Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

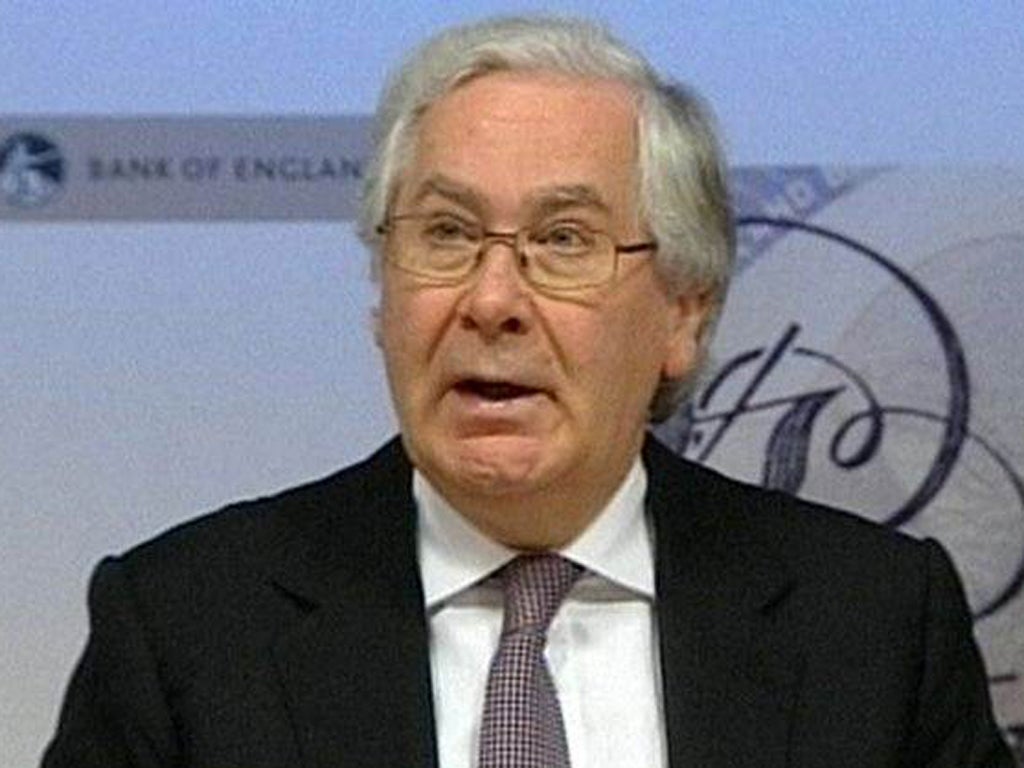

Your support makes all the difference.The Governor of the Bank of England, Sir Mervyn King, last night demanded that the Government speed up its reform of Britain's financial sector. He also attacked bankers for resisting new financial regulation in order to protect their large bonuses.

The Chancellor, George Osborne, met the bosses of Barclays, the Royal Bank of Scotland and Lloyds separately in the days before the Vickers report on reforming the banking sector to prevent another crisis was published in September 2011. Last December, i revealed that senior bank executives met or called Treasury ministers nine times in the weeks after the report's release.

"Already we see vested interests rise up to defend their bonuses and profits," the Governor said.

His call for reforms of the banking sector to be speeded up is likely to meet a hostile reception in the City, where Sir Mervyn is already an unpopular figure. Last night, he praised the Vickers commission – which has recommended that the Government compel Britain's largest banks to "ring-fence" their high street lending operations from their high-risk investment banking arms and hold significantly larger capital buffers. "It's vital that Parliament legislates to enact these proposals sooner rather than later," he said.

Speaking about the roots of the 2008 financial crisis, the Governor put the blame squarely on the excesses of the banking sector. "In a nutshell, our banking and financial system overextended itself," he said.

He defended the Bank of England's conduct in the run-up to the crisis, saying it had warned of the dangerous build up of risk in the financial system, but adding that it was powerless to do anything about its concerns, having been stripped of its regulatory powers after being granted independence in 1997. He added, however, that "we didn't imagine the scale of the disaster that would occur when the risks crystalised."

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments