How Chase is supporting children’s literacy in the UK

Sanoke Viswanathan, the CEO of Chase bank in the UK, is on a mission to instil the rudiments of good English in youngsters around the country. He speaks to Andy Martin

It says something about the state of literacy in this country when an American-owned bank has to step in and help us out with at least two of the three Rs – reading and writing (maybe ’rithmetic will be next). But, to be fair, I am grateful to Sanoke Viswanathan, the CEO of Chase in the UK, for chipping in to what is a huge collective effort to instil the rudiments of good English in youngsters around the country. My only qualm is that we are going to end up writing “sidewalk” and “elevator” and spelling “colour” without the “u”.

He is now based in Canary Wharf, but Sanoke (rhymes with “bloke”) Viswanathan was born in Chennai in the south of India where he grew up on his parents’ poultry farm, speaking Tamil but going to an English school. “If anything breaks down on a farm, you have to fix it yourself,” he recalls. His father – “there was nothing he couldn’t fix” – inspired him to desert the chickens in favour of studying mechanical engineering at the elite Indian Institute of Technology.

He got his BTech in 1996, a period when India was liberalising and privatising and achieving high economic growth. “It was a great time to learn about business,” says Viswanathan.

So he went on to do a masters at the Indian Institute of Management in Ahmedabad and join the newly opened Mumbai office of McKinsey in 1998.

He transferred to New York, but was ultimately recruited by JPMorgan in 2010 to head up corporate strategy in the aftermath of the financial crisis (with the emphasis on scaling down risk). He landed in London in 2013 as its chief administrative officer and took over as CEO of the new UK offshoot of Chase in 2018 (JPMorgan and Chase are, it should be said, joined at the hip as JPMorgan Chase, the largest of the big four American banks).

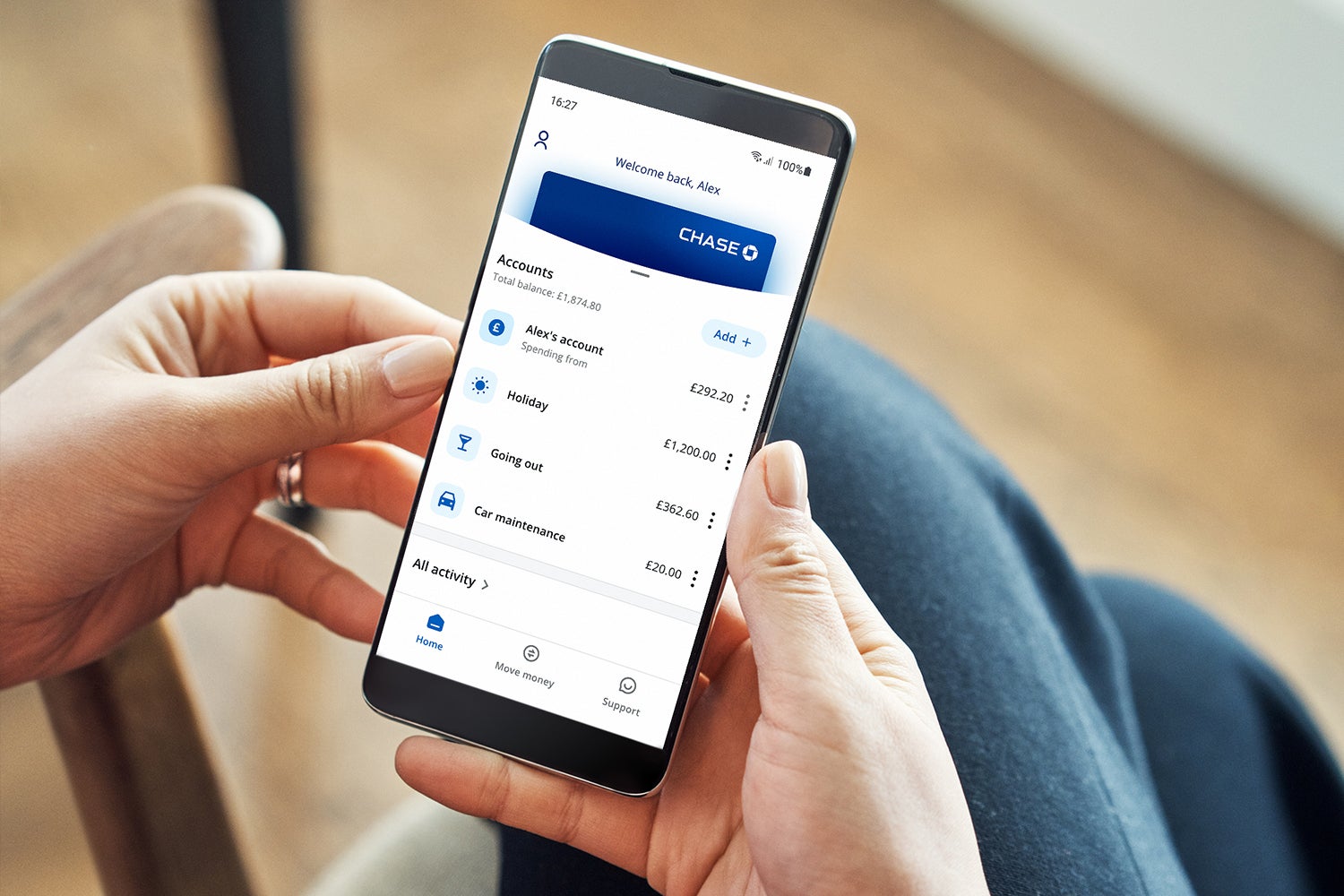

To declare an interest, I have an account with Chase in New York. But apparently they have long been asking themselves the question: what is the best way to serve customers outside of the US? Maybe pay them some kind of bonus, I suggest. Crack them a special deal. “We always thought that the cost of opening in other countries was too high,” says Viswanathan. “But people are going digital and using banking apps on their phone. Footfall is declining at branches in the UK. It is a good time to create a digital-first bank.” With his background in tech, Viswanathan was a natural for the job.

The education system is doing everything it can do, but it’s a tough problem where there’s a lack of resources. We’re happy to supplement families and schools

In his previous role, he was supervising approximately 40,000 JPMorgan employees around the globe. But at the end of 2018, he was starting from scratch with zero staff. “It was like a start-up. Suddenly we were the underdogs. No one knew us in the UK. We needed to claw our way up.”

They opened for business in September. The sad thing for me is that I now need two apps – one for the US and one for the UK. But there is talk of merging the two in due course. Viswanathan says that the underlying philosophy of Chase is “to help customers make the most of their money so they can make the most of their lives”, and he is bringing that approach to the UK. In recruiting, the firm has Advancing Black Pathways in support of diversity. And in the US, they offer Second Chance hiring to convicted felons.

The logic behind its commitment to literacy is that better academic attainment implies better financial outcomes. Sanoke and his team are working with the National Literacy Trust and a major publisher to create or refurbish around 150 libraries in schools in the UK. At present, one in four schools in underserved areas don’t have a dedicated library. Chase is also supplying e-readers and books.

Sanoke is diplomatic about the project. “The education system is doing everything it can do, but it’s a tough problem where there’s a lack of resources. We’re happy to supplement families and schools.”

The Jesuits used to say give them children young enough and they crank out perfect little Jesuits. I can’t help wondering if there isn’t a sinister motive to shape up a generation of future Chase customers while they’re still at school. Sanoke laughs off my conspiracy theory. “If we can improve the lot of cities and communities around the country that will improve the economy – and that will help Chase in the long term.”

JPMorgan Chase has been doing similar things in the US over the last few years, leading a project to revive downtown Detroit, for example, investing in housing and employment. “It’s a tremendous success story,” says Sanoke. They have supported comparable initiatives in the Paris banlieue too, sponsoring education and workplace skills.

In the UK, they have gone from one (Sanoke) to 800 staff dedicated to Chase digital, half in Edinburgh and half in Canary Wharf (with several thousand more JPMorgan Chase people providing back-up in Glasgow, Bournemouth and London).

Sanoke Viswanathan says he was already a fan of Tamla Motown even before Chase got involved in Detroit. But he is also an experienced musician and plays bass guitar in the Chase band in the US. He is thinking about getting the band back together in the UK. And perhaps he is dreaming of the world tour too. The bank and the band are as one in his thinking. “We hope to be in many countries over time.”

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks