Finance chiefs are less downbeat – but they’re still not in the mood to spend

Confidence is up, on last year – but then again it couldn’t have got much lower

Perhaps it’s pushing it too far to suggest Britain’s finance chiefs are leaping about like the mad March hare in spring, but the latest Deloitte survey of their views is strikingly upbeat.

The CFO Survey looks at the responses of 64 finance directors, including 11 in the FTSE 100 and 24 in the second tier FTSE 250. In total, they account for more than 10 per cent of the London Stock Exchange by market value.

It found a net 25 per cent were more optimistic about the financial prospects of their businesses than three months ago. To put that into some context, the long-term average of the series is minus two but over the last year it has run well below that so the plus 25 represents the greatest improvement in sentiment since the rollout of the Covid-19 vaccine.

The survey was conducted between 21 March and 3 April, during which time Silicon Valley Bank failed and others were wobbling. We’ve since seen another round of fairly grim assessments of UK economic prospects, most recently from the International Monetary Fund.

I wouldn’t be at all surprised to see the Deloitte numbers cited in parliament this week as evidence the doomsayers at the IMF got it wrong.

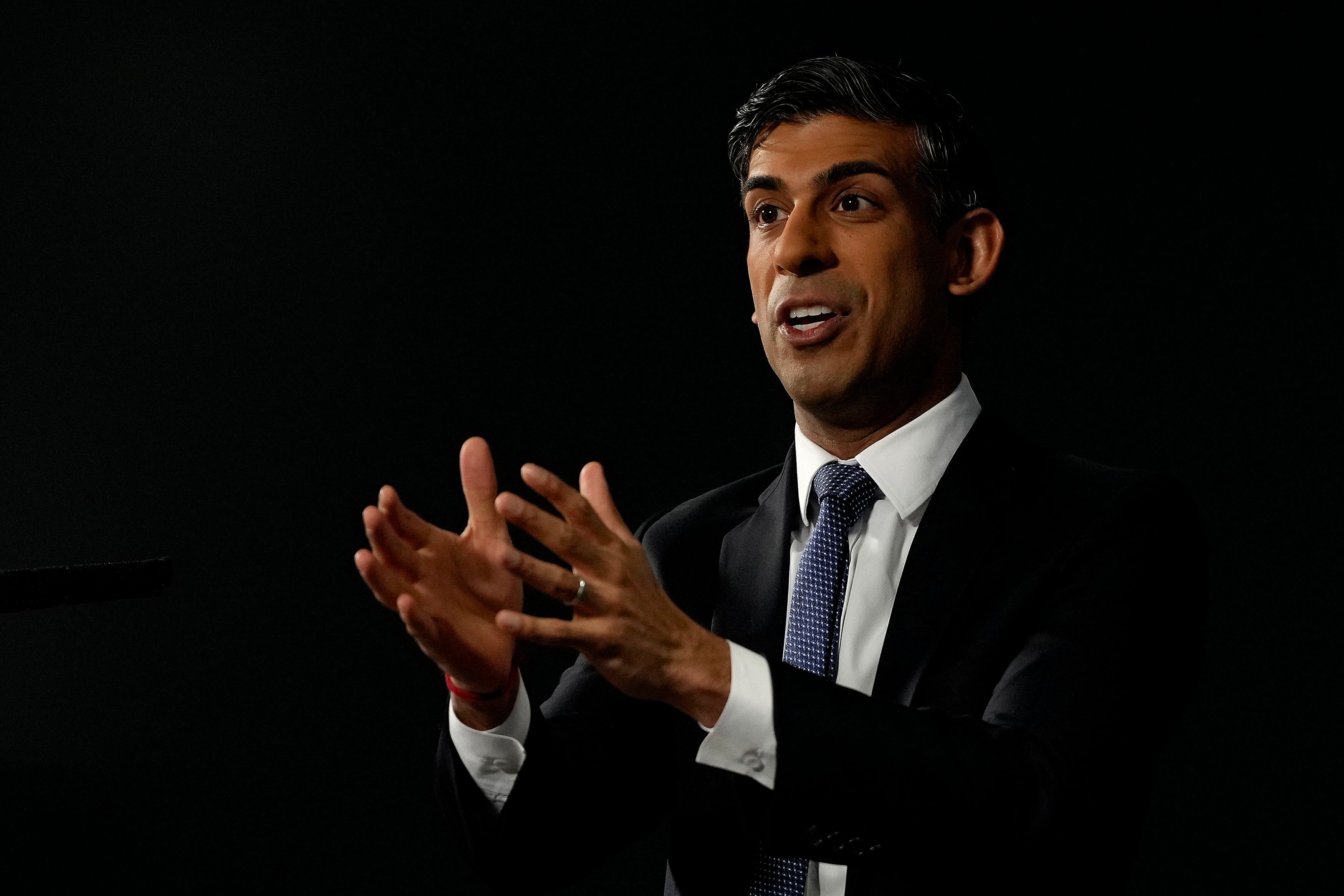

Even Brexit has declined as a concern, falling to its lowest level in years although Rishi Sunak is unlikely to bring that up, chiefly because he and his party flatly refused to admit it was ever a problem.

So is there some real summer sunshine on the way for the British economy? I wouldn’t get as excited as the special adviser who put this on Sunak’s desk with a cheery “see, we’re winning”.

With a survey like this, it is necessary to consider the wider context and the backdrop against which previous, much more negative polls, were conducted. That backdrop was very, very bad. Last year saw the mass resignation of cabinet ministers, which forced Boris Johnson out of office; his replacement lobbed a hand grenade into the British economy and was gone within weeks. Brexit was shaping to end up with the UK locked in a trade war with the EU, its biggest trading partner with a market many times its size. Throw in surging energy prices and the very real fear that the UK could face winter blackouts, leading to the highest level of inflation in decades and the Bank of England raising interest rates every six weeks. No wonder Deloitte’s surveys were negative.

Since then, Sunak has signed the Windsor Framework and easily got it through parliament, healing the biggest Brexit sore and modestly improving relations with Europe. The lights stayed on and energy prices have started to fall. Inflation is still high, but it is expected to come down. With all that being the case, it’s no wonder finance directors feel a lot more optimistic compared to where they were. Even with several banks wobbling badly.

Why didn’t the banking wobble appear to have much of an impact? For a start, CFOs will have heard the reassurances Bank of England’s reassurances; they also saw little sign that credit conditions, while tight, were deteriorating badly. Threadneedle Street’s contention that banks had the capacity to support householders and businesses rang true.

The sting in the tail of the survey, is that finance chiefs – and thus also CEOs in the glass cubicle next door – aren’t yet optimistic enough to change the way they run their companies. Appetite for risk-taking remains well below normal levels, with just 17 per cent of CFOs saying this is a good time to take greater risk onto their balance sheets. That’s bad news for an economy in dire need of investment. Instead, the focus remains on cutting cost and banking cash, with 41 per cent and 44 per cent respectively rating these as strong priorities for their businesses. “Corporates remain in defensive mode and CFO risk appetite is subdued,” said Deloitte chief economist Ian Stewart.

That was underlined by a downbeat trading upbeat from Page Group, the recruiter. It’s a business with global reach and it’s finding the going tough. It said UK clients have been hiring temporary rather than permanent staff, another sure sign of a reduced appetite for risk.

Sentiment must improve before CFOs will put real money to work; but the Page results underline that there isn’t much confidence about. The spring hares are still in their burrows.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments