The energy crisis could get much worse – our leaders need to step up

A credible plan is needed urgently – but the government is moving too slowly, argues Ben Chapman

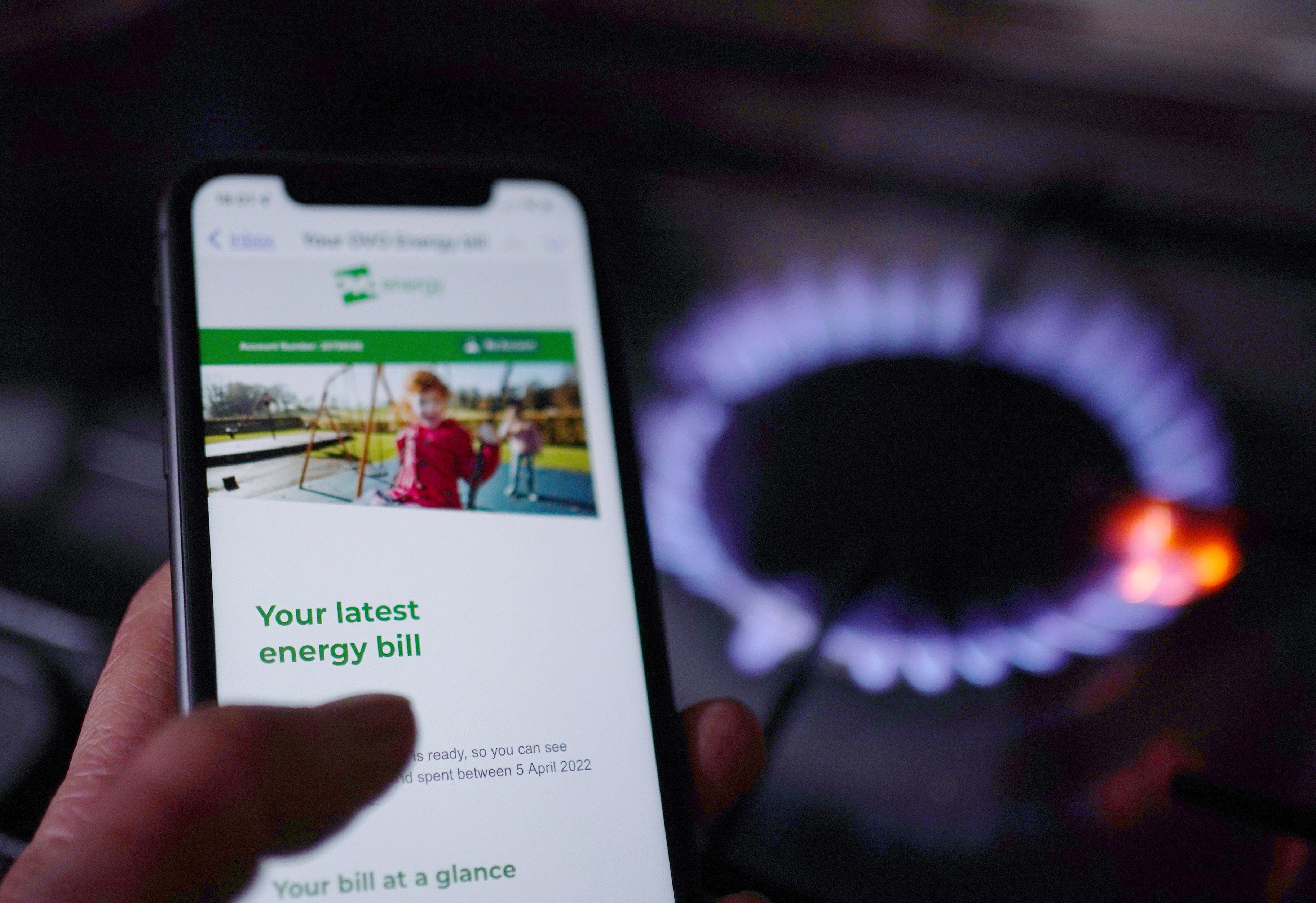

It is now undeniable that the UK is in a severe and deepening energy crisis. Without a swift and decisive intervention from government, the nation undoubtedly faces widespread hardship.

Those in charge have so far failed to make clear to the public the scale of what lies ahead. A price cap of £3,549 for the average household means millions of people will struggle to heat their homes, and there is much worse to come. Prices will go higher still.

In economic terms, it requires a fiscal response similar to the one that came during the Covid pandemic. At least £100bn is needed to shield people – particularly those on lower incomes – and businesses from unaffordable price rises.

We have a simple choice: to bear the costs collectively as a society or to leave every person to themselves. The cost of the former is great; the cost of the latter will be much higher.

The first rule of crisis management is to communicate; to be open and completely frank with everyone involved about the nature of the challenges faced.

So I found it dismaying, to say the least, that the boss of Ofgem, Jonathan Brearley, chose to downplay the severity of the situation.

Live on BBC Breakfast, minutes after the nation awoke to news that their energy bills had tripled in a year, he was asked about forecasts from experts that the cap would go even higher in January and then again in April. Such figures should be looked at “extremely cautiously” and were mere “speculation” at this stage, he claimed.

It was akin to the captain of the Titanic standing out on deck beneath a vast iceberg and proclaiming that no one could be sure if it would hit the ship.

The forecasts he dismissed as speculation are not plucked from the air. They are based on real, publicly available market prices for gas – the exact data that goes into Ofgem’s algorithm to decide the price cap.

Energy experts such as Cornwall Insight and Auxilione simply take the same data and calculations that Ofgem uses and work out what the cap will be. For the January cap, which Ofgem will announce in November, more than half of the price data is already locked in.

Based on those statistics, it is heading for well in excess of £5,300 in January and higher still in April. That is a fact, not speculation. The only thing that will bring it in lower is a big drop-off in wholesale energy prices, which most experts think is highly unlikely.

The causes of this crisis are well known. As Brearley laid out clearly in the same interview, Vladimir Putin has cut the vital flow of gas to Europe from Russia. He has used it as a political weapon and he will continue to do so. There is little prospect that he will reverse course unless Western nations immediately end sanctions on Russia.

You do not need to be clairvoyant to foresee that Putin will continue to turn the screw and further reduce gas supplies.

The most worrying thing is that this means the forecasts the Ofgem boss seemingly does not want to acknowledge are likely to prove too optimistic.

If the January cap were calculated today it would be £5,300 in January and close to £7,000 in April. Market prices for gas have doubled in the past few weeks. A further reduction of flows from Russia will push them higher again. There is almost no limit to how high those figures could go.

Is a £10,000 price cap possible? Yes, experts tell me. People need to know this. Yet the boss of the industry regulator appears to be attempting to shield the public from the truth.

Sadly, he is not alone. Three weeks ago, Bank of England governor Andrew Bailey explained why he now thought inflation would hit 13.3 per cent this year when, just a couple of months earlier, he’d forecast 10 per cent.

Bailey and his number two, Ben Broadbent, trotted out excuses as to why they’d got it so badly wrong. It would have taken “exceptional foresight”, they claimed, to predict that gas prices would have gone up so much in the past few weeks.

One might have thought they would be eager not to make the same mistake twice. Yet they delivered a report in which their most pessimistic scenario for the UK economy was one in which gas prices gently levelled off and then fell back.

This proved to be wildly optimistic. Days later, the Bank’s numbers were – once again – worthless. It did not take exceptional foresight to see this coming. In fact, I asked several experts on that day and they foresaw it.

An average household will need to pay £700 for their January gas and electricity alone. Many simply cannot cope.

National Energy Action estimates that 8.9 million households will be in fuel poverty, unable to adequately heat and power their homes.

Local authorities are setting up “warm banks” where people will be able go to make sure they don’t freeze during the winter.

The response from government must rest on sensible worst-case scenarios and assumptions.

But where is the plan? So far this unprecedented situation has been met with silence, punctuated by the occasional empty slogan about market forces, cutting taxes and national pride.

In difficult times we need leaders who are up to the job. Sadly, they are nowhere to be seen.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments