Inflation is climbing again – yet Liz Truss is still shying away from economic reality

The Institute for Fiscal Studies says the poorest 10 per cent of Britons face an average inflation rate of 14 per cent, writes James Moore

The punches just keep on coming.

Inflation, as measured by the Consumer Prices Index, has once again landed in double figures at 10.1 per cent for the year to September (after a surprise fall of 9.9 per cent during the previous month).

Food prices have been identified by the Office for National Statistics as a key driver, hitting an eye-popping 14.6 per cent (with some individual food stuffs climbing even higher). This is even worse than the 13.9 per cent recorded by research company Kantar as part of its regular series looking at the grocery sector. How high will these figures get?

All this feeds into a brutal truth: price rises are hitting those Britons least able to cope with them the hardest.

Low-income groups spend proportionately more of their budgets on food/energy. In response to the figures, the Institute for Fiscal Studies has said that even taking into account the government’s energy price guarantee – which may now only last for six months – the poorest tenth of households will have faced an average inflation rate of 14 per cent in October. That compares to 10 per cent for the richest tenth of households.

The point is particularly pertinent given September’s inflation rate is the one used to calculate increases in state benefits.

The state pension is, in theory, protected by the “triple lock”, which links increases to the highest from one of the following: rate of inflation, average earnings or 2.5 per cent. It is something Liz Truss said during Prime Minister’s Questions (PMQs) that she is “completely committed” to. However, benefits for working-age adults and their families are calculated based on inflation alone.

But will the latter group even get that? Given the government is in the middle of a fiscal crisis of its own making? The black hole in the UK’s public finances has been expanded by the collapse of confidence engendered by the fatally flawed mini-Budget put together by Truss and her former chancellor, Kwasi Kwarteng. Gilt prices collapsed, greatly increasing the government’s borrowing bill.

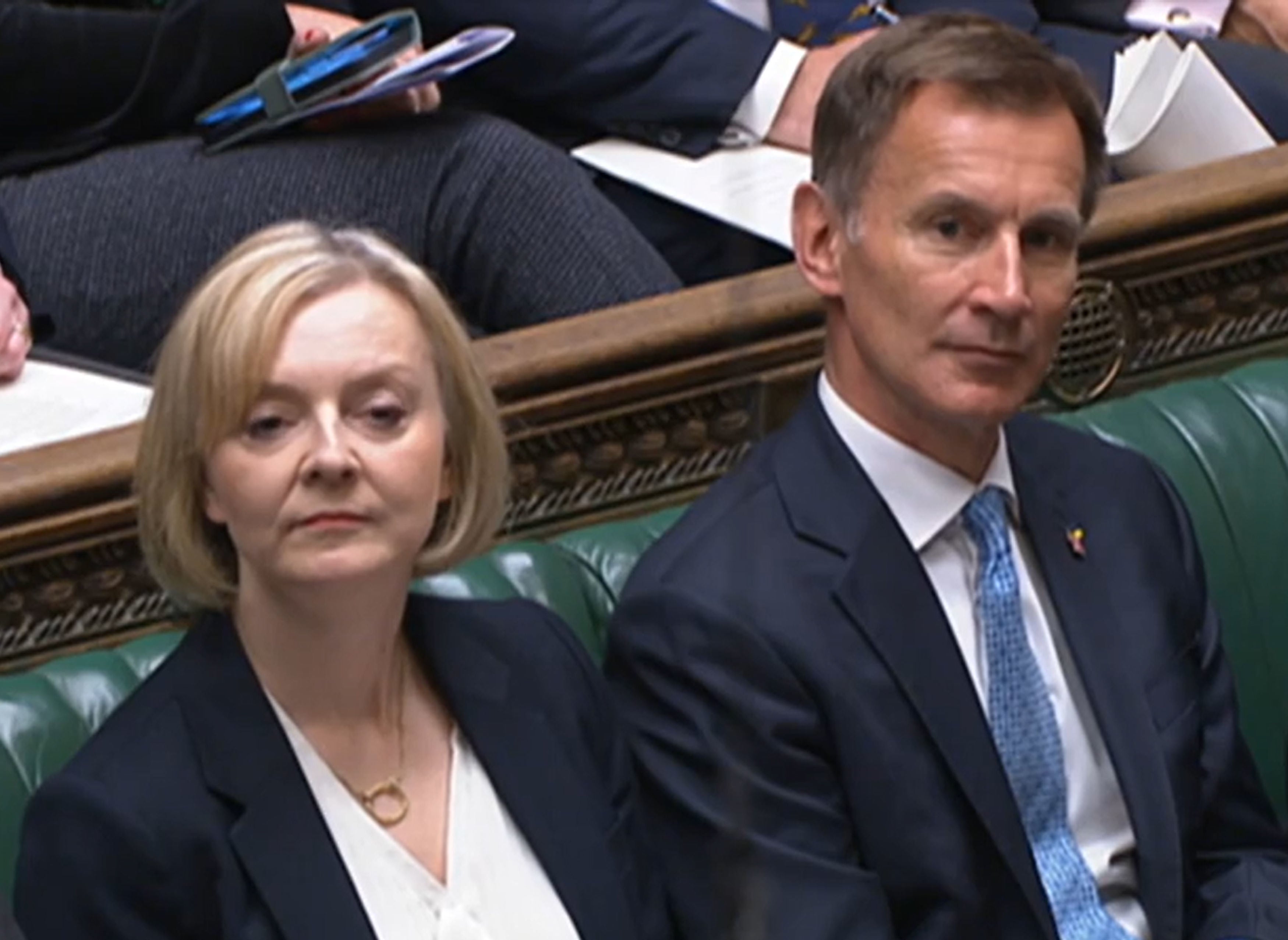

Kwarteng has now gone, and most of his policies have been scrapped by the new chancellor, Jeremy Hunt. But Truss remains and so does the fiscal mess she helped to create. Gilts have stabilised somewhat but they are still far weaker than they were. The government is still hamstrung by a credibility gap – and the markets are demanding an idiot premium to lend to Britain. Even jettisoning Truss may not fix it.

Despite saying how “committed” she is to the triple lock on pensions, when questions over working-age benefits were raised at PMQs there was no similar promise. Truss would only go as far as to say that the next mini-Budget on 31 October would make sure that the most vulnerable were “protected”. From a fiscal perspective, suspending the triple lock and increasing pensions in line with earnings would save more (£5bn vs £3bn) than would increasing working-age benefits in line with earnings.

But, of course, the bedrock of Tory support comes from pensioners. Without them, they’d be toast electorally (which they may be anyway). Those reliant on working-age benefits are much less likely to vote Tory (although some still do) or even to vote at all. However, if Truss’s repeated claim that the government would “protect the most vulnerable” is really to hold water, the latter group ought to come first.

I’m going to call on a report from the Resolution Foundation, which dates from 2019. But the figures are, I think, still broadly relevant.

“The Generation of Poverty” report found that pensioner poverty reached a high of 45 per cent among the “greatest generation” who were born between 1911 and 1925. But since then it has fallen rapidly. Relative poverty rates at age 70 have more than halved, to below 20 per cent, for the next generation of pensioners – the “silent generation” born between 1926 and 1945. Then a futher fall to just 15 per cent for the “baby boomers” now entering retirement. That represents the lowest on record.

In contrast, relative child poverty has been rising sharply for those born during the past decade, when compared to their predecessors. Children born between 2016 and 2020 face the joint-highest rates of early years poverty in 60 years, with more than 35 per cent expected to be living in poverty by the age of two.

Millennials, born between 1981 and 2000, are also on course to face record rates of working-age poverty. If you are claiming to “protect the most vulnerable”, it is these groups, who are also far more exposed to the current inflationary surge, that should be prioritised.

Is it any wonder that Tory support among millennials is so limited? Perhaps the party thinks they will switch as they age. But will they? After the economic kicking they have been taking under the party’s deplorable strategy, the Conservatives have no cause for complacency.

The current spike in inflation could easily light the fuse on a Tory demographic time bomb. Truss seems blind to it. Some of the party’s MPs aren’t so sanguine. Do Truss and Jeremy Hunt dare to take them and this harsh economic reality on?

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments