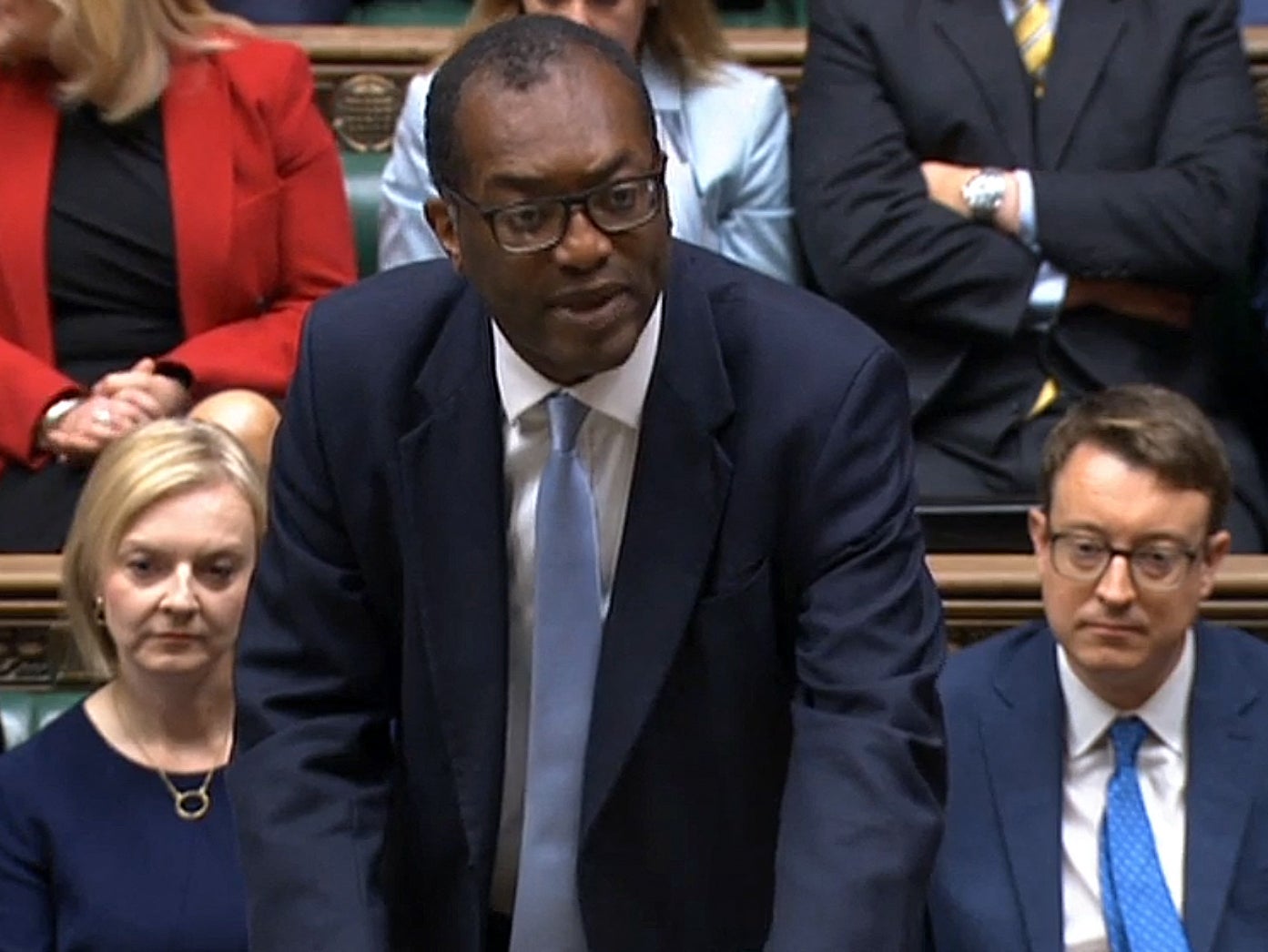

Bankers’ bonus cap scrapped by Kwasi Kwarteng in mini-budget

Chancellor says move will attract top talent to the City and boost tax revenue

The cap limiting bankers’ bonuses to 200 per cent of annual salary has been scrapped by chancellor Kwasi Kwarteng in his mini-budget.

The EU-wide cap was imposed in 2014 to discourage the type of profit-chasing that some critics said triggered the financial crash of 2008.

It limited annual bonuses to 100 per cent of salary - or 200 per cent if shareholders approved - in order to give less of an incentive for risk-taking.

But Mr Kwarteng said its impact had never capped total remuneration, as banks had simply shifted payments from bonuses to salary.

“The strong UK economy has always depended on strong financial services sector,” he told MPs.

“We need global banks to create jobs here, invest here and pay taxes here in London, not in Paris, not in Frankfurt, not in New York.”

But shadow chancellor Rachel Reeves said that the move was part of “a plan to reward the already wealthy - a return to the trickle-down of the past”.

She added: “Bigger bonuses for bankers , huge profits for energy giants, shamelessly shielded by Downing Street, and all the while ministers pile the crushing weight of all of these costs onto the backs of taxpayers.”

Mr Kwarteng faced immediate warnings that the removal of the cap will lead to a return to the risky behaviour which caused the 2008 crash.

Chartered wealth manager David Robinson, of London-based Wildcat Law, said: "The removal of the cap on bankers’ bonuses is beyond irresponsible.

“Bonuses promote short-term behaviours and hence risk-taking to generate profit as quickly as possible, with no implications for sustainability.

“As someone who spent years repairing some of the damage done in 2008, it is very concerning that just at the point the banks are back on a stable footing, the government is removing many of the checks and balances put in place to keep them there.”

According to the jobs website Prospects, the average starting salary for a corporate investment banker is between £30,000 and £40,000.

This rises to between £50,000 and £70,000 after three years, although those with significant experience may earn a base salary of up to £165,000.

Within the old rules, a banker on £165,000 could in theory be given a bonus of £330,00 on top of their base salary.

Some top bankers, however, earn far bigger salaries, with rewards at the top running into millions.

Prior to the imposition of the cap, many high-fliers earnt more from bonuses than salary.

Fred Goodwin, the former Bank of Scotland chief executive, was paid £4m in 2006 - £3.8m of which came from a bonus.

In his statement to the Commons on Friday, which the government described as a “fiscal event”, Mr Kwarteng also abolished the top rate of income tax for the highest earners as he spent tens of billions of pounds in a bid to drive up growth to ease the cost of living crisis.

He scrapped the 45 per cent higher rate of income tax and brought forward the planned cut to the basic rate to 19p in the pound a year early to April.

And he revealed his estimate that the two-year energy bills bailout will cost around £60 billion over its first six months from October.

The package enacting Liz Truss's tax-cutting promises - including reversing the national insurance rise and axing the hike to corporation tax - came a day after the Bank of England warned the UK may already be in a recession.

The Bank also lifted interest rates to 2.25 per cent - the highest level for 14 years and analysts expect a further hike next month.By terming it a "fiscal event" rather than a full budget, Mr Kwarteng avoided the immediate scrutiny and forecasts of the Office for Budget Responsibility.

Speaking after Mr Kwarteng delivered his statement, Mel Stride, the Tory chair of the Treasury select committee, said he welcomed some of the measures outlined by the chancellor but questioned the “vast void” at the heart of the spending plans.

He urged Mr Kwarteng to publish an independent statement to ensure his tax cuts were enacted in a “fiscally responsible manner”.

“Now is the time for transparency,” he added.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments