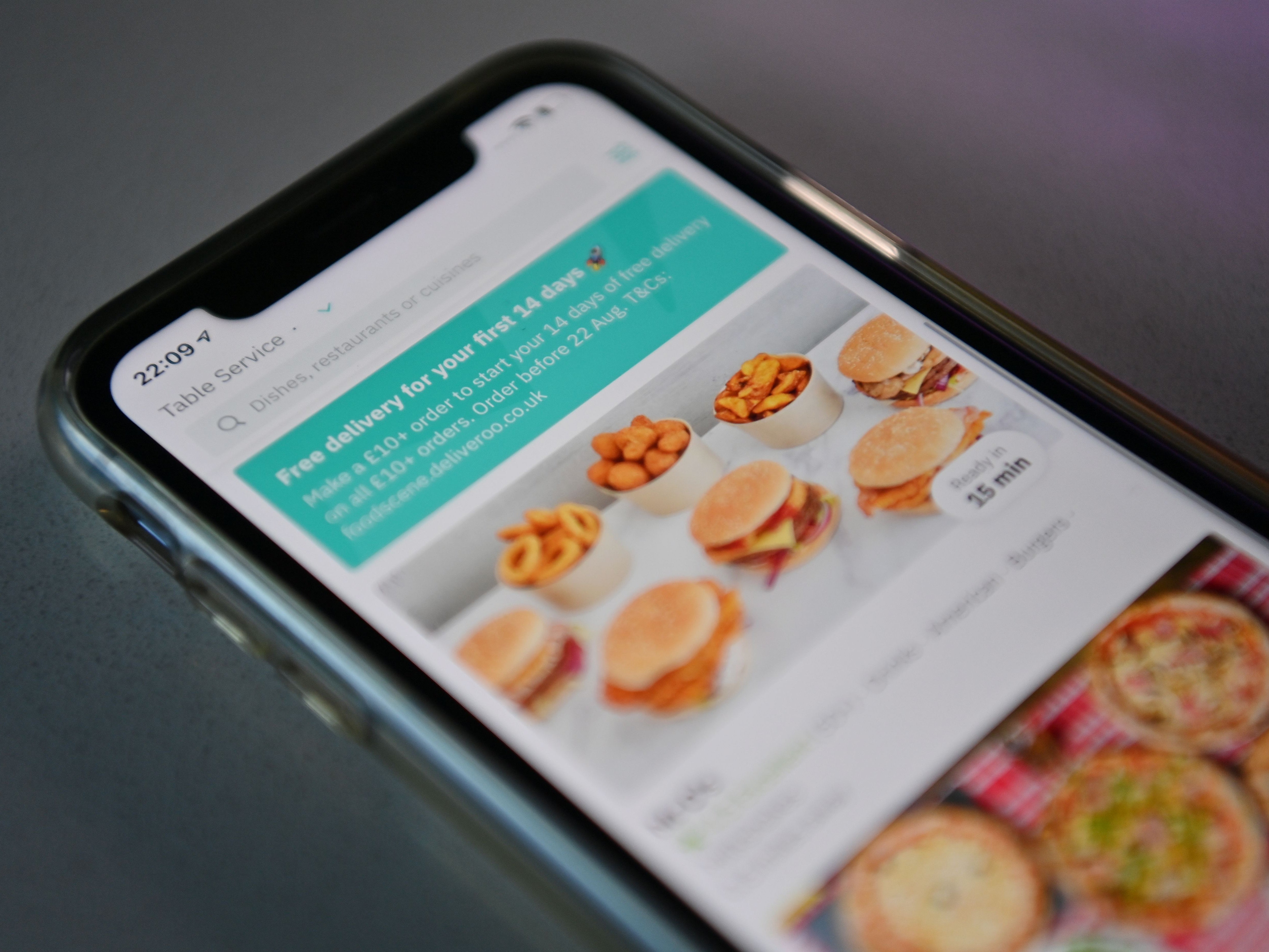

Why have Deliveroo shares tanked on their stock market debut?

A lack of profits, questionable governance and poor treatment of riders have all been identified as factors behind Deliveroo’s calamitous first day of trading. But which was most responsible? Ben Chu investigates

The takeaway food delivery company Deliveroo had a very disappointing stock market float on Wednesday.

Despite the company reducing the initial share price considerably in response to scepticism about the original £8.8bn market capitalisation price, the shares still sank by 30 per cent soon after trading began.

It was one of the biggest first-day falls on record for a large company making its stock market debut – and knocked £2bn off the firm’s initial valuation of £7.6bn.

The build-up to the float had been torrid from a public relations perspective as a host of large institutional UK asset managers – including big names such as Aviva and Legal & General – said they would not invest in the company because of its controversial treatment of its delivery riders.

Deliveroo deliberately hires them as self-employed contractors rather than workers. This reduces the company’s costs but raises the prospect that regulators or legislators will compel the company to change its business model.

Read more:

But there are also concerns among institutional investors about the unusual control rights which will be retained by Deliveroo’s founder, Will Shu, relative to other shareholders. There are also plenty of sceptics about Deliveroo’s profit outlook.

So which of these factors best explains the company’s painful first day of trading? And does a bad first day on a public market tell us anything about a firm’s longer-term prospects?

In some ways it was not an auspicious time for Deliveroo, founded in 2013, to go public.

2020 was a difficult year for the company. Despite expectations that the first lockdown would give a big financial boost to food delivery apps, Deliveroo found itself under severe financial pressure as major customers such as Nando’s simply shut up shop. It had to be rescued by an injection of cash from Amazon.

Deliveroo explicitly warned that it could go under if the competition authorities blocked that investment from the US digital leviathan.

There was a recovery in the latter half of the year, with Deliveroo’s takeaway orders jumping by more than a half. Yet it still ran a £224m loss for the year.

Neil Wilson, an analyst for Markets.com, said that the company was “just plain mis-priced” for a loss-making delivery platform in a competitive market. Just Eat is the market leader and Uber Eats is also growing its share.

Deliveroo’s model of hiring riders as contractors, rather than workers, is a clear financial risk given the recent Supreme Court ruling that a group of Uber drivers are workers, not self-employed.

"If forced to offer more traditional employee benefits, like company pension contributions, Deliveroo’s already thin margins would struggle to climb, and the road to profitability would look very tough indeed,” says Sophie Lund-Yates, an analyst at Hargreaves Lansdown.

The fact that corporate governance issues also loom larger for UK investors, than in the US, will certainly not have helped Deliveroo.

Russ Mould of AJ Bell says that the opposition of big institutional shareholders probably contributed to the lack of enthusiasm from smaller investors for the Deliveroo stock.

Chancellor Rishi Sunak recently expressed the hope that a proposed relaxation of stock exchange rules – enabling companies like Deliveroo with share structures that favour founders to be included in the London Stock Exchange’s “premium” market including the FTSE 100 – will persuade other technology firms to list in London, rather than the choosing the US.

But if UK institutional investors aren’t on board with such an overhaul of the rules, the economic benefits might prove elusive. Deliveroo’s weak debut sends a strong message to the chancellor on that front.

A shift in general market sentiment might not have helped either. DoorDash, a US version of Deliveroo, shot up on its American stock market debut in December, benefiting from the investor enthusiasm for all technology firms. But that enthusiasm for tech stocks has faded somewhat this year.

In truth, Deliveroo’s horrible first day on public markets is likely due to a confluence of factors – concerns about governance, rider treatment, profitability and bad timing coming together – rather than a single one.

Mr Mould does think Deliveroo could yet recover: “One must question if the knee-jerk reaction we saw at the market open is simply a short-term issue and if investors who like the long-term growth opportunity will flock to buy stock at the even cheaper price.”

As Mr Sunak noted yesteday, Facebook struggled on its US market debut in 2012 and its investment bank underwriters had to buy the stock to prevent it falling below its float price of $38. Facebook shares are now worth $290 (£210).

Yet it would be a pretty brave investor who would argue today that Deliveroo is set to grow like Facebook.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments