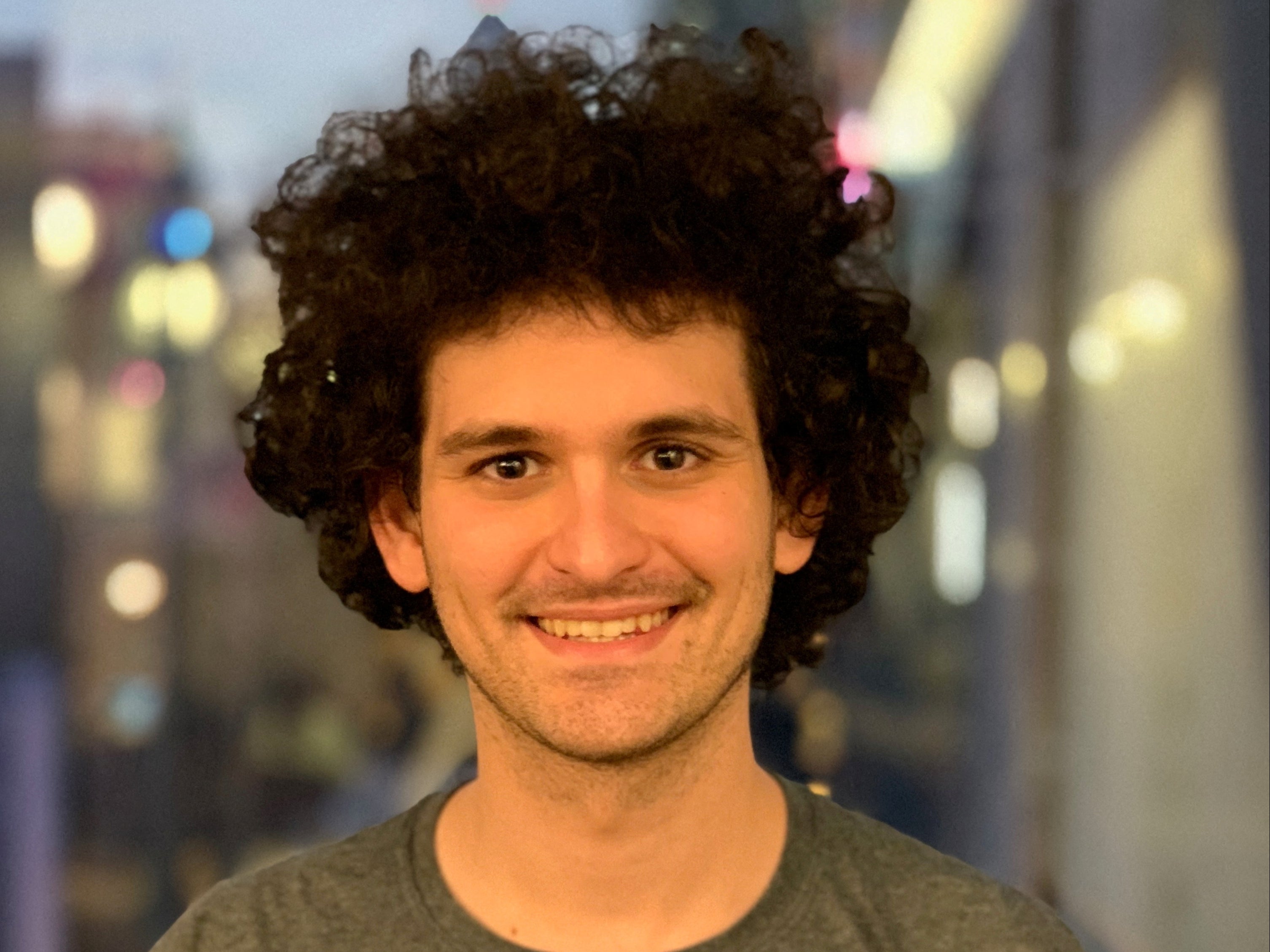

Sam Bankman-Fried: The crypto king who lost it all

Once seen as a bulwark against the shadier sides of the cryptocurrency world, the tech entrepreneur is now a pariah, writes Bevan Hurley

This week, Sam Bankman-Fried will appear alongside Mark Zuckerberg, Mike Pence, Ben Affleck and Volodymyr Zelensky at the New York Times DealBook Summit.

That the man known universally by his initials “SBF” is receiving star billing at the annual gathering of powerbrokers from the worlds of politics, tech and entertainment has enraged many in the crypto community, who believe the floppy-haired founder of the fallen FTX empire should already be behind bars.

“If SBF isn’t arrested and charged with fraud, wire-fraud, theft, and possibly money laundering before [the DealBook Summit] and instead gets to spew out his bulls*** narrative, our system of justice has been compromised,” former US attorney and founder of Crypto-Law US John Deaton wrote on Twitter.

In the world of cryptocurrency, SBF was until recently seen as a bulwark against the shadier industry practices.

He was the vegan workaholic who espoused a belief in “effective altruism”, and had the ear of Washington lawmakers thanks to his $40m (£33m) in donations to Democrats during the 2022 midterm elections cycle.

He courted celebrity endorsements and hosted conferences at his base in the Bahamas attended by Tony Blair and Bill Clinton.

Earlier this month, Bankman-Fried’s cryptocurrency trading firm FTX and a sprawling web of affiliated businesses collapsed almost overnight amid accusations of fraud and mismanagement, leading to billions of dollars in losses for investors.

The 30-year-old’s $16bn fortune plummeted by an estimated 94 per cent in one day – the largest ever drop recorded on the Bloomberg Billionaires Index.

He is now under investigation by the US Department of Justice and the Securities and Exchange Commission.

“You have witnessed probably one of the most abrupt and difficult collapses in the history of corporate America,” an attorney for FTX said during the company’s first hearing at the US Bankruptcy Court for the District of Delaware.

It is a remarkable fall from grace for the son of two law professors – he was born on the Stanford campus – who studied physics at MIT and, while still in his twenties, created one of the world’s leading crypto exchanges.

In rambling, cryptic Twitter threads, Bankman-Fried has attempted to explain what went wrong. He has apologised to his FTX “family”, and given softball interviews.

But, according to bankruptcy proceedings in Delaware, he is yet to substantively address the key issues surrounding FTX’s collapse: that he diverted billions of dollars in client funds to prop up Alameda Research, a quantitative crypto trading firm that he founded in 2017.

After FTX’s implosion, lurid allegations began to emerge about goings on at Bankman-Fried’s $30m Bahamas penthouse where the company’s top executives lived and worked.

Rumours spread online that the team’s punishing work habits were fuelled by the prescription stimulant Adderall and that several senior employees were in a polyamorous relationship.

(Bankman-Fried has acknowledged that he was romantically involved with Caroline Ellison, chief executive of his trading firm, Alameda Research.)

In an apparent attempt to dispel the claims, FTX’s in-house coach, a psychiatrist named George Lerner, approached the New York Times to deny that sex and drug use was anything out of the ordinary.

“The higher-ups, they mostly played chess and board games. There was no partying. They were undersexed, if anything,” Dr Lerner said. Some executives were prescribed medicine to treat ADHD, but that was typical in the tech industry, he added.

The most revealing interview Bankman-Fried has given since FTX’s demise was with Vox journalist Kelsey Piper.

In an exchange via direct message on Twitter, which Bankman-Fried later claimed had been off the record, he admitted the effective altruism claims had been a front.

“You were really good at talking about ethics, for someone who kind of saw it all as a game with winners and losers,” Ms Piper asked.

“Ya... Hehe... I had to be,” Bankman-Fried replied.

“I feel bad for those who get f***ed by it… by this dumb game we woke westerners play where we all say the right shiboleths and so everyone likes us.”

The FTX Foundation and FTX Future Fund – philanthropic projects which Bankman-Fried founded ostensibly to give away his fortune – have also become casualties of his hubris.

The group gave away hundreds of millions of dollars in the past few years to fund community groups such as the Grand Bahama Down Syndrome Society, to India’s Rajalakshmi Children Foundation, and others.

The $100m pledged in 2022 will never arrive.

“Brand ambassadors” such as NFL star Tom Brady, his former wife Gisele Bundchen, Curb Your Enthusiasm actor Larry David and the entire Golden State Warriors NBA team have also been caught up in the fallout. Last week, out-of-pocket investors launched a billion-dollar class action lawsuit claiming the celebrity backers were liable for promoting the failed firm.

Attorney John Jay Ray III, who served as chief executive of failed energy giant Enron during its bankruptcy, has been installed as FTX’s new CEO and is responsible for trying to recover the missing billions.

In a court filing last week, he said he had never seen such a “complete failure of corporate control”.

“From compromised systems integrity and faulty regulatory oversight abroad, to the concentration of control in the hands of a very small group of inexperienced, unsophisticated and potentially compromised individuals, this situation is unprecedented,” he wrote in the filing to the Delaware court.

Bankman-Fried is expected to appear at the NYT’s DealBook Summit on Wednesday remotely from the Bahamas, as he awaits the next move of US authorities.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks