Like its cuddly meerkat mascots, ComparetheMarket has revealed it has real claws

One investigation by the competition watchdog and a £17.9m fine later, the price comparison website finds itself in hot water, writes James Moore

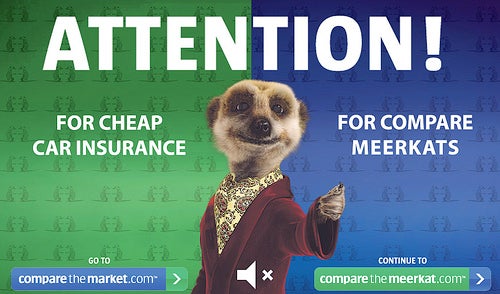

Meerkats are cute, loveable creatures that work in teams, have each other’s backs and are adored by kids. No wonder ComparetheMarket chose them for the centrepiece of its ubiquitous advertising and used offers of cuddly toys based on Aleksandr Orlov, Sergei and their pals to boost its business.

It should be said, however, that real life meerkats also have the sharp claws and predatory instincts necessary to survive on a carnivorous diet.

Judging by findings of the Competition & Markets Authority (CMA), which has slapped a £17.9 fine on the company, you might very well come to the conclusion that this makes them all the more appropriate as corporate mascots for its business. Simples.

Price comparison sites like ComparetheMarket like to portray themselves as consumer champions dedicated to saving their users money on a wide array of financial products; insurance in particular but also loans, credit cards, even mortgages. You put your details into the website and, hey presto, the algorithm coughs up the best possible deals.

But according to the CMA, CompareTheMarket’s business practices might actually have stopped some of the best possible deals from reaching the market.

The watchdog found that between the end of 2015 and the end of 2017, owner BGL used what are known as “most favoured nation” clauses in its contracts with a number of home insurance providers using its site.

These prohibited said insurers from offering lower prices on rival price comparison websites. The CMA says this protected CompareTheMarket from being undercut by rivals seeking to challenge its position through, for example, offering to cut the commissions they charged to insurers when people bought policies through their sites.

It’s not all that different to what Amazon used to do with third party sellers on its marketplace. They also used to be barred from selling at cheaper prices elsewhere, including on their own websites, until the old Office of Fair Trading flexed its muscles and the policy was dropped.

Not only did these contracts protect CompareTheMarket from competition, never a good thing in itself, its actions could also have served to make things entirely too cosy across the home insurance market. That’s a real problem with this product.

I’ve repeatedly expressed the view in this column that insurers don’t compete as aggressively as they might because there are too few of them underwriting policies. The market looks a lot more vibrant and competitive than it is because there are a lot of brands. But many insurers own multiple brands and also sell under other companies’ names via white labelling. When it comes to the underwriters who set the prices there are little more than a handful of them out there. The CMA really ought to look into this at some point.

The last thing this particular market needed, then, were business practices restricting competition at the retail end.

ComparetheMarket has huffed and puffed, stating that it “disagrees” with the CMA’s findings. Really, when did anyone fined by this particular regulator ever say “it’s a fair cop guv”.

The emergence of price comparison websites has generally been a good thing. Where they work properly they can be a boon to competition. They’ve helped a lot of consumers to save a lot of money. I’d like to to be able to say that more people should use them but this sort of thing makes it hard to do that. There’ve been troubling allegations swirling around the sector for a while now. Which?, for one, has been agitating for action.

It’s a sad reflection on the culture of financial services generally that this sort of thing seems to be endemic to the industry. It really does need to pull its socks up but how often have we had to say that?

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments