Will more working from home kill our cities and reduce house prices?

In the third part of our series on the future of the workplace, Ben Chu asks what the impact of abandoning the office would be on our major cities and living costs – and also whether this could help the economic rebalancing of the UK

Many cities in the UK, particularly London, have prospered in recent decades. Our major urban centres have grown in terms of population, productivity and creativity – yet the coronavirus lockdown this year emptied them of visitors and many workers too, as millions of white-collar employees switched to working from home.

Ministers now want to encourage office workers back to their jobs in city centres. But many think working from home is now likely to become a permanent feature of the post-Covid economy. It’s certainly what many workers seem to want.

So what would such a shift in working practice mean for our cities? Could it send them into a long-term decline?

And what might be the implications be for house prices and residential rents in dense urban areas if, over time, fewer people feel the need to live within commuting distance of city offices?

Would fewer city centre workers help, or impede, attempts to rebalance the UK economy away from a dependence on London?

First, it’s important to note that while there are many commentators who predict that our cities are facing a period of decline due to the crisis, this is by no means a consensus among experts on urban development.

Richard Florida, an urban studies theorist at the University of Toronto, notes that cities through history have experienced worse disasters than coronavirus and yet continued to grow over the long run.

“When the pandemic and all its related crises finally ebb and we are on the road to recovery a couple of years from now, we will look back and see that the roster of the world’s leading cities is unchanged,” he forecasts.

Henry Overman, a professor of economic geography at the London School of Economics, points out there remain powerful economic benefits, often called agglomeration effects, for companies that base themselves in cities, such as proximity to clients, a skilled potential workforce and the possibility for face-to-face interaction.

And he cautions against assuming that overall business activity in urban centres is bound to decline even if some larger firms reduce their presence there.

“It might mean lots more firms can think of having a central London office because they don’t need much space,” he says.

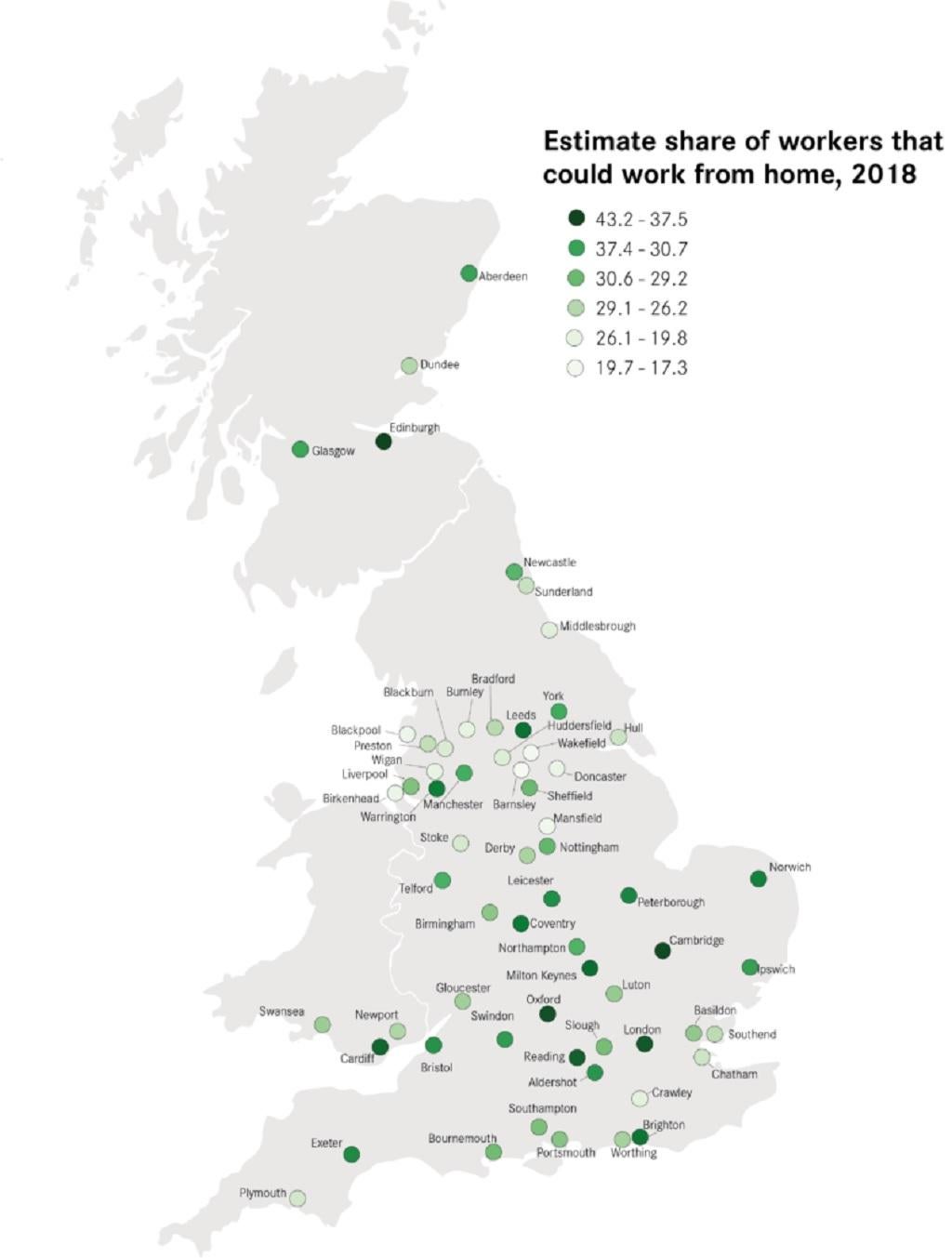

The Centre for Cities think tank is also sceptical of the idea that UK cities face depopulation due to a big shift to working from home, noting that even in major white-collar cities such as London and Edinburgh less than half of people are able to work from home, while in places such as Barnsley, Burnley and Stoke just two in ten people can do so.

Not everyone can work from home in cities

Nevertheless, it’s clear that a permanent expansion of working from home will have negative impacts for many urban businesses and jobs. “City centre service businesses such as shops, cafes and pubs depend on office workers for much of their custom,” says the Centre for Cities. “If more and more people work from home then many people working in local services will likely lose their jobs.”

It’s this concern that seems to have motivated the government’s campaign to get white-collar workers back to their city offices.

Yet the fundamental purpose of economic policy, most economists would agree, is not to protect particular jobs or to bolster urban centres for the sake of it but to increase a population’s wellbeing, whatever job they are doing or wherever they are in the country.

And some are arguing that more working from home could be of benefit to the quality of life of many white-collar workers if it means they can move out of big cities, where house prices tend to be high and rents expensive, to less expensive outlying villages and towns.

Yet Mr Overman questions whether large population shifts from cities to the surrounding countryside or smaller towns are possible given the still relatively low rate of new house building.

“Our net housing build is about 150,000 a year, most of it in our big cities,” he says. “This idea that we can see large shifts in aggregate population… I don’t understand where these people are going to live. The vacant housing is in Midlands and northern cities, not in villages.”

Hansen Lu, an analyst at the consultancy Capital Economics, suspects the impact of more homeworking by white-collar workers is likely to increase, rather than reduce, average UK house prices relative to where they would otherwise be.

“Working from home increases housing demand. Previously companies were supplying workspace but the supply of workspace is shifting from companies to you providing it yourself,” he says. “If housing demand is going to rise, then most likely the impact on house prices will be positive.”

And larger homes – which can support home offices – might have a bigger premium.

This is supported by the Nationwide building society’s suggestion this week that UK house prices jumped in August partly because people “reassessed their housing needs and preferences” as a result of their experiences in lockdown.

Mr Lu thinks this upward pressure will apply to rents too, though he does think that housing close to commuter transport links might lose its premium pricing. Research last year showed Londoners were prepared to pay an average of £43,000 more for their homes to be within a five-minute walk of an underground or railway station. “If you’re working from home three days a week you’re going to be willing to live further away from stations,” argues Mr Lu.

And what of the regional rebalancing question, which this government made its priority at the last election? How would a move out of cities by higher skilled white-collar professionals, to the extent that it’s possible, impact the “levelling up” agenda?

Mr Overman argues that though such moves could create some “statistical levelling up” through higher income people living in less well-off areas, he warns against assuming this would help the people in the areas affected.

“The benefits really go to the more educated and the higher skilled who’ve just seen their choices hugely expanded rather than lower-skilled families who suddenly see rents going up and school places becoming scarce,” he says.

The Centre for Cities agrees, saying that the root cause of UK geographic inequalities is low skills in left-behind areas. “Moving a couple of thousand people out of London and dispersing them around the country will not address this problem,” it argues.

“The levelling up agenda should be about creating more high-paying firms and jobs outside the southeast and training people to a level to which they can actually take good jobs in these firms.”

The future of cities in the wake of Covid is inevitably uncertain.

“There are good reasons to be cautious about bold predictions about what this means,” says Mr Overman, admitting that it’s not impossible that we are at an “inflection point” where new technologies allowing remote working finally loosen the immense economic pull of cities.

Be that as it may, there is little credible economic support for the idea that weaker cities will automatically make the rest of the UK more prosperous.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks