Bank of England intervention prevented destructive ‘spiral’ after mini-Budget

Threat to pension funds could have triggered ‘widespread financial instability’

The Bank of England has said that its intervention last month in the gilt market prevented a “self-reinforcing spiral” following Kwasi Kwarteng’s mini-Budget which could have wiped out the value of a large number of funds held by pension companies.

In a letter to the House of Commons Treasury Committee setting out the thinking behind the dramatic 28 September move, the Bank’s deputy governor for financial stability Sir Jon Cunliffe said that soaring gilt prices could have triggered “widespread financial instability”.

Had the Bank not intervened, a “large number” of liability-driven investment (LDI) funds would have been left with “negative net asset value”, reducing to “zero” their value to pension providers with significant stakes in them.

This would have triggered an “excessive and sudden” spike in interest rates on borrowing in the wider economy, said Sir Jon.

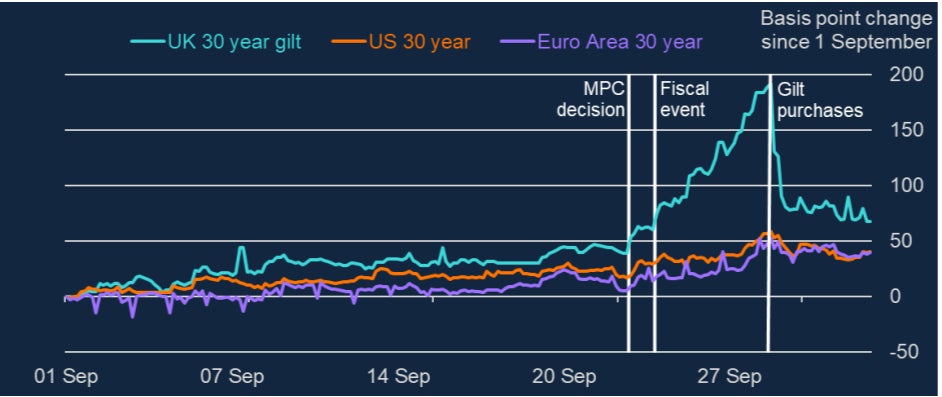

The Bank’s account – including graphs showing gilt yields rising sharply after Mr Kwarteng’s statement – blows a massive hole in government attempts to portray the market chaos as part of a global phenomenon driven by Vladimir Putin’s invasion of Ukraine.

It emerged as Mr Kwarteng held emergency talks on Britain’s biggest lenders over protection for home-owners amid surging interest rates on mortgages, now at around 6 per cent after more than a decade below 2 per cent.

Senior executives at high-street banks and building societies pressed the chancellor to extend a mortgage guarantee scheme which protects them against losses when lending to first-time buyers but which is due to end in December.

Labour Treasury spokesperson Pat McFadden said the Bank of England letter “shows once and for all that the Tories’ kamikaze budget is responsible for the economic chaos we have seen, leaving people with skyrocketing mortgage rates”.

“This is a Tory crisis made in Downing Street,” said Mr McFadden. “The government’s reckless mistakes show they cannot be trusted to manage the public finances. They must revisit this Budget as soon as possible and urgently publish OBR forecasts tomorrow when they receive them.”

On the morning of 28 September – five days after the markets were spooked by Mr Kwarteng’s £45bn package of unfunded tax cuts – the Bank announced it was ready to pump unlimited sums into gilts to stabilise prices, with a maximum of £5bn a day thought to be sufficient.

The action is due to continue until 14 October, putting the maximum envisaged Bank intervention as high as £65bn. But Sir Jon said that up to Wednesday of this week it had proved necessary to deploy only £3.7bn of its potential firepower, as the announcement itself had the effect of calming markets.

Spelling out the scale of the market chaos which prompted the unprecedented intervention, Sir Jon told the committee that by the Monday after Mr Kwarteng’s statement on Friday, yields for 30-year gilts – essentially the interest government must pay on its borrowing – had risen by more than 0.8 percentage points.

Gilts are a financial instrument favoured by pension funds because of their reliability over the long term, and volatility in the market is highly unusual.

“Through the day and into the evening, the Bank received market intelligence of increasing severity from a range of market participants, and in particular from LDI fund managers, reporting that conditions in core markets, should they continue to worsen, would force them to sell large quantities of long-term gilts in an increasingly illiquid market,” said Sir Jon.

“Taken at face value, this market intelligence would have implied additional long-term gilt sales of at least £50bn in a short space of time, as compared to recent average market trading volumes of just £12bn per day in these maturity sectors.”

After a brief rally early on the Tuesday, yields shot up by a further 0.67 percentage points later in the day “worsening the situation materially”, he said.

“The Bank was informed by a number of LDI fund managers that, at the prevailing yields, multiple LDI funds were likely to fall into negative net asset value.

“As a result, it was likely that these funds would have to begin the process of winding up the following morning.

“In that eventuality, a large quantity of gilts, held as collateral by banks that had lent to these LDI funds, was likely to be sold on the market, driving a potentially self-reinforcing spiral and threatening severe disruption of core funding markets and consequent widespread financial instability.”

Bank officials worked through the night of 27 September, in coordination with the Treasury, to draw up a plan to prevent the spiral from developing.

He told the cross-party panel of MPs: “Had the Bank not intervened on Wednesday 28 September, a large number of pooled LDI funds would have been left with negative net asset value and would have faced shortfalls in the collateral posted to banking counterparties.

“Defined benefit (DB) pension fund investments in those pooled LDI funds would be worth zero.

“If the LDI funds defaulted, the large quantity of gilts held as collateral by the banks that had lent to these funds would then potentially be sold on the market.

“This would amplify the stresses on the financial system and further impair the gilt market, which would in turn have forced other institutions to sell assets to raise liquidity and add to self-reinforcing falls in asset prices.

“This would have resulted in even more severely disrupted core gilt market functioning, which in turn may have led to an excessive and sudden tightening of financing conditions for the real economy.”

Setting out the scale of the crisis in the days after the mini-Budget, Sir Jon pointed out that the previous record daily interest hike had been 0.29 percentage points during the so-called “dash for cash” in 2020.

Measured over a four-day period, the increase in 30-year gilt yields was more than twice as large as the largest move since 2000 and more than three times larger than any other historical move.

The rise of 1.6 percentage points in the 30-year nominal gilt yield – which stood at just 1.2 per cent at the start of the year – over the course of a few days was larger than envisaged in even the most doom-laden risk management exercises.

Gilt market functioning was “severely stretched”, with “particular pressure” on LDI funds, he said.

Sir Jon said that after the purchase programme ends on 14 October, the operation will be “unwound in a smooth and orderly fashion once risks to market functioning are judged by the Bank to have subsided”.

He added: “The approach to unwind will depend, among other things, on the scale of actual purchases, the market conditions during those purchases and the market conditions when the purchases end.”

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments