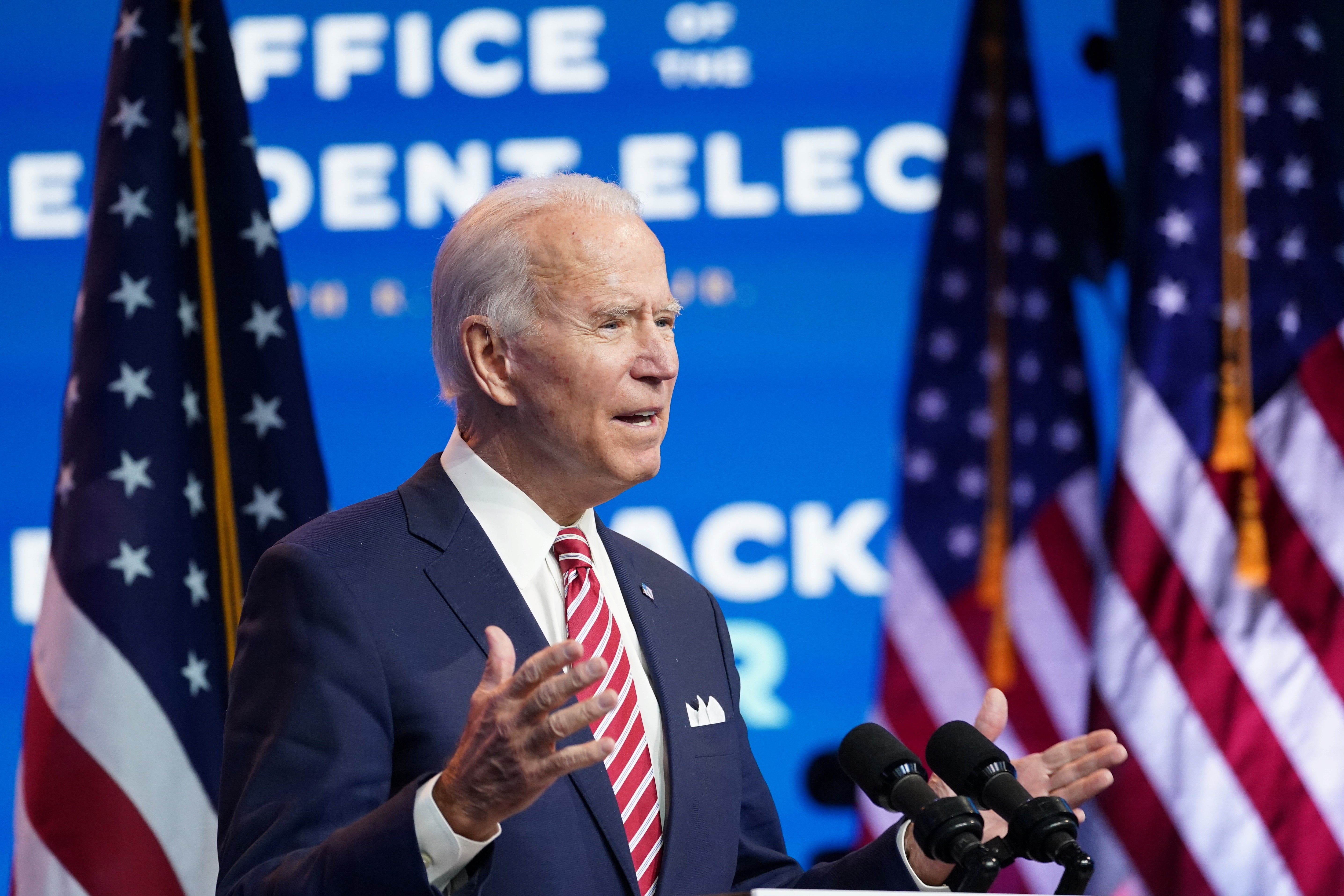

The US dollar will be weaker under Joe Biden’s presidency – here are six reasons why

The decline of the US currency is not a sign of trouble ahead but a great global shift in investor sentiment, explains Hamish McRae

The Biden dollar will be weaker than the Trump dollar. Or at least that is the majority view of the investment community: that the dollar, which had already lost a little of its shine in the past few weeks, will decline further. The irony of that is that this is rather what Donald Trump wanted. True, he was a bit ambivalent about it, but eventually came out strongly against Federal Reserve policy because it had the effect of strengthening the currency.

So Joe Biden looks like getting what was denied to his predecessor. Why?

Well the first thing to say is that this is not signalling any lack of confidence in his new pick as treasury secretary, Janet Yellen, or indeed the rest of his economic team. Her appointment in particular has been warmly welcomed both within the US and abroad. Rather it is one of those great global shifts in investor sentiment that take place from time to time.

It is early days but there seem to be at least half-a-dozen elements to this.

One is that fear is receding. The dollar is always a safe haven in time of trouble, and the world has had its share of that. But now there is the prospect of a solid global recovery next year, the only debate being the speed at which things will take off. So money that fled into dollars is being redeployed elsewhere, including emerging markets.

Second, the yield advantage of US government debt vis-à-vis European debt is expected to narrow. Both will follow ultra-easy money policies and everyone will be looking for direction from Janet Yellen’s testimony to Congress and from Christine Lagarde at the European Central Bank policy meeting this week. US yields will remain higher than German yields. The 10-year US treasury interest rate is a bit under 1 per cent, which isn’t much. But the equivalent German bunds offer minus 0.6 per cent, which for most investors that have any choice is absurd. However, as the world economy recovers, investors seem to think, rightly or wrongly, that the long crushing of European interest rates will be reversed and that European investments generally will become relatively more attractive.

Third, there is the switch from investing in “growth” stocks to “value” ones. Growth stocks – Apple, Microsoft, Amazon et al – have had an amazing run, but they are now very expensive. In recent weeks, the mood seems to have shifted and people are considering there are better opportunities in less glamorous companies making things like household products, such as Unilever, and pharmaceuticals, such as AstraZeneca. Even airlines, banks and oil companies are coming back.

The point about this is that if you want to invest in high-tech, you have to buy US companies. There are no Apples or Facebooks in Europe. Of course the US has value stocks too, but the net effect of a shift to value is to move money out of the US – and out of the dollar.

Four, Europe is being viewed as more attractive generally. That might seem a bit of an odd assertion this week, given the shenanigans over the EU’s trading relationship with its ex-member the UK and its budget tussle with its errant members Poland and Hungary. But global investors are looking beyond this to a solid European economy two or three years ahead. They are not simply buying the euro over the dollar; they are buying into what they expect to be at least a mini-European boom.

They are also buying into Asia, force number five. Asia has had a “better pandemic” than Europe or the US, in the sense that they have controlled the virus better and as a result their economic dip has been lower and the recovery faster. Money is racing into red-hot markets as investors fear being left behind.

Obviously a lot is going into mainland China, the only big economy to grow at all this year, but it is also flowing into South Korea and Hong Kong.

Finally, there is fashion itself. If we are able to predict the swings of investment fashion, we would all be rich. We can’t. But what wily investors can do is to identify a fashion trend early and stick with it until it flips. It is called momentum investing. If the momentum has been to pile money into the US, then you stick with that. If a lot of people start questioning whether that trend is coming to an end, as has started to happen, you don’t ask why – you simply follow them.

The upshot of all this will not be a dollar collapse, or at least I can’t see that. Rather it will be a rebalancing of global finance as normality returns. A somewhat lower dollar will support the US economy, as the Donald wanted. Insofar as it helps rebuild American jobs, Joe Biden will like that too.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks