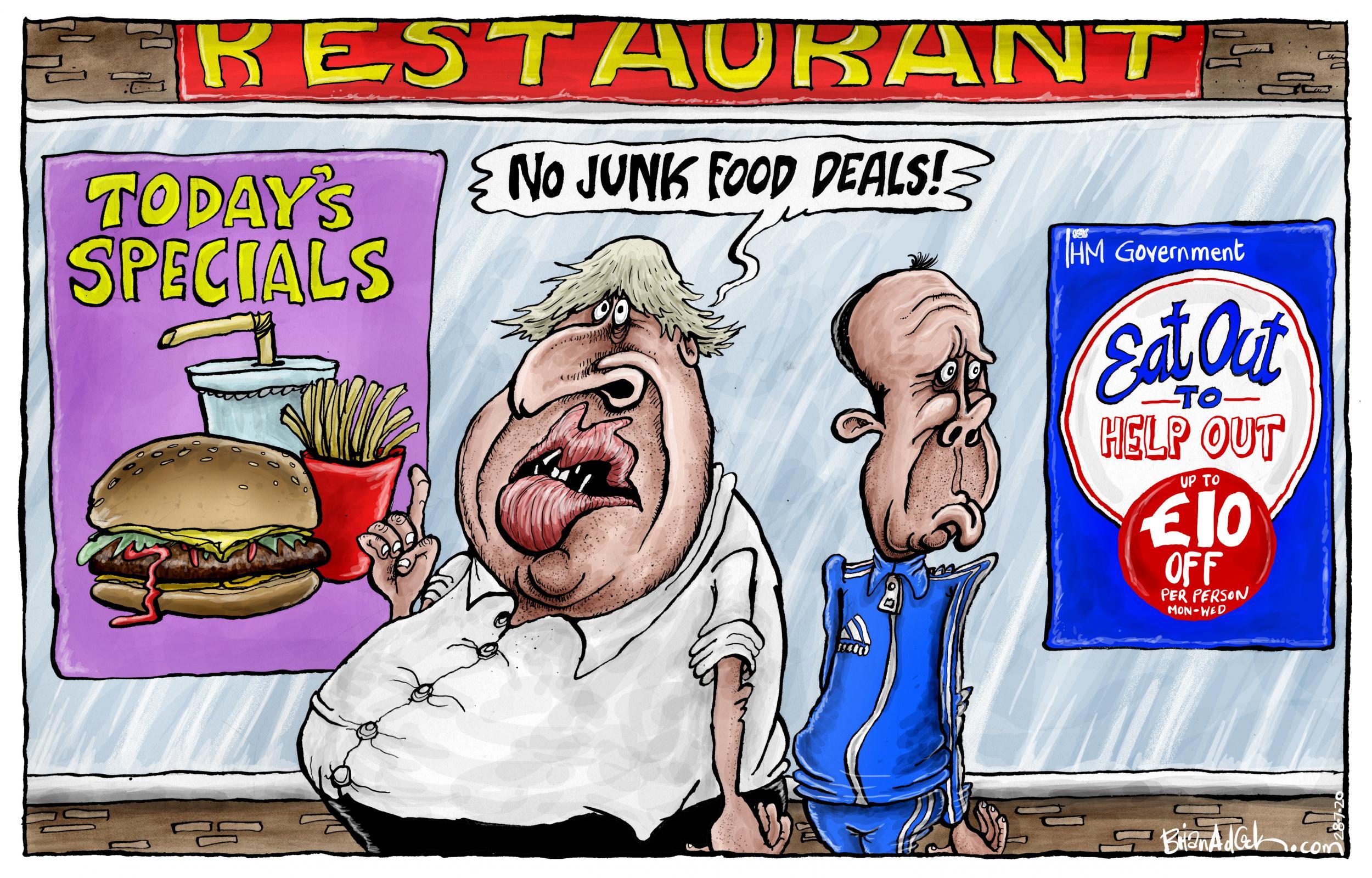

Boris Johnson, a product of lifelong privilege, has apparently had his opinions on intervening in the obesity crisis at least partly changed by his own brush with Covid-19. He might also be considering how a drive for more sensible eating might level up health outcomes among his new working class political base. Hence the new restrictions on television advertising and regulating two-for-one offers on treats. GPs will be encouraged to prescribe more exercise. Like the first day of Mr Johnson going on a diet, it’s a start.

The public health message needs to be clear, but obese children, and adults, do not need to be body shamed: what everyone needs, whatever their body shape, is to be more conscious about what they are eating and drinking, and nudged in the right direction. As with alcohol and smoking, it is not a simple matter of individual freedom to choose, laudable as that right is. It is about the impact on others, on family and friends, and on an NHS having to cope with so many of us living so much longer but in declining health.

The prime minister plainly dislikes the idea of taxing chocolate cake and the like – nannying as he calls it. He probably likes to have his cake and eat it. But it is a strange fiscal system that will put 20 per cent VAT on a Cadbury’s Flake and on a Flake ice cream, yet no VAT at all on a Flake cake or a pack of Flakes for the catering trade, such as would be used to create a 99 ice cream.

Not only is it illogical, bureaucratic and offensive to the fine principle of fiscal neutrality, but such irregularities are damaging health. The obvious answer is to tax the sugar content of all food and drinks, from whatever source, including the fizzy drinks covered by the 2016 levy, on a consistent, fair basis. The same should apply to the fat and salt content of food and drink, again whether it is bought from a supermarket, a fast-food outlet or a Michelin-starred restaurant.

The obvious objection to tax on food is that it hits the poorest hardest. That would be true if the tax was levied on all foods; but even in a tax system heavily biased towards healthy outcomes there would be many opportunities to avoid the levies altogether. A basket full of fruit and vegetables would suffer no penalty.

Yet heavy taxation on some processed foods is not necessary. The happy experience of the sugary drinks tax suggests that comparatively small adjustments in price can yield encouraging results. Consumers switch to cheaper alternatives that taste much the same; and the industry is incentivised to manufacture them.

It echoes the long experience of pushing smoking rates down: public health education, duties, and indoor bans have changed public attitudes to cigarettes. And there is no reason to believe that, over many years, attitudes to junk food will evolve in a similar fashion, much to the benefit of poorer families.

No one will be deprived of their occasional Whopper with fries or plate of bangers and mash, which we are told is a favourite of the prime minister, or their birthday cake. Just for once, he could even have his cake and eat it.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments