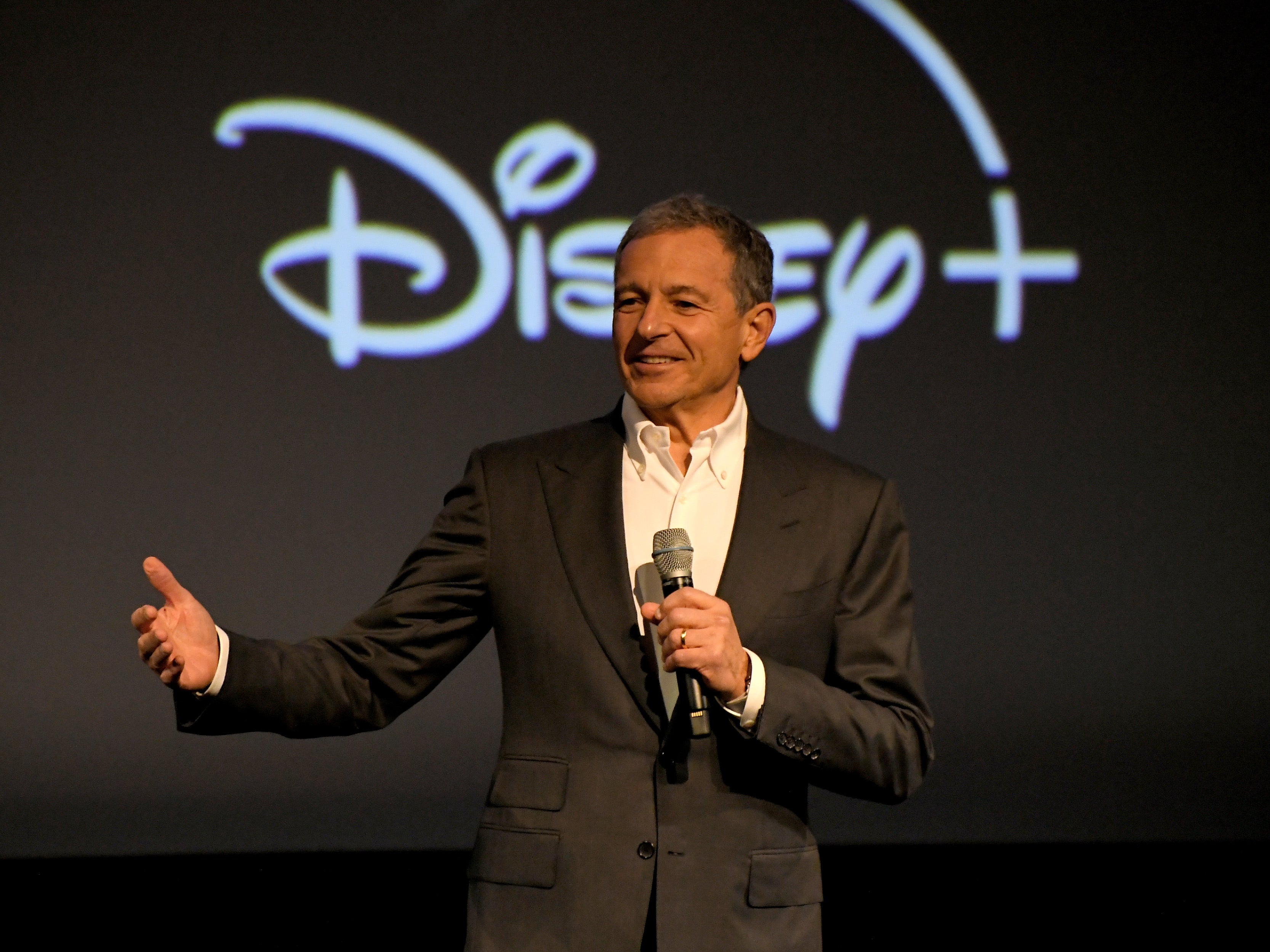

After Disney’s epic corporate dust-up, can Bob Iger fix the House of Mouse?

Having successfully fended off hedge fund manager Nelson Peltz for now, the entertainment giant must reckon with its rapidly fading box office sparkle, writes James Moore

As corporate ding-dongs go, the battle for Disney’s soul was an epic worthy of one of the bigger movies produced by its dazzling array of creators.

The hero? That would be Disney boss Bob Iger because the heroes mostly win, and he did. This casts octogenarian activist hedge fund manager Nelson Peltz, angling for a seat on the entertainment giant’s board while using corporate Death Star zappers to attack the company’s strategy and the returns it has been providing investors, as the baddie. Oh, and he doesn’t much like “woke”.

We now know the result. After a combined $70m was spent on campaigning, Disney, Peltz and third-party Blackwells, which put up its own slate of directors to play spotter with the aim of keeping Peltz out, Iger cried: “Avengers Assemble!” and won the day.

Handsomely, according to the preliminary results, with the support of nearly 70 per cent of the company’s investors overall and 75 per cent of the sizeable retail shareholder base who hold almost a third of the stock.

Iger’s Avengers superteam included institutional heavyweights such as BlackRock and Vanguard. They are Thor and Iron Man-level powers for those more familiar with the company’s wildly successful output than they are with corporate showdowns.

And most people are familiar with that output: Marvel’s Avengers Endgame grossed a shade under $2.8bn (£2.4bn), which looks like magic in today’s market.

Peltz wasn’t without allies of his own. His Trian Capital is Disney’s fifth-largest investor, having built up a $3.5bn stake. Ike Perlmutter, a former Marvel exec and longtime pal, is also on board.

ISS, an important and influential voting adviser used by institutions to help decide which way to jump, backed Peltz, although its chief rival Glass Lewis assembled for Iger.

They each had their individual corporate cheerleaders too. Iger was able to call upon Star Wars creator George Lucas, JP Morgan boss Jamie Dimon, Laurene Powell Jobs, the widow of Apple’s Steve, plus members of the Disney family.

Stumping for Peltz: fellow hedge fund manager Bill Ackman and a certain Elon Musk. The Tesla boss doesn’t have a Disney stake but expressed an interest in buying one should Peltz win. If Iger thought he had a headache with Peltz, just imagine having Musk to deal with.

Whether the CEO would have survived a defeat is an interesting question. Peltz wasn’t calling for Iger’s head, which would have been a step too far for even the most restive of investors. His stated aim was to “refresh” the board by getting himself and former Disney executive Jay Rasulo elected, depriving current Disney directors Michael Froman and Maria Lagomasino of their seats in the process.

But his assault on the company ultimately played out as a referendum on Iger, with attack ads, low blows and even political style colours – white for the establishment, blue for Peltz’s rebels.

What if – it’s a fun game to play. Perhaps one for the next iteration of the Marvel animated series of that name on Disney+?

But with the dust still settling, Jeffrey Sonnenfeld, from the Yale School of Management, described the result as a crushing blow” for Peltz on CNBC, saying he believed that it could “maybe deactivate a lot of the activity fervour that’s been out there in recent years”.

“It shows that Bob Iger truly is the magician, the great wizard of the Magic Kingdom, whereas the cheap parlour tricks were coming from Nelson Peltz, the illusionist.”

But while the vote has put Peltz in his place, as Ken Squire – president of 3D Monitor, a researcher and analyst firm specialising in shareholder activism – pointed out, some 98 per cent of companies elect their slates of directors unopposed every year. Iger won decisively but the level of dissent speaks to the problems the company has faced, even with this “magician” at its helm.

Disney has some of the biggest brands in entertainment. Its portfolio of market-leading franchises is unmatched. There has never been a concentration of pop culture powerhouses like it.

It also has a string of theme parks which print money, 20th Century Studios, Pixar, a substantial sports broadcasting business (ESPN), one of the big linear US networks (ABC), and the aforementioned streaming service with its 150 million or so subscribers, second only to market leader Netflix.

And yet, as is often the case with conglomerates, the group has seemed to be struggling under the weight of all those prime assets. This is what attracted the attention of Peltz and created an opening for him.

Activists don’t target companies where the going report reads “good” or better. They jump into businesses running on heavy ground.

With nearly a third of his investors backing the insurgents, Iger will now have to prove he can reinvigorate a business that once dominated the global box office and looked poised to become the top streamer but has struggled of late.

It shows that Bob Iger truly is the magician, the great wizard of the Magic Kingdom whereas the cheap parlour tricks were coming from Nelson Peltz, the illusionist

In the pre-pandemic year of 2019, three of the top five movies at the global box office were Disney properties and it had a piece of a fourth (Sony’s Spiderman: Far from Home). The company had six of the top 10, all of which grossed in excess of $1bn.

That was a particularly good year and the market has changed since then. Billion-dollar grossing movies are less common across the board post-pandemic. At least part of the reason for that might be because Disney, the dominant force in producing them, has lost its magic touch.

Last year, it had just one entrant in the top five – the third Guardians of the Galaxy outing which grossed $845.5m – and two more in the lower reaches of the top 10 (the $570m live-action remake of The Little Mermaid and Pixar’s original property Elemental which managed $496m).

Peltz told the FT: “ Why do I have to have a Marvel that’s all women? ... Why do I need an all-Black cast?” which makes him look like a grumpy old man. Black Panther, with its mostly black cast, grossed more than $1.3bn, won three Oscars and was nominated for Best Film.

Its sequel, Wakanda Forever, brought in a very respectable $860m. The Brie Larson-fronted Captain Marvel delivered $1.1bn.

It was the fifth-biggest film of 2019. Black Panther was the number two performer in 2018. Its second outing finished sixth.

But lately, the once all-conquering Marvel Studios has hit the critical and, much more importantly, commercial buffers, exemplified by the Larson-led team-up The Marvels, which limped in with just $206m.

The box office number 30, Marvel’s lowest position to date, was even beaten by The Nun II, an R-rated horror flick which garnered mixed reviews.

No wonder the studio is now talking about a “soft reboot”. Disney+ has meanwhile been shedding subscribers and losing ground on Netflix. Returns and margins (especially compared to the latter) have disappointed shareholders.

But don’t sleep on Iger. The revival has started. The stock is still some way off the near $200 high recorded in 2021 but has gained 26 per cent since the beginning of the year, 36 per cent over six months. Peltz has meanwhile reportedly made a $300m (£2.3m) profit on Trian’s stake, which ought to ease the pain of his defeat.

Disney+ is currently streaming Taylor Swift’s hit Eras tour film with more to come from the partnership. A crackdown on password sharing – which has worked wonders for Netflix – is coming.

A savvy ad campaign with the message that the service is “not just for kids”, putting the spotlight on parental controls but also showcasing content aimed at grown-ups such as Shogun and The Bear, is all over the internet.

Talented showrunners have been drafted in to help pep up the troubled MCU/Star Wars TV offerings. Iger, a consummate deal maker, has also secured a tie-up with Fortnite producer Epic Games.

That’s not to say that the House of Mouse is out of the woods, even if it has escaped the activists’ predatory attention this time around.

“Bob Iger tacitly acknowledged at the Morgan Stanley TMT Conference [in March] that Disney continues to lag in technology, particularly its direct-to-consumer (DTC) costs, an area requiring improvement that we have previously highlighted,” said Enders in a research note.

“Pointing out that Netflix remains the ‘gold standard’, the implication, and confirmed by our research, is that Disney’s cost-per-bit-delivered remains higher than Netflix’s, not taking into account the enormous scale of investment that Disney has made.”

Enders aligns with Blackwells’ view that Disney would do well to address these issues by appointing a chief technology officer. While it praises the Epic deal, it thinks Disney needs to do more in this space: “In the case of Epic, one major deal for Disney in gaming is unlikely to be enough to overhaul its strategic position.

“With Epic emerging as a comprehensive gaming platform, effectively transforming Fortnite into the host of thousands of third-party developed games via Unreal Engine for Fortnite, the Disney Universe will have strong headwinds and be competing in a very crowded market by the time it launches – perhaps in 2025. Its strategic competitor, Netflix, is aware of this problem and remains committed to establishing its own delivery platform and experience along with leveraging in-house IP [intellectual property]. Disney will need to move faster, again by acquisition, simply to keep up.”

Other issues in what remains a sore point for Iger are the futures of ESPN – an odd fit about which there has been continued speculation – and ABC, given the declining importance of linear TV networks.

But perhaps the biggest problem facing the company – one highlighted by Peltz – is that of succession. This is the 73-year-old Iger’s second term at Disney. He had retired in 2020, handing the reins to Bob Chapek, only to return when the latter was ousted in 2022.

This is not the first time that succession issues have caused trouble for Disney and the question of who follows Iger will continue for as long as he is in the CEO’s chair.

If Disney is to find a corporate happily ever after, it needs to find a new protagonist. Preferably one with a blockbuster story ready to sell to Wall Street and the superpowers necessary to pull it off.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks