Take That on taxman's hit list after Carr admits a 'terrible error of judgement'

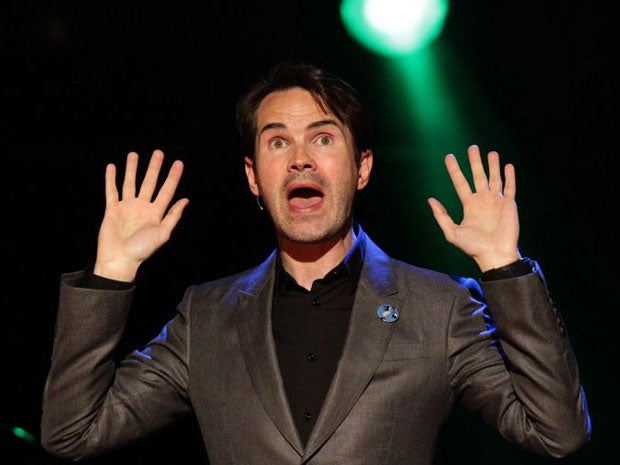

The tax authorities yesterday vowed to close down and claw back lost income from two legal tax avoidance schemes which are estimated to have saved the comedian Jimmy Carr and members of Take That millions.

David Cameron looked to have scored a victory in his high-profile attack on Mr Carr's tax affairs as "morally wrong" when the millionaire comedian issued a mea culpa saying he had made a "terrible error of judgement". Mr Carr said he had now withdrawn from the Jersey-based "K2" scheme which reduced his income tax rate to about 1 per cent.

But amid anger in Tory ranks that Mr Cameron had drawn attention to tax avoidance claims against its own billionaire donors, Downing Street was last night fighting a battle to avoid being drawn further into the row. Questioned by journalists, the Prime Minister refused to criticise Take That star Gary Barlow and – notwithstanding his comments on Mr Carr – said he was not providing a "running commentary on different people's tax affairs".

The Conservative high command faced further charges of hypocrisy after No 10 signalled it had gone cool on plans for senior ministers, including the Prime Minister to disclose their tax returns.

Her Majesty's Revenue and Customs signalled its determination to shut down K2, whose beneficiaries have avoided paying £168m annually to the taxman. The scheme is legal and works by paying its clients in the form of an offshore loan.

The Revenue said K2 was "already under investigation" and it would, if necessary, take a case to the Taxes Tribunal to ensure its closure. The HMRC, which estimates about £5bn a year is lost through tax avoidance by individuals, said it was also preparing action against Icebreaker 2, a separate scheme designed to fund projects in the music industry.

According to The Times, Mr Barlow, a Conservative supporter who was appointed an OBE this month, and his fellow band members Howard Donald and Mark Owen, along with their manager Jonathan Wild, have invested £26m in the scheme. The Revenue said it had already "successfully challenged" a predecessor scheme – Icebreaker 1 – and was now preparing a case against its successor. Icebreaker Management Services, which oversees the schemes, strongly denied the HMRC claims, saying its products were "categorically not avoidance schemes" and that Icebreaker 1 had been recognised as a "legitimate trade". In a statement, the company added: "We recognise the need for the proper administration and collection of taxes."

Lawyers for the Take That members said the musicians believed the investments were legitimate enterprises and not schemes designed to avoid tax.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks