An election result that leaves the struggling US economy as the biggest loser

This is a country that needs a coherent plan from politicians to shore up households’ incomes and to stimulate overall activity to prevent long-term damage to the economy, says Ben Chu

Investors, they say, hate uncertainty. If so, they will have detested US election night.

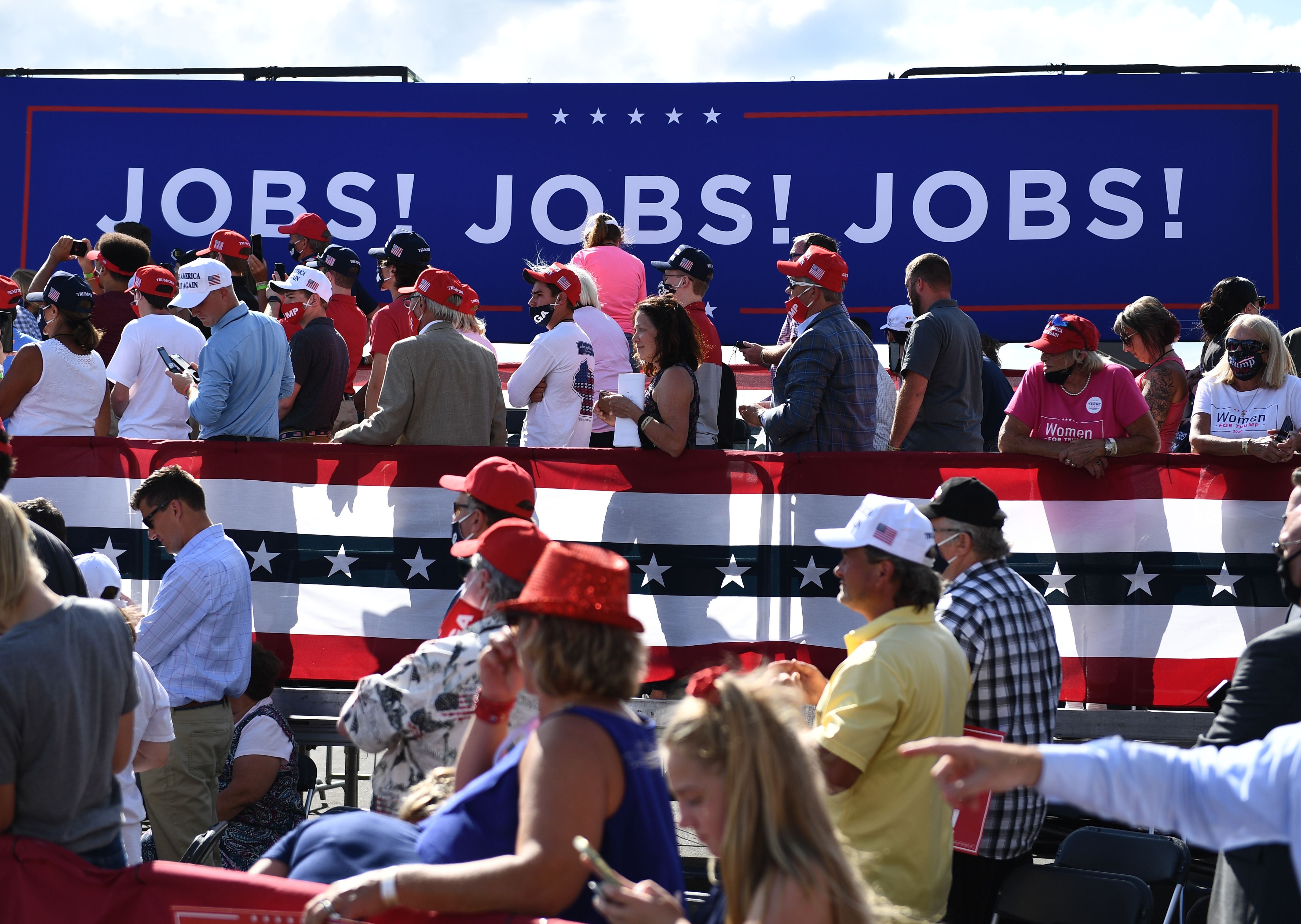

Entrenched market narratives of a Democrat “blue wave” breaking over the White House and Congress and unlocking trillions of dollars of stimulus spending were rapidly upended once the counting of the votes began and Donald Trump started chalking up majorities in key swing states such as Florida and Ohio.

Stocks and stock derivatives were sold, bonds were rapidly bought.

Investors will have hated the following morning too, which left the country with no clear result in perhaps the most important election for modern American economic policymaking.

And yet it should be said that, despite all the reviled uncertainty, trading wasn’t exceptionally volatile.

Price swings were not extreme, certainly not relative to the turmoil of March when governments started imposing coronavirus lockdowns across the world.

On the night of 3 November investors were in “wait and see” mode, rather than “panic and sell”.

Even Trump’s outrageous and unfounded claims of electoral fraud over postal votes at 2am – opening up the prospect of a constitutional crisis, with a Republican-packed Supreme Court ruling effectively choosing the next president – did not collapse the ceiling of the market’s composure.

Such a cataclysm for American politics may yet, of course, happen. If this turns into a legal battle in the manner of the contested Bush-Gore election of 2000, then we might still see markets hammer the panic button.

As it was, the US stock markets ended up opening slightly higher on Wednesday despite the anxiety of the evening. And thereafter they rose.

But even if a catastrophe for democracy has been avoided, the results of the election still hold out a bleak prognosis for the American economy.

The most likely outcome that was coming into view on Wednesday, as the counting continued through the afternoon, was one in which the US economy would get, perhaps, the worst of all worlds – namely a narrow White House win for Biden and a firm Republican majority in the Senate.

If Trump had won the White House, he would probably have increased his own negligible official stimulus plans, knowing that, without this, the US recovery would likely stall under his watch.

He had refused to work with the Democrat-controlled House of Representatives before the vote to extend the emergency support payments to some 12 million unemployed Americans, claiming that he would implement his own stimulus plan after re-election. We can now probably rule that out.

If the Democrats had won the Senate they would have been in a position to unleash Biden’s major $2 trillion stimulus and spending package next year.

As it is, the safely re-elected Republican Senate leader, Mitch McConnell, is likely to resist Biden’s every move on stimulus. McConnell’s shameless record of breaking political conventions suggests he would have tried this in any case, but he will feel all the more empowered to do so after the Democrats under-performed their own expectations on Tuesday – and with Trump having poisoned the legitimacy of the result in the mind of many Republican supporters with his baseless claims of fraud.

It’s easy to forget in all this that the US economy is still in a deep pandemic-induced recession, with output still well below its level earlier this year.

And the pandemic itself is far from over, with 80,000 new cases and over 800 deaths being registered every day in the US. Both counts are rising ominously.

This is a country that badly needs a coherent plan from politicians to get the virus under control, to shore up household incomes and to stimulate overall activity to prevent long-term damage to the economy.

The view in financial markets seems to be that monetary policy, in the form of more asset purchases by the US central bank, the Federal Reserve, will be cranked up again to keep the recovery on track.

But the Fed’s chairman, Jerome Powell, has warned that it’s fiscal, as much as monetary, stimulus that’s required to prevent “weakness feeding on weakness” in the US economy. The IMF’s chief economist Gita Gopinath argues the same.

Yet what chance of that fiscal boost emerging from the wreckage of this polity-shredding election?

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments