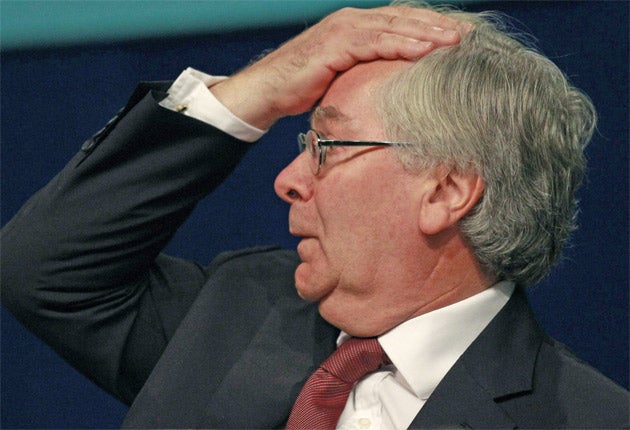

Markets tumble as new recession fears grow

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.World markets collapsed last night, as investors panicked that the US and the eurozone were "dangerously close to recession". More than £62bn was wiped off the blue chip FTSE 100 index, which slumped by 239.37 to 5092.23 – its worst one-day fall in points terms since November 2008, and in percentage terms since March 2009. European shares put in their worst daily performance since the credit crunch as growth concerns added to worries about the eurozone's sovereign debt crisis.

The Spanish stock market was down by nearly 5 per cent, France by 5.5 per cent, Germany by 6 per cent and Italy by more than 6 per cent. In the US, the Dow Jones Industrial Average fell back below the 11,000 point mark. The Dow was nearly 4 per cent lower at 10,978.4 as the City's dealing rooms closed for the day.

The jitters began as traders learned that Morgan Stanley had cut its global growth forecast for this year to 3.9 per cent from 4.2 per cent. The bank's view was that, as the world slowed, the US and the eurozone were "hovering dangerously close to recession".

Although traders still anticipate growth, with the US expected to expand by 1.8 per cent this year and the eurozone expected to grow by 1.7 per cent, they warned that "it won't take much in the form of additional shocks to tip the balance". "The main reasons for our growth downgrade, apart from disappointing incoming data, are recent policy errors in the US and Europe, plus the prospect of further fiscal tightening there in 2012," they said, pointing in particular to Europe's slow response to the sovereign crisis and the drama preceding the lifting of the US debt ceiling.

The bears did not have to look far for evidence to back up the fears of a dreaded double dip in the world's largest economy. Although the weakness in New York may have been exacerbated by technical factors, sellers found enough fodder in some disappointing economic data out of the US.

First, the US Labor Department said new claims for unemployment benefits had climbed by a higher than expected 9,000 to 408,000 last week. Then came the news that the Federal Reserve Bank of Philadelphia's index of business conditions in the mid-Atlantic region had plummeted to -30.7 in August, down from 3.2 in July, and well below expectations of 3.7. The headline reading takes the index back to levels last seen before 2009.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments