My Carbon Footprint: How to stop our hard-earned cash fuelling climate chaos

If you have to ask whether your personal finances are funding climate change, the answer is probably yes. Here’s what you can do about it, says Kate Hughes

Deep down, I already knew my card would be declined as I approached the bloke at the till. He took one look at it, looked up at me, looked back at it, and muttered “Not a chance” under his breath.

Sure enough, the computer said no. But not for the usual reasons.

My bank card, a plant-based number rather than plastic, was disintegrating fast. I figured it was worth one last go, if only to satisfy my curiosity about which bit of the card – either present or by now missing in action – was the important bit. I’m still not sure.

I fished out some coins instead, but I am oddly reluctant to part with that card. It’s linked to my current account with Triodos, a bank whose headquarters are up the road, and whose environmental position is, I feel, the most hardcore of all those currently available to UK retail banking customers.

Many of the others, according to the latest Banking on Climate Chaos report, out today and endorsed by 312 organisations from 50 countries, are still going the other way, and on a terrifying scale.

They include five of the UK’s best-known high street banks.

In fact, between them, Barclays, HSBC, Standard Chartered, Lloyds and NatWest channelled more than £35bn of new money into fossil fuels in 2021, with Barclays remaining the biggest financier of dirty energy in Europe, according to the report. The figures suggest that, since the 2015 Paris Agreement, these five lenders have poured more than £275bn into fossil fuels.

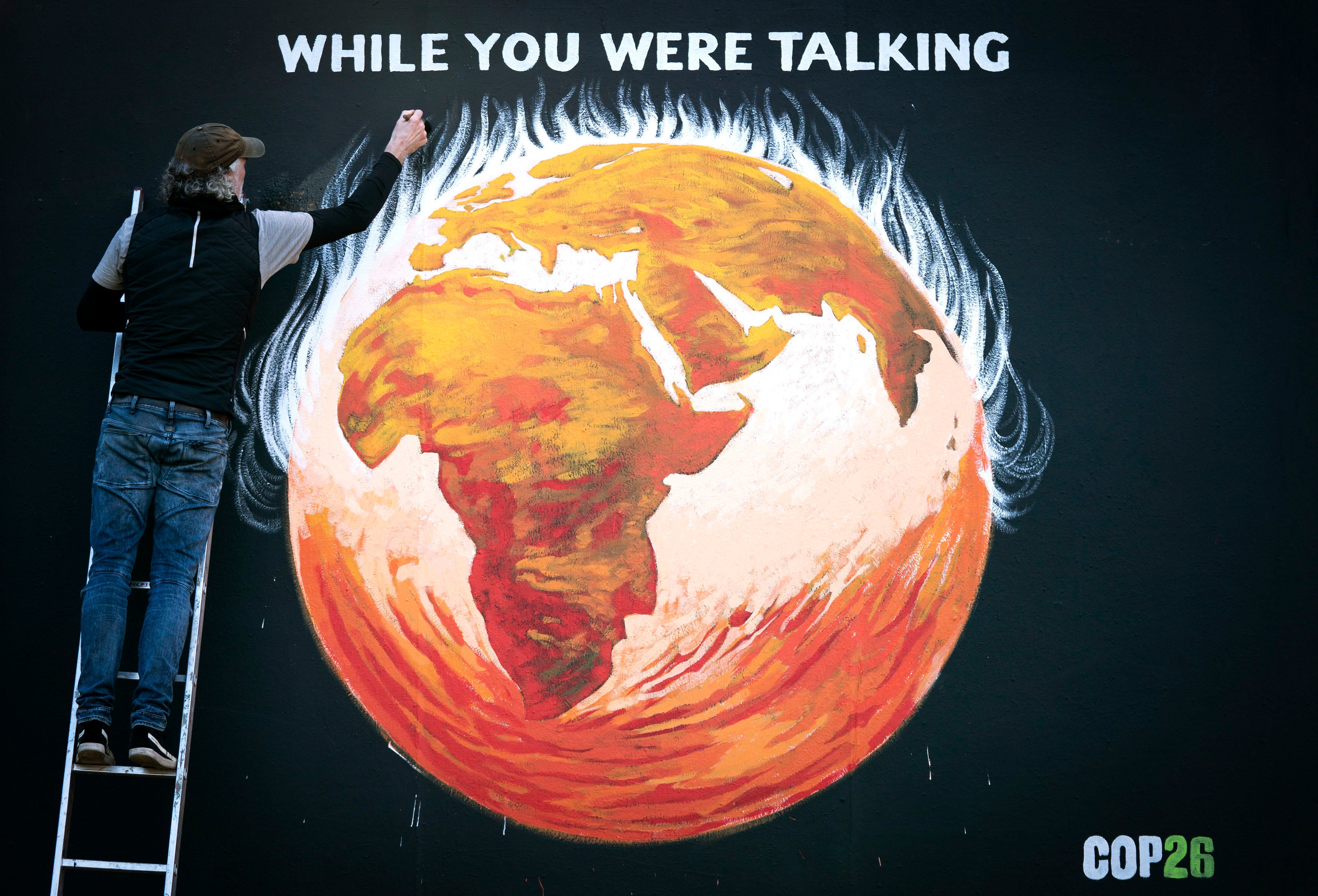

This, research and campaign group Positive Money reminds us, is in spite of the fact that such banks are members of the Net Zero Banking Alliance, a member alliance of the Glasgow Financial Alliance for Net Zero (GFANZ) – the crowning glory of Rishi Sunak’s Cop26 announcements, with 450 global finance firms committed to alignment with the Paris Agreement, including limiting global warming to 1.5C.

“The fact that UK banks continued to pour tens of billions of pounds into fossil fuels in the same year we hosted Cop26 shows just how unserious our financial sector is about the climate crisis,” says Fran Boait, executive director at Positive Money.

I wholeheartedly agree.

So, and mostly because I have to, I asked those five banks to respond to the findings. Two didn’t bother replying at all.

Of those that did, a spokesperson for NatWest Group said: “NatWest Group’s lending to oil and gas customers has declined significantly in recent years – reducing by 21 per cent in 2021 alone – and now makes up less than 0.7 per cent of our total lending.

“We have been working closely with major oil and gas customers to make sure they have credible transition plans in place that are in line with the Paris Agreement.

“As a bank, we are determined to help end the most harmful activity and to champion climate solutions, by aligning our portfolio and lending with the ambition of the Paris Agreement, which is why we are aiming to lend £100bn in climate and sustainability funding and financing by 2025.”

HSBC told me: “We are committed to working in high-emitting sectors and geographies with clients who take an active role in the energy transition, and apply good industry practice focusing on accelerating low- and zero-carbon solutions critical to building a clean and secure net zero energy system. We are focused on supporting carbon-intensive clients to transition to net zero, and we believe the biggest contribution that HSBC can make to a low-carbon global economy is to actively engage our clients on their transition to net zero.”

Finally, a Barclays spokesperson said: “We are determined to play our part in addressing the urgent and complex challenge of climate change. In March 2020 we were one of the first banks to set an ambition to become net zero by 2050, across all of our direct and indirect emissions, and we committed to align all of our financing activities with the goals and timelines of the Paris Agreement.”

The problem with all of these “determined”, “committed”, and “Ah, yes, but ignore that and look at all these clean energy investments we’re making over here” statements is that we have run out of time for reductions and transitions.

The International Energy Agency warns that there can be no new investments in fossil fuel expansion if the world is to reach net zero by 2050. None.

“Unless there are immediate rapid and large-scale reductions in greenhouse gas emissions, limiting warming to 1.5C will be beyond reach,” said Abdalah Mokssit, secretary of the UN’s Intergovernmental Panel on Climate Change (IPCC), when last summer’s report came out.

Immediate, rapid, large-scale. I might have that tattooed somewhere about my person and flash it at the next person that hides behind a “credible transition” excuse within earshot, because they all use it in one form or another.

And no, don’t bother trying the economic case for a slower divestment on me either, because at this stage in proceedings, it’s a moot point if there’s no functioning natural capital left on which to base the economy – any economy – anyway.

Meanwhile, “[We] never dictate any policy to any country – it is for the governments to take the decisions,” Mokssit added.

Sadly, we know how that’s going here in Blighty. So we’ll have to do it ourselves – all us little people to whom it isn’t worth defending a bank’s fossil fuel investment track record.

In fact, if you really want to take action on climate change, focus on your money. It’s the source of half the typical Brit’s carbon footprint, so we could have a huge individual impact here – far greater than a personal flying ban or switching to an electric vehicle.

There are some great places to start. And I’d start with the big money – your pension (Make My Money Matter is a great resource for this), followed by investments, bank accounts, insurance policies, mortgages.

Positive Money, as well as today’s Banking on Climate Chaos report, can also help you identify the worst culprits from among your financial services providers.

Meanwhile, I should probably replace that bank card.

‘Going Zero: One Family’s Journey to Zero Waste and a Greener Lifestyle’, by Kate Hughes, is out now.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments