Matthew Norman: Jimmy Carr's tax avoidance makes a mockery of the Chancellor's plan

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Living in the lip of this economic supervolcano, watching in terror as the euro-magma rises and retreats and then rises again, wondering whether it will be a Hellenic or Hispanic crisis that brings on the eruption, we instinctively seek out comic relief where we may.

Whether laughter really is the best medicine remains unclear, though the doctors' strike may offer a chance to explore the theory via a double-blind clinical trial, with 5,000 antibiotics-deprived bronchitics watching Bill Bailey DVDs and another 5,000 (the placebo group) subjected to the oeuvre of Michael McIntyre. But, either way, we all need a decent giggle in petrifying times.

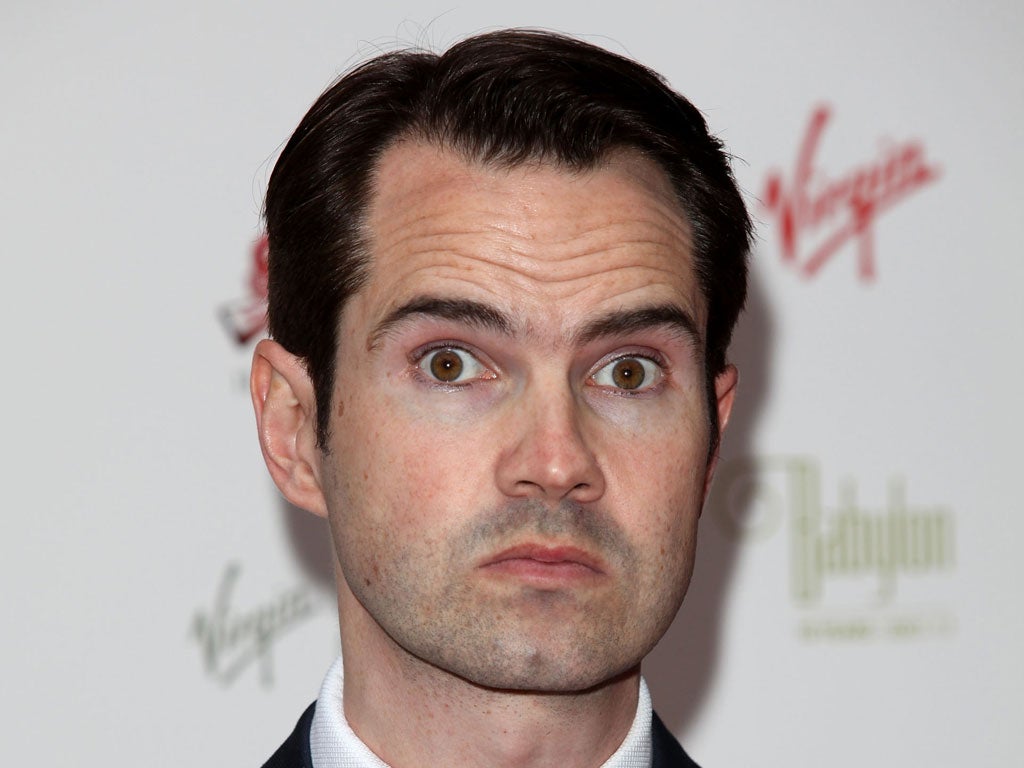

So voluminous thanks to Jimmy Carr, the headline act in yesterday's Times for his ribcage-busting take on dodging income tax. The irony of a News International title getting its knick-knacks in a twist over this is mildly amusing itself. But the real mirth resides in the adorably mischievous form of Mr Carr. The scallywag has reduced his income tax to virtually nil through a cunning scheme, run by an old friend, called K2. God knows whether K2 is the absolute highest point of tax avoidance. There may be another called Everest, whereby the Inland Revenue actually pays you for earning an untold fortune. But the comedian has been paying as little as a penny in the pound on his income of more than £3m a year. This, Carol Vorderman will confirm, makes him a tediously literal member of the One Per Cent.

Were it Jim Davidson, or another of that clique of right-wing chucklemeisters, you probably wouldn't have to beg matron for the smelling salts. But, sadly, Jim did his dough long ago, Chalky White's best mate going bankrupt over an unpaid £700,000 tax bill in 2006.

If only the chump had known about K2, which services 1,100 people, of whom Mr Carr is the biggest beneficiary. The fine details are too complex for a financial dunce like me to bluff at fully comprehending. So far as I can make out, the idea is to stick the dosh in the balmy tax shelter of Jersey, and then pretend to loan it to film and music companies. I use the word "pretend" because, according to the K2 mastermind covertly taped by The Times, there is not a snowball's chance in an active volcano of the loan ever being forfeit. Somehow, this scam vastly reduces the liability to chip into the NHS, state education, welfare and all the other fripperies you and I might consider it our duty as citizens to fund.

With some of these schemes, apparently, investing £150,000 in a movie can generate tax relief worth £1m if it flops (as, if it's British, it almost certainly will), which sounds eerily like a classic movie plot itself. Should Mel Brooks ever decide to remake The Producers yet again, he'll have no problem casting Leo Bloom. Mr Carr's tax career seems an instance of a live-the-part method acting preparation to make Robert De Niro look dilettante.

Yet it is lazy journalism to fixate on Mr Carr. It's true that he has given every impression of having liberal-leftish, 99 per cent sensibilities on the 10 O'Clock Live show, Channel 4's crack at Jon Stewart-esque political satire. It is also true that in one sketch he donned a blonde wig and wickedly teased Barclays Bank for using sophisticated financial planning to pay tax on its profits at – yup, yup, I think you've guessed it – one per cent. All right, he's the Ken Livingstone of ribald merriment.

But which among us is so pure of heart that they would glibly cast the first stone at another for flirting with the kind of weapons-grade hypocrisy that could be used, were one accidentally to swallow poison during the doctors' strike, as a makeshift emetic?

The serious point here is not about individuals avoiding their tax in what must ritualistically be termed an entirely legal way. The central question is how it is legal at all. A while ago, George Osborne described "aggressive" tax avoidance as "morally repugnant". Perhaps the Chancellor has performed another of his nifty U-turns on the sly, but, according to the K2 mountaineer taped by The Times, circumnavigating tax is as easy as ever.

The only credible explanation for this failure is lack of political desire... a sort of wilful blindness, to borrow the phrase routinely applied to senior News International management, to practices which simply cannot be that hard to outlaw. If the Government chose, it could legislate next month to ensure that every ha'penny of self-employed income is taxed at normal rates; and that if philanthropists like Mr Carr wish to loan money to a film production company, they do so out of earned income in the traditional way, offsetting any losses against future income if the company were to go bust.

One would grieve for all the tax lawyers whose own incomes were slashed as a result. Of course, we would. I'd gladly man a soup kitchen for them and their impoverished clients myself. But if Mr Osborne stood at the Dispatch Box and straight-facedly declared that it was beyond his powers to stop these disgusting scams, he'd be established as a more gifted deadpan comic than even Mr Carr.

What would be an outrage at any moment in economic history isn't merely a rank obscenity but a symptom of national insanity today. Of the £7bn annually lost to the Treasury through fancy tax avoidance, according to The Times, individuals account for £4.5bn. This is roughly five times what this Government hopes to claw back from the disabled by cutting or withdrawing their benefits.

This decadence has an overwhelming Last Days of Pompeii aura, and we know what ended the orgiastic self-indulgence there in AD79. It seems that only a dreaded Vesuvial eruption will end it here, forcing even Mr Osborne to make the tax-shy play nice and share a decent chunk with the destitute.

If so, it will come as some comfort to fans of Jimmy Carr, as they join the endless queue to get their meagre savings out of Barclays, that he will have more than enough in reserve to enable him to laugh all the way to the offshore bank.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments