Will the $2 trillion American coronavirus economic bailout package be enough?

Analysis: Underneath the headline figure, what’s this package actually made up of? Who will benefit? And is it really as substantial as it sounds? Ben Chu investigates

Two trillion American dollars. That’s almost a tenth of the size of the entire US economy, the world’s largest.

It’s a quarter of total American public expenditure last year.

The Coronavirus Aid, Relief and Economic Security Act, passed by the Senate earlier this week and due to go before Congress today, sounds huge.

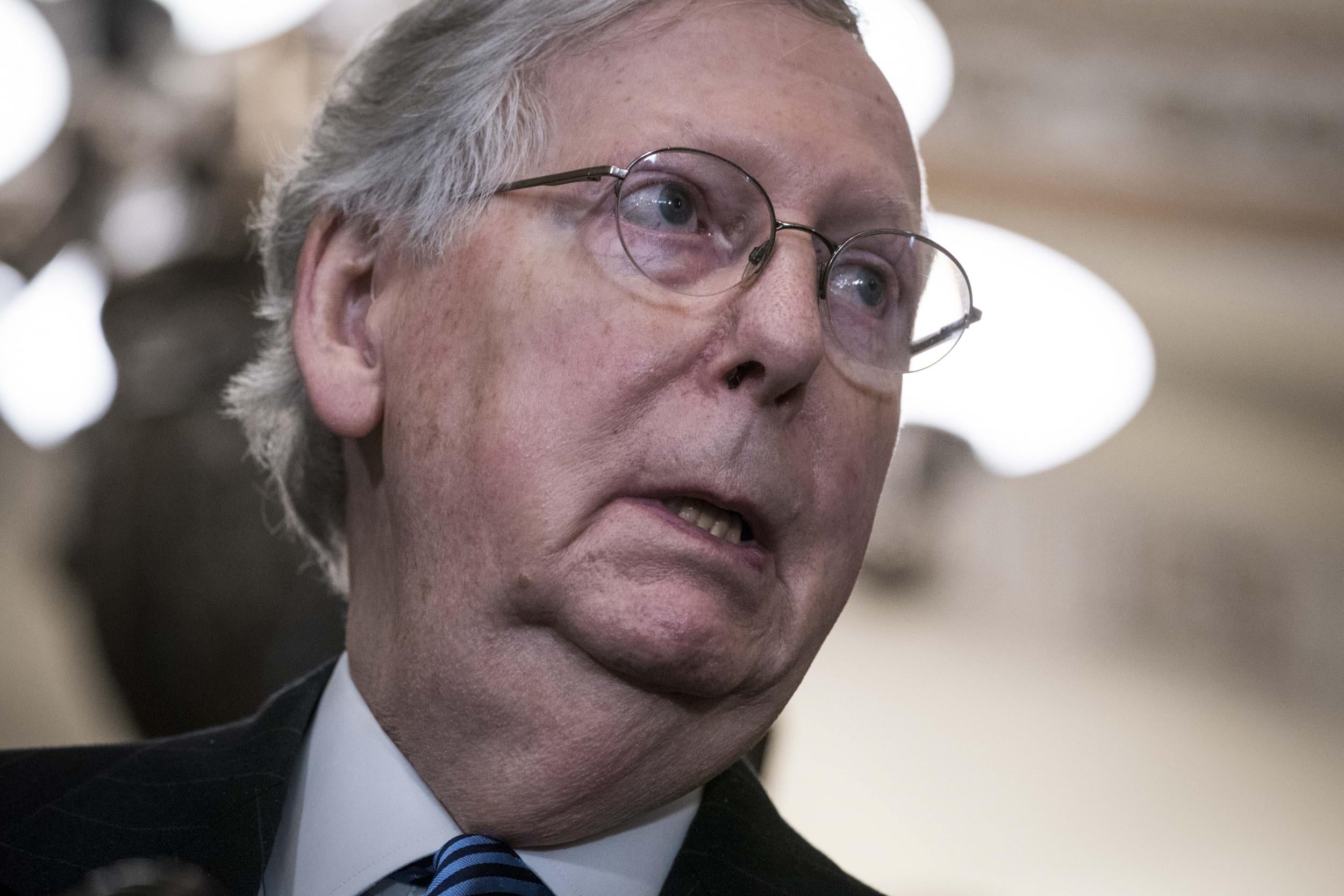

The Republican Senate leader Mitch McConnell described it as: “In effect … a wartime level of investment into our nation.”

It’s more than double the $800bn US stimulus package implemented during the global financial crisis.

But underneath the headline figure, what’s the $2 trillion package actually made up of? Who will benefit?

And is it really as substantial as it sounds?

What’s in the package for families?

The most remarkable element of the package is a cash payment directly to individuals.

Every adult in America will be sent a cheque for $1,200. Households with children will also get $500 per child. Payments phase out though, starting at those with incomes of more than $75,000, in an attempt to try to target the assistance on those with lower and middle incomes.

Yet it remains an unprecedented giveaway of public money and much less targeted than wage subsidy schemes elsewhere. America’s Tax Policy Centre think tank estimates that about a third of the payments will go to households in the most well-off 40 per cent.

This giveaway accounts for $290bn, about 15 per cent of the headline package.

It’s also about 1.3 per cent of US GDP.

There’s also a large increase in unemployment benefits and a new assistance scheme for the self-employed – projected to cost around $250bn.

The fact that jobless claims jumped by an unprecedented 3.2 million in the most recent week suggests that this support will soon be needed by millions more families.

What about businesses?

One of the things that held up the bill was the original proposal from the Republican side that US firms could be bailed out with public money, but the firms would remain anonymous.

Democrats refused to accept that, saying that it amounted to a secret bailout.

But the two sides agreed on an independent oversight board for loan dispersions and assurances that firms connected to Donald Trump and his family – and also members of Congress – would not receive any of the money.

And so there is $500bn of aid in the package earmarked for large US firms, including $75bn for airlines and $17bn for firms “critical to maintaining national security”.

There’s also $232bn of tax relief in the form of deferred payroll taxes.

Under the act, small firms will be able to access some $350bn in cheap government guaranteed loans, which will be forgiven if the funds are used to pay workers, rent and utilities and the companies don’t lay staff off.

What about hospitals?

The US health sector gets $150bn of additional funding, which will be channelled through state and local governments.

This includes funding for hospitals, the procurement of medical supplies, including protective equipment for workers, and also money for vaccine development.

That’s around 1 per cent of US GDP.

Will it be enough?

It’s important to note that it’s not all government spending which supports economic activity – a good deal of the $2 trillion total is loans and state loan guarantees.

Yet economists estimate that the package will, nevertheless, push the US federal deficit up to almost 10 per cent of GDP.

This won’t, however, be enough to stop the US falling into a deep recession, almost certainly deeper than the 2008-09 slump.

But a fall in GDP is inevitable because that’s a by-product of population lockdowns to stop the spread of disease.

The direct cheques to families will be useful in repairing their balance sheets and sustaining their incomes, but if unemployment, as now seems entirely possible, surges to heights not seen since the Great Depression of the 1930s, it will merely mitigate the economic suffering rather than offset it.

And if the outlook continues to deteriorate, pressure will probably increase on the US government to go beyond this $2 trillion support package.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments