The cycling insurance company putting riders before premiums

Tired of the traditional insurance model, Laka aims to be fairer and easier for the customer. In fact, they’ve made it in their interest to settle a claim, writes Sean Russell

The traditional insurance model can seem fundamentally flawed. You pay a premium in advance and maybe receive a service later. But the insurer wants to keep that premium to themselves, so it’s in their interest not to pay out on a claim. Laka, a cycling insurance company, is turning the model over, with a customer-focused brand that they want, above all else, to be trusted.

“Instead of me taking your money first and giving you a service later, we go upside down,” says Tobias Taupitz, co-founder and CEO of Laka. “I don’t want any of your money up front. You keep it, and only at the end of the month, once we know how many claims happen in a month, we’ll charge everyone involved – the Laka collective, we call it.”

Every member of Laka pays a small amount of every claim. So if there were 500 claims in a month you’d pay more than if there were 100 claims. But when you join up, the amount you pay is capped based on the value of the bike or bikes you are insuring. Instead, Laka makes its money by attaching a charge to each claim – therefore they only make money when they pay out.

“The dynamics change because we as the insurer come last, because I have to send you a bill to ask please, please, please pay me back,” laughs Taupitz.

Taupitz was born in Stuttgart, Germany. His father is an insurance broker and can be “conveniently” blamed for his son’s involvement in insurance. Taupitz did an apprenticeship and studied the insurance business but found it old fashioned and so ran away to start a career in corporate finance.

After moving to the UK and working for Barclays in London he ended up in insurance again but this time combined with fintech. He saw again that the traditional model of insurance was flawed – in seeking low prices for comparison websites, the service and the customer care suffered; people didn’t trust their insurance companies.

“In fintech, you have the idea that every financial services product should be more customer-friendly, whether it’s banking or stock trading,” says Taupitz. “It should be much, much simpler and yet with insurance you haven’t seen huge attempts of really changing the underlying principles. When we started out it was a really big endeavour because we had to realign a centuries-old puzzle.”

Along with co-founders Ben Allen (CTO) and Jens Hartwig (CPO), Taupitz created Laka, a unique, fair model with a focus on the customer and their passion for cycling. The main goal was to keep their riders happy and on the saddle.

They believe one of the main issues when dealing with traditional insurance companies is inconvenience. Laka tries to replace your items like-for-like instead of giving a cheque. Their claims handlers are all expert bike mechanics and the way they see it, there’s no point giving you money for you to then go to a shop and buy something they could have just sent to you immediately; for them, it is about getting the rider back on the bike as soon as possible.

First and foremost theft went down quite a bit, but what happened was, that those people with a nice Sunday bike went out six days a week, you could almost have a cheeky lunch ride

This mentality has led to Laka’s new product: recovery insurance.

“It’s a recovery, health and wellness product meaning that at the moment we cover your bike for theft, damage and loss but not the rider themselves,” says Taupitz. “If you’re an enthusiastic cyclist you lose fitness very quickly. If you’re six weeks off the bike it’s so painful to get back on. Or if you’re a commuter you can’t get to work, you can’t do the groceries. This product covers a bit of medical cost but the real hook is the recovery, we want to get you back on the saddle much faster.”

Laka has built relationships with multiple partners to be able to offer riders physiotherapy and specialist nutritional advice as if you were a professional rider. But it’s not just for the athlete. If you are a commuter the service could cover Uber vouchers until you’re ready to get cycling again. Often, recovering from an accident is not just about physical injuries but also mental and so they offer support with that as well. This is especially key when cars are involved in the incident.

To Taupitz, it’s all about building a trusted insurance brand and creating a feeling that the customer is supported when they need it, almost like a concierge service. He says if there is any reason you can’t cycle you should contact Laka and they’ll do what they can.

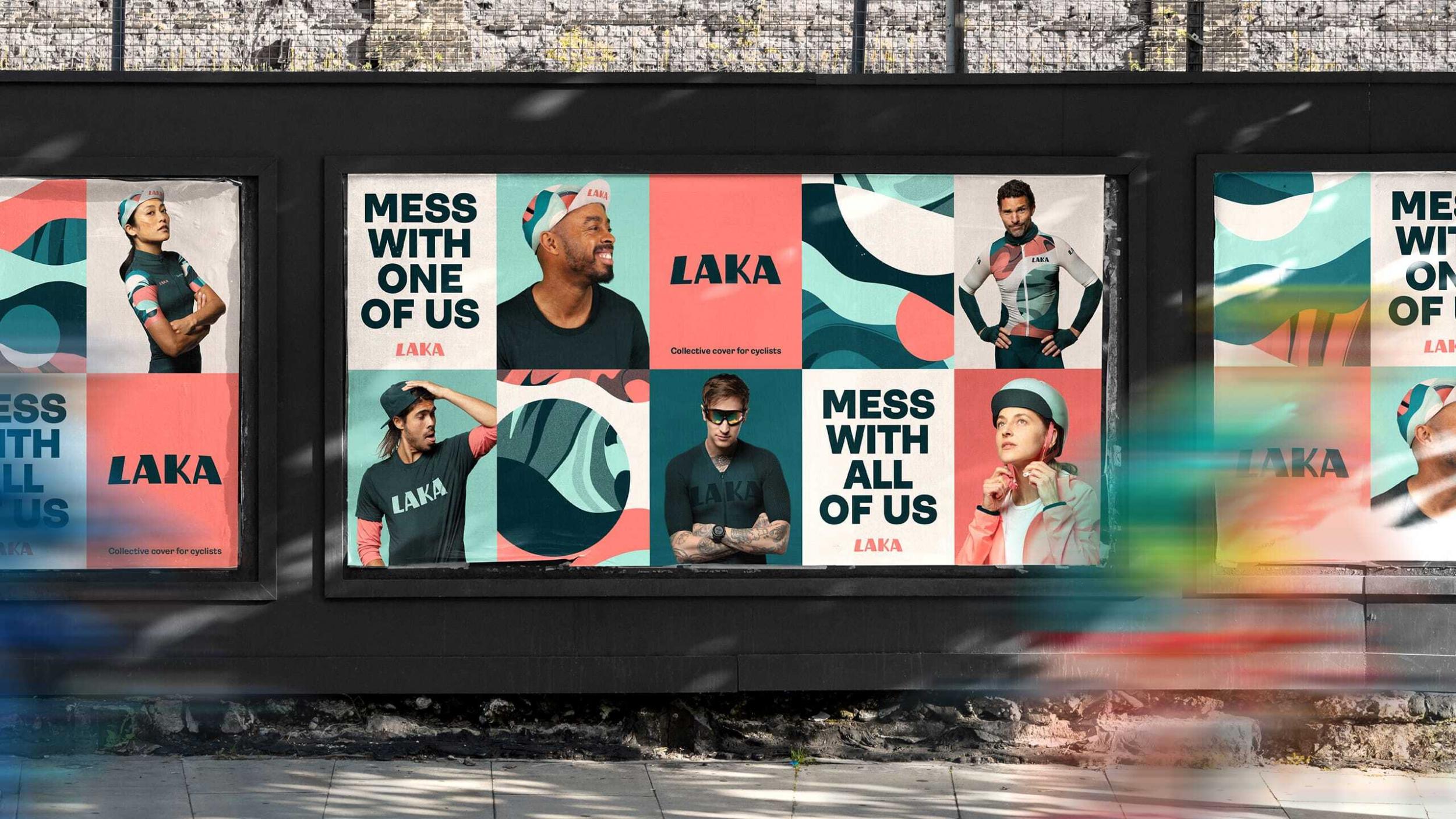

Cycling is so much about community, and Laka’s new tagline, “Mess with one of us, mess with all of us”, reflects this. In fact, their recent rebrand makes Laka seem not like an insurance company at all, but a club.

They are fully FCA regulated (and underwritten exclusively by Zurich Insurance plc) and quite proud of that stamp of quality. The regulators have a close view of what they do and it is the first insurance company to modernise this community-led model, harking back to the olden days when farmers would come together to help each other when one farm was damaged or destroyed, and Taupitz sees no reason why other insurance companies shouldn’t follow their lead.

At the beginning of lockdown, Taupitz was unsure what it might mean for the company being so based on community as it is. However, unlike some other European countries, the UK did not ban cycling; if anything they actively encouraged exercise.

“First and foremost theft went down quite a bit, but what happened was that those people with a nice Sunday bike went out six days a week, you could almost have a cheeky lunch ride, so we have seen the frequency going up of our customers and also the claims volume going up.”

But perhaps more importantly for Laka was the increase in people using bicycles as a way to get around, the infrastructure put in place to support this, and the surge in bicycle sales. With this in mind, Laka is now looking to build upon its solid base of lycra-clad cycling enthusiasts and expand into the urban mobility market; commuters, e-bikes and perhaps eventually privately owned e-scooters, anything that is not a car. Part of this is a new deal for commuters to sign up for third-party liability insurance for £1, this will give the rider £2m of cover until the end of 2020. From there, the company is looking to expand into Europe, starting with the mother of urban mobility: the Netherlands.

“People often tend to think they’re covered on a home insurance policy. For me it’s a false positive almost, very often you have a high excess with home insurance and so the payout is very limited and as a ‘thank you’ from your home insurance for claiming with them your premium goes up immediately. Also, they don’t have the network, or the partnerships, or the experience to really understand your bike like we do. Laka is more than just insurance, but really a service; we’ll keep you on the bike.”

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments