Banks helping fund destruction of Amazon rainforest, environmental group claims

Institutions ‘complacent’ and not making best use of risk management policies, Stand.earth says. By Jon Sharman

Major banks’ investments in fossil fuel extraction are putting at risk the Amazon rainforest and the wider global climate, with the ecologically vital region now at a “tipping point”, according to a new report by activists.

Stand.earth accused the institutions of being complacent and failing to do all they could to protect the rainforest, despite having policies in place that purported to screen out risky ventures.

The Canadian pressure group analysed 14 top US and European banks for its report, released on Thursday.

In broad terms, Stand.earth said: “We found that banks are being complacent – putting the burden on stakeholders with less power and means to raise issues, without clear policy on how their voices will be heard or how recourse will be just.”

The group added: “By waiting for stakeholders to sound the alarm, banks are not addressing shortcomings in their policy implementation until frontline communities have already borne the brunt of negative impacts in the Amazon.

“In addition, the research found that the banks analysed in this scorecard have a major blind spot in their lending practices. They create syndicated renewable loans [known as] revolving credit facilities worth billions of dollars for their oil trading clients, but don’t have adequate oversight on how the money will be spent.

“Oil traders could feasibly spend it on whatever they decide ‘general corporate purpose’ entails, without enough scrutiny by banks to detect environmental and social risks or corrupt business practices.”

Stand.earth said that the Amazon was now at a “tipping point”. It added: “Further oil and gas extraction, a major driver of deforestation, will push the biome – essential for climate change mitigation and home to 400-plus indigenous nationalities ... to the brink of irreversible collapse.”

Fossil fuel extraction drives deforestation, Stand.earth said, through road-building in previously untouched areas, which then opens those locations to exploitation.

Banks should refuse to finance oil and gas extraction in the Amazon as many have already done for the Arctic, the group added. It called for this step to be taken by the end of 2021.

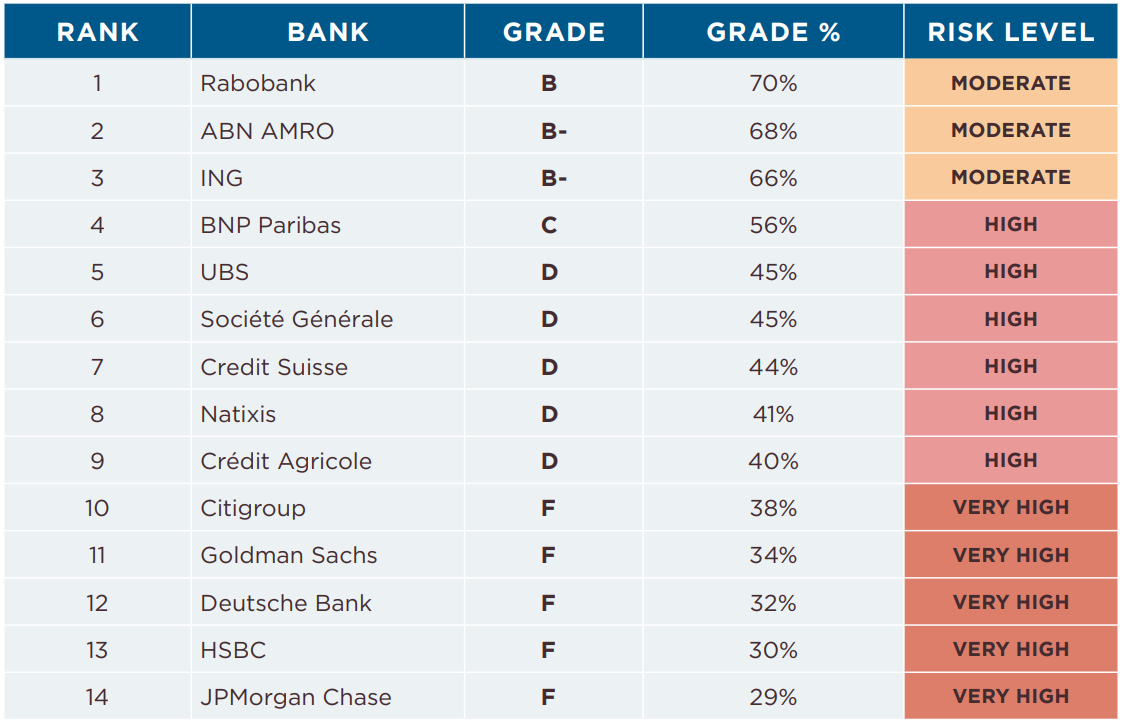

In awarding its grades to each bank, campaigners balanced the institutions’ use of positive risk management policies against their exposure to those risks. Rabobank, of the Netherlands, was rated highest with a “B” grade and a “moderate” risk rating, followed closely by ABN AMRO and ING.

Five institutions – Citigroup, Goldman Sachs, Deutsche Bank, HSBC and JP Morgan Chase – received “F” grades and “very high” risk ratings.

How have banks responded?

The Independent contacted all 14 banks analysed by Stand.earth for comment

Deutsche Bank

“Deutsche Bank will not finance activities where there is clear and known evidence on clearing of primary forests, areas of high conservation value or peat lands, illegal logging or uncontrolled and/or illegal use of fire.

“We observe the developments regarding the fires in the Amazon as region with great concern. Together with other German companies in Brazil – and under the patronage of the German-Brazilian Chamber of Commerce and Industry – we continuously talk with representatives of the Brazilian government about sustainability and environment protection.

“Deutsche Bank is committed to act as a responsible partner to all our stakeholders and to address impacts that our business operations may have on the environment and society. We acknowledge that large-scale agricultural production in some cases can be linked to deforestation, poor labour conditions or conflicts with local communities.

“To promote sustainable agricultural production, Deutsche Bank introduced a set of guiding principles for companies active in these areas. Deutsche Bank is also a signatory of different commitments like the New York Declaration on Forests and the Soft Commodities Compact between the banks of the Banking Environment Initiative (BEI) and the members of the Consumer Goods Forum.

“Deutsche Bank expects companies to publicly demonstrate their commitment to no-deforestation standards. We also expect companies to have policies in place to conduct a high conservation value assessment before any new plantation development.”

ING

“We have been examining the concerns of local indigenous communities and the impact of oil and gas exploration on the Ecuadorian Amazon. When it comes to protecting the Amazon, we share many concerns of civil society stakeholders. That’s why we have undertaken research on our financial exposure to oil and gas trade flows from the region.

“Our research and resulting engagements are ongoing. In the meantime, we have decided not to engage in any new contracts for the financing of oil and gas trade flows from the Ecuadorian Amazon.”

Credit Suisse

“Credit Suisse is committed to address climate change, protect biodiversity and respect human rights. We therefore embed these considerations into our responsible approach to business activities.

“The bank reviews and updates its sector-specific policies on a regular basis. As part of our commitments, we introduced further restrictions on financing fossil fuels.

“Our group-wide oil and gas policy draws special attention to biodiversity and excludes providing finance or advice for activities undertaken in areas of high conversation value.

“Our ambition is to become a sustainability leader in the financial industry, which we introduced in 2020 when we established our sustainability, research and investment solutions function on the executive board level and the sustainability advisory committee on the board of directors level. In this context we also announced our target to provide at least £237bn of sustainable financing to support transition strategies over the next 10 years.”

HSBC

“We have an ambitious climate strategy, first announced in October 2020, to align our provision of finance to net zero by 2050 or sooner, in line with the Paris Agreement goals.

“We expect to provide between $750bn (£545bn) and $1 trillion (£727bn) of finance and investment by 2030 to support our customers in the net zero transition. HSBC takes our agricultural commodities policy very seriously and regularly assesses its clients for commitment to sustainable business practices.”

BNP Paribas

“BNP Paribas was aware of the report well ahead of its release and welcomed the opportunity to have an in-depth dialogue with Amazon Watch and Stand.earth during the preparation phase.

“Our relative rank (four of 14) and position among the ‘frontrunner’ category signal our active work to continuously improve our financing and investment sector policies, including in the oil and gas sector.

“As part of the bank’s commitment to finance ecological transition and engage clients on this issue, BNP Paribas excluded unconventional oil and gas specialists (shale oil and gas, oil sands, and oil and gas from the Arctic) as well as dedicated projects in end-2017. In December 2020, BNP Paribas further excluded seaborne exports of oil from the Esmeraldas region in Ecuador from its trading activities.

“For the first time in May 2021, the BNP Paribas Group set itself an intermediary target of reducing by 10 per cent its credit exposure to oil and gas exploration and production activities by 2025 (on a 2020 baseline).

“The bank is fully aware of the adverse impact that biodiversity loss can cause to the environment and society, and BNP Paribas issued its first public position on biodiversity in May 2021. This includes a commitment to assess all of BNP Paribas’ corporate customers on criteria linked to biodiversity by 2025.

“BNP Paribas is working on developing biodiversity-related impact measurement methodologies, and has been one of the co-chairs on the Informal Working Group of the Taskforce on Nature-related Financial Disclosure (TNFD). In May 2021, BNP Paribas Asset Management also announced the launch of its new partnership with CDP [a charity] to explore and support the development of common biodiversity corporate reporting metrics.”

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments