Inside the ‘doge-eat-doge’ world of the memecoin community

Capitalism needs a giant reset. Could cryptocurrencies sweep away society’s imbalances to create a new world? Generation Z thinks so. Brian McGleenon reports

I bought my wife this in straight cash.” The young man smiles as he holds up a photograph of a mansion, then adds: “You can’t beat the rich at their own game. The system is rigged and crypto is the only way to hack it, the only way to tell the boss to clear off.” As I stepped out of the Hex cryptocurrency conference in London in early December, my mind was spinning after witnessing hundreds of ecstatic crypto enthusiasts articulate how intangible computer code can change lives and is on the cusp of changing the world.

In my reverie, I stepped straight into the path of an approaching limousine. The car doors opened and out stepped more cryptocurrency nouveau riche, tuxedoed, and smoking cigars. They presented with the same common denominators as those within the conference. They were young, weighted more towards Generation Z than Millennials; they wanted to remain anonymous; and they had recently become the recipients of life-changing wealth.

The sudden shock of the coronavirus pandemic in 2020 plunged the world into a deep economic recession and produced the worst increase in income inequality since the 2008 financial crisis. Central banks across the globe turned to quantitative easing to resuscitate trade activity that had been crippled by a succession of lockdowns. This only served to exacerbate the inflation of national currencies, and forced a swathe of retail and institutional investors to consider digital assets, such as bitcoin and ethereum, as a hedge against inflation for the first time.

By the second quarter of 2021 there were signs of a recovery, but most of the gains became extra padding in the wallets of the uber-rich. The recent publication of the Forbes 400 list of richest Americans is confirmation that since the pandemic began, socioeconomic stratification has been solidifying, not dissipating. The collection of billionaires that sit atop this list have added a further $4.5 trillion to their collective wealth, an increase of 40 per cent in the last year. Most of these individuals acquired their wealth via the creation of web 2.0 applications, such as Jeff Bezos’s Amazon, Mark Zuckerberg’s Facebook (now Meta), and Elon Musk’s PayPal.

Now, Millennials and Generation Z are seeking avenues of progress that will circumnavigate the entrenched wealth of the web 2.0 barons. They are seeking a disruption of this status quo, and ex-Wall Street banker Brian Rose says that web 3.0, and the opportunities presented by cryptocurrencies, will provide this. The World Economic Forum has touted a “great reset” of capitalism as a way to solve the deepening economic woes confounding nation states as they try to recover from the lacerations of multiple pandemic lockdowns.

However, Rose claims that the emergence of the cryptocurrency ecosystem will provide the actual reset, and sweep away society’s imbalances to create a reconstructed new world. He does not tread lightly with the significance of the changes to come when he tells me that web 3.0 and cryptocurrencies provide “a paradigm shift that will usher in a total change in human mindset and power”.

If web 3.0 is a vision for the future of the internet, then that future rests upon the systematic disruption made possible by blockchain technology. Ethereum founder Vitalik Buterin described the nature of this coming disruption when he wrote in Bitcoin Magazine: “Whereas most technologies tend to automate workers on the periphery doing menial tasks, blockchains automate away the centre and instead of putting the taxi driver out of a job, blockchain puts Uber out of a job and lets the taxi drivers work with the customer directly.”

The gatekeepers of power, institutional finance and the centralised tech giants, must be prepared to relinquish control in the face of the disruptive inevitability of web 3.0. The internet is reinventing itself as we speak, and ownership of the online networks that rule our lives will be fragmented among the communities that use them. The way to have a stake in this new paradigm is to invest in the cryptocurrencies that power it. Rose says that “by 2025 the world will have a billion cryptocurrency users because adoption of the new technology is at an exponential rate that has never been seen before”.

The Wall Street veteran adds that the paradigm shift being roused by web 3.0 and the cryptocurrency revolution will see wealth generation on a scale “10 times greater than the dot.com boom of the early ’90s and the largest dislocation of wealth in history”.

This wealth dislocation has been advanced by the emphatic rise of memecoins throughout 2021. The first memecoin was dogecoin, beginning life as a joke cryptocurrency with no proper use case. Dogecoin is distinctive because of its cartoonish logo of a Japanese shiba inu dog, which became a popular online meme.

Generation Z was three times more likely to purchase cryptocurrencies and more inclined to trust them as legitimate money for daily purchases

It was created in 2013 as a parody to lampoon the wild speculation surrounding the cryptocurrency sphere at that time. The world’s first memecoin has rocketed 12,000 per cent in value since the beginning of 2021, and is now, bizarrely, considered alongside its major memecoin rival, shiba inu, to be a serious investment opportunity. This is an irony not lost on the founders of dogecoin, whose original purpose was to make fun of the lofty ideals of bitcoin proponents, who pontificate that their digital asset will eventually replace the world’s existing monetary systems.

However, the irony seems to have confused the disciples of dogecoin’s rival, shiba inu. This younger memecoin sports a similar dog motif, but for shiba inu’s dedicated troop of followers, their currency is definitely not a laughing matter. The so-called “shib army” has higher aims for their cryptocurrency, which began life in August 2020. They believe it has the power to change the world, and present an almost religious fervour from their headquarters on the Reddit page, r/SHIBArmy. It is from here that the rally cries emerge, encouraging members of the community to “spend more money on shiba inu to change the world for the better”.

They are dedicated to furthering the schemes of shiba inu’s founder, a mysterious developer known as Ryoshi, who has referred to himself as “a guy of no consequence tapping at a keyboard and I am replaceable”. In his manifesto, Ryoshi assures his shiba inu acolytes that his cryptocurrency will “slowly but surely become the immutable globalised exchange of value”. He compels his “army”, described as one “organic organism”, to set “the proper financial foundations for the future”.

In May 2021, the price of shiba inu jumped by more than 300 per cent after Tesla CEO Elon Musk mentioned he was planning to get a shiba inu puppy. In October, he tweeted again stating that he only holds three cryptocurrencies: bitcoin, ethereum, and dogecoin. The series of tweets by Musk has catalysed the popularity of dogecoin and shiba inu, allowing interest in memecoins to spread from the internet’s fringe to the mainstream media.

The rise of memecoins has coincided with the onset of coronavirus restrictions. The pandemic lockdowns have accelerated the trend of life moving online. As we spend more of our lives staring at a screen, we place more trust and value in the virtual. When someone moves hard cash from the real world to purchase a cryptocurrency, they are purchasing what is essentially a line of computer code. The intangible nature of the purchase resonates with the intangible nature of pandemic life, where interactions are conducted virtually. The majority of memecoin investors come from the Generation Z demographic, which has a belief in the potential of the cryptosphere to give life-changing wealth. They are comfortable navigating digital environments and riding out the volatility of the cryptocurrency market.

This generation has come of age with pandemic-related monetary stimulus packages and the resulting inflation of traditional fiat currencies, such as the pound and the dollar. Respondents to a recent survey by Engine Insights revealed that Generation Z was three times more likely to purchase cryptocurrencies, and more inclined to trust them as legitimate money for daily purchases. This generation is funnelling its meagre disposable income into cryptocurrency markets on a monthly basis.

Fear of missing out, or “Fomo”, is a strong psychological driver, and a prime destination for investment has been the multitude of memecoin cryptocurrencies that are being deployed online. The wealth transfer through 2021 has seen the value of shiba inu tokens rise by 39,000 per cent, creating the absurd situation in which the dog-faced token is now worth more than major global corporations, such as Nokia, Hewlett-Packard, and General Mills.

A new zeitgeist is forming, wherein memecoins are now being accorded the same credibility as serious digital assets in major financial news outlets. They are also in consideration for listing on the new FTSE Digital Asset Index. Generation Z has driven the uptake in interest in these entry drugs into the world of crypto.

The younger generation sees memecoins as monetisation of a world they understand and a community they can belong to. But behind these alignments lies the need to escape crippling student loans, and the chance to get a foothold on an increasingly inaccessible property ladder. One of the developers of a newly minted memecoin, called dogebonk, spoke of a name that has arisen within the depths of cyberspace to describe the new zeitgeist. This name is “Clown World”, and it was coined by anonymous memecoin advocates who frequent the 4chan internet forum.

The developer I spoke to described their dogebonk memecoin as “the real memetic answer to the ridiculous Clown World we live in and a social response to the madness incited by shiba inu”. The developer pointed out that cryptocurrencies with strong, fundamental use cases that society might need, such as the Chainlink cryptocurrency, are falling in price, while pointless, zero use-case memecoins like dogecoin, shiba inu and dogebonk have soared in value throughout the year.

He described “memecoins with zero value reaching billions of dollars in valuation, and young people gambling their savings because there is zero chance of them affording a house”. “Clown World” sums up a collective feeling that is brewing among Generation Z that they are “living in a world we can no longer understand, where the most absurd outcome that no one would expect happens”. Dogebonk is ironically seen as “the way to complete Clown World and get that much-needed ticket out of the rat race”.

I bought dogebonk on the first day it appeared and I’ve already taken out enough to buy my first apartment without a mortgage, something that puts me at least 25 years ahead of most people my age

Many of those who bought into dogebonk when it was first launched at the beginning of October 2021 have fully realised this “ticket out of the rat race”. One early adopter told me how, after dogebonk soared to an all-time high during November, they were able to pay off all their student loan debt. Another member of the community said: “I bought dogebonk on the first day it appeared with a few thousand dollars, which are now worth millions, and I’ve already taken out enough to buy my first apartment without a mortgage, something that puts me at least 25 years ahead of most people my age.”

Another member of the “bonk squad” claimed that investing their savings into the memecoin “could be the best decision of their lives or the dumbest”, adding that they’d “rather lose £4,000 than miss out on the next big memecoin”.

Early adopters of shiba inu have been even more successful. One anonymous crypto wallet revealed that its owner had invested £5,800 in shiba inu in August 2020, and in October 2021 the same amount was worth £4bn. The story reached the mainstream media and reinforced the conviction that investing in memecoins was 2021’s No 1 get-rich-quick scheme.

All was going well with this narrative until cryptocurrency markets nosedived in an early December flash crash. Many people who poured money into memecoins during the October-November 2021 gold rush lost staggering amounts. One dogebonk community member described themselves as “a broke college student who poured in their savings and made profits throughout October”, but when the crash came their “hubris was short-lived and it all came crashing down about a week after I had bought in”.

After the crash, an anonymous Reddit user admitted they had persuaded their aunt to invest £150,000 in shiba inu crypto; the same amount is now worth less than £36,000. At the esteemed headquarters of the shiba inu community, the 452,00-subscriber r/SHIBArmy Reddit page, one panicked investor claimed they had sold their apartment to buy shiba inu when the price was soaring. The price is now tilting into a downward spiral, but this shiba inu advocate has such faith in the currency that they are willing to keep holding until the price “gets to at least 1 cent”.

The current price of shiba inu is $0.00003. However, shiba inu advocates have a dream that their cryptocurrency will one day reach $1 per coin. This is an extremely unrealistic ambition, as $1 per coin would give shiba inu a market capitalisation of $1 quadrillion, which is many times the value of the whole of the cryptocurrency ecosystem. However, shiba inu followers will not be deterred in their belief.

The Clown World term originated on the fringes of the internet, on the 4chan anonymous imageboard, where many memes are born and incubated. We can thank this fringe forum for popular memes such as Rickrolling, Rage Faces, LOLcats, Pepe the Frog, and Hiding Crying Behind a Mask. The memes generated on 4chan are creative and perceptive. But like the Trojan horse, they also belie a power that is hidden and dangerous.

In November 2016, members of the 4chan community announced: “We actually elected a meme as president.” This was after the election of Donald Trump to the White House. After Trump was inaugurated, the 4chan message boards lit up with glee at the failure of Hillary Clinton’s “libtards”.

They argued that it was partly down to the “weaponised autism” of 4chan keyboard veterans who had channelled their combined memetic attacks to help elect a reality TV star to the highest office in the land. The nihilistic memes of Clown World had manifested in reality. The triumphalism after the Trump election shock revealed the darker side of 4chan. Because the message board is anonymous and unmoderated, it has developed a reputation as an incubator for conspiracy theories, a home to incels, and a place where reality is reduced to harsh generalisations and disturbed thought patterns can be amplified.

Understanding in-jokes and meme fluency are essential when navigating the deeper regions of 4chan, and these same attributes are needed in grasping the significance of memecoins and their almost parabolic rise in value in 2021. Insiders on 4chan get the latest innovation within a meme, just as insiders within crypto projects invest in the right memecoin early on to siphon away life-changing profits. Out-groups fail to understand the meme, just as traditional investors fail to understand the lucrative potential of the memecoin.

Memecoins have been lambasted for being frivolous and devoid of any hard-use case. However, Rose, the CEO of media platform London Real, describes a facet of memecoin developers that their more serious counterparts neglect. He maintains that the developers behind shiba inu, dogecoin, floki and dogebonk understand and capitalise on “providing a community”. He cites the market capitalisation of shiba inu as quantifying “a community worth $20bn”. He adds that “shiba inu as a cryptocurrency and a memecoin doesn’t make sense, but what they get is community, and they are presently tracking and quantifying a community on the blockchain and you can’t ignore the value of this”.

In the foreground of the meme banner that floated at the edge of the stratosphere is the dogebonk dog wearing a dickie bow and using a baseball bat to ‘bonk’ a weeping dogecoin dog

The collective will of memecoin communities is a force that can drive assets into the stratosphere or dump them into the abyss. This has been shown by the combined trading strategies of the WallStreetBets community. This group of Reddit retail investors managed to “short squeeze” veteran Wall Street traders out of millions in profits through a mass-market buy-in that inflated the price of GameStop from $20 per share to nearly $500. When a member of a memecoin “community” goes lone wolf, their almost religious devotion is explicit.

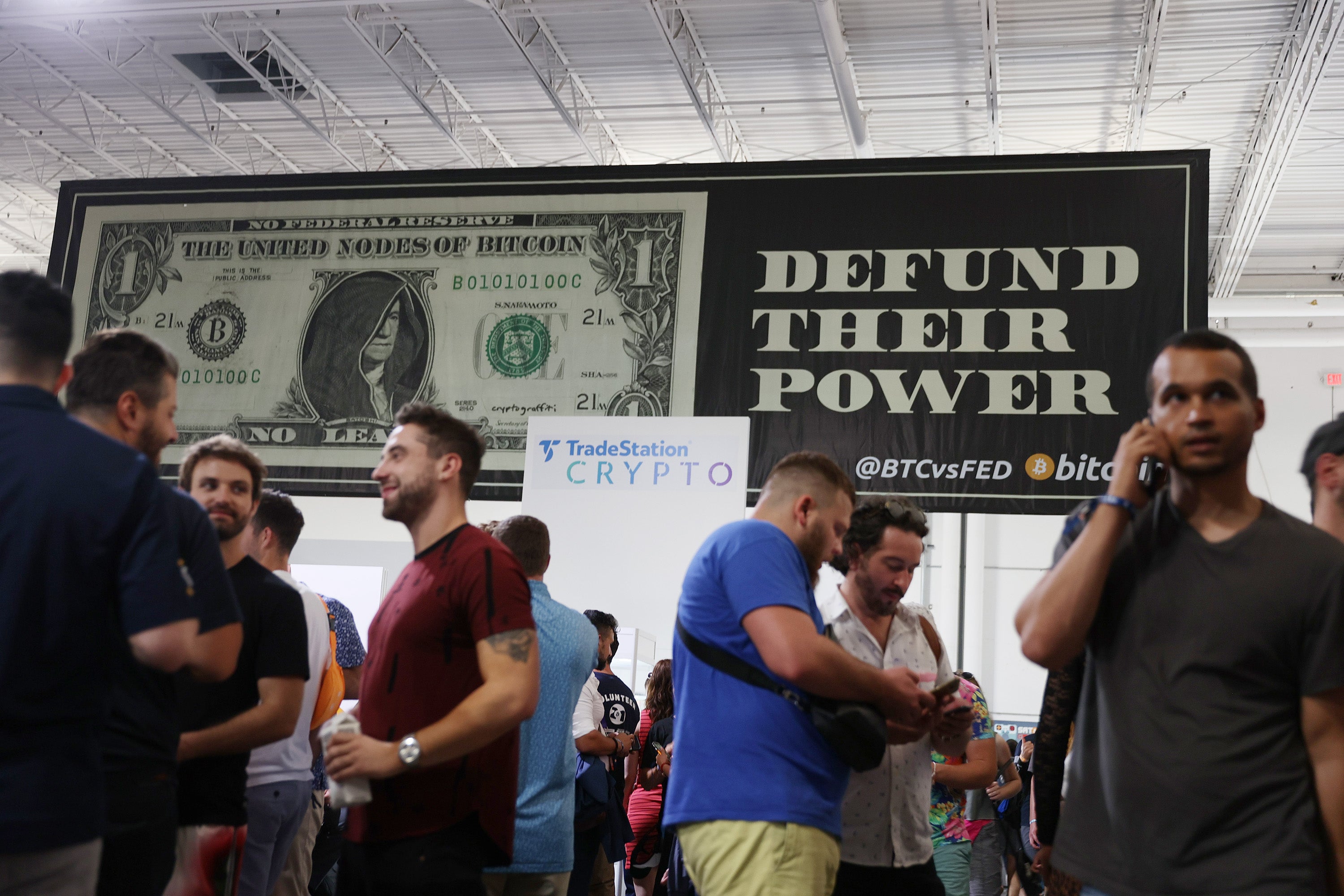

One example of zealous commitment to the spirit of community was revealed in June 2021 at the Miami Bitcoin conference, when a young man gatecrashed the event, jumped up on stage and ripped off his shirt, shouting: “Attention everybody, we have a very important announcement, dogecoin to the moon”. He had interrupted a serious discussion about bitcoin’s use as a hard asset that could replace the primacy of gold.

He goes by the Twitter handle of @Maxotg_ and he tells me his impetus to pull the stunt was “because Bitcoin Miami was full of bitcoin maximalists, people that either hate or dismiss other cryptocurrencies and I wanted to make a statement to all the bitcoin maxis that there are more coins with just as strong as communities as yours, so don’t be so stuck up in your bitcoin maxi bubble”. He adds that his passion for dogecoin stems from it being “the first memecoin to ever exist”.

Richard Dawkins conceived the term “meme” to explain cultural inheritance within species as opposed to genetic inheritance. In his 1976 book The Selfish Gene, Dawkins suggested that if our bodies are the culmination of the most successful replicated genes, then the ideas in our minds are the culmination of the most successful memes that have replicated down the eons. However, internet memes differ from the biological variety conceived by Dawkins. The online versions that include such classics as Pepe the Frog, and of course the dogecoin shiba inu dog, are altered deliberately by human creativity rather than random mutation.

In his seminal book, Dawkins postulated that for a meme to become successful and replicate down the generations it must “dominate the attention of a human brain”, and “it must do so at the expense of ‘rival’ memes”. A meme must survive the brutality of the online ecosystem, and only the strongest get selected and stand the test of time.

There now exists an intense rivalry in the world of memecoins, from the London Underground advertising boards where floki battles for space with its memecoin alternatives, to the stratosphere, where dogecoin has succeeded in becoming the first “meme in space” at the expense of Elon Musk’s planned DOGE-1 satellite launch. Musk had planned to launch a satellite into space, named after his favourite cryptocurrency and paid for entirely with dogecoin, in 2022. However, the dogebonk “bonk squad” community has beaten the Tesla CEO to it by launching its own memecoin into space on December 15.

On the day of the launch, I got a call from the developers of dogebonk to say, “Meme went up, successful launch to 90,000 feet, in the footage you can see the curvature of the earth, space, and the atmosphere.” The expensive effort was partially paid for using the dogebonk cryptocurrency, and a meme was launched to the edge of the stratosphere containing memetic symbols of the darker regions of cyberspace embedded with all the sardonic connotations of Clown World. This “meme in space” launch is the antithesis of Carl Sagan’s golden plaques attached to the Pioneer 10 deep-space probe, which symbolically displayed the achievements of humanity. The dogebonk meme in space displays humanity’s absurdities.

In the foreground of the meme banner that floated at the edge of the stratosphere is the dogebonk dog wearing a dickie bow and using a baseball bat to “bonk” a weeping dogecoin dog. In the background we see a meme version of Elon Musk crying, his face reminiscent of the popular “Pretending to be Happy, Hiding Crying Behind A Mask” meme. The banner meme was anchored with the words, “Sorry Elon, Dogebonk is the first memecoin in space”.

I asked one of the dogebonk developers what their motivation was for such an expensive effort. He replied that they wanted “to show what a real memecoin with actual memes and a genuine community can achieve”. He added: “While other memecoins pay Elon to run ads on his SpaceX satellites, we beat his pet project dogecoin into space using community-paid funding. We are the first memecoin in space, the new trolls of web 3.0. We have the funds to do funny things and we want to meme dogebonk into being the biggest memecoin of 2022.”

The large holders of memecoins may have many more absurdities planned for the wealth they have amassed, but I was contacted by some individuals who had shared their financial gains in a more altruistic way. One of the developers of the floki memecoin told me how he had “partnered with Pencils of Promise and is working together with them to build three schools in three countries: Ghana, Guatemala, and Laos”. He added that it is the goal of floki “to build a school in every underdeveloped nation of the world”. A member of the dogebonk community informed me that they had donated $10,000 (£7,330) to St Jude Children’s Research Hospital in London.

A multitude of digital currencies with dog-meme logos has taken its toll on the reputation of the cryptosphere as a whole. Just when the hard-use case of bitcoin and ethereum was starting to win over the sceptics in institutional finance, along came a frivolous salad of smiling canine cryptocurrencies. Memecoins may have given crypto a bad name, but Rose sees an upside, saying they “also allow people to start a conversation with money that they would never have had previously”.

Coronavirus-related lockdowns have deepened Generation Z’s relationship with the online world. The spread of coronavirus across the globe has caused social lives to become diminished because of lockdowns, traditional money has depreciated as a result of stimulus packages, and job security has floundered in the wake of trade slumps and supply-chain woes. Added to this are governments touting a trickle-down economy that has failed to materialise.

The younger generation, dubbed the “digital natives” because they came of age in the information age, see a chance to progress within the coded promises of the cryptocurrency sphere and web 3.0. Those who have the appetite for delayed gratification will place their chips on the bitcoin and ethereum tables. Those who don’t can opt for a bet on the 13-plus memecoins flaunting their wares in online crypto exchanges, where, using the vocabulary of Clown World, one coin will lead to a Lamborghini, the others to a job in McDonald’s.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks