Smart finance tips to help you make the most of your assets in 2023

Plan for a financially stable future with the help of these experts

Whether you’re looking to secure the best car leasing deal or navigate the property market successfully, here’s how to better manage your money and smash your long-term goals in 2023 and beyond.

Invest in gold at uncertain times

According to bullion dealer Tavex Bullion, gold and silver are among the few sensible assets to keep your money in at uncertain times. The dealer maintains that gold has always been one of the best hedges against inflation and that owning it means you’ll have access to a tangible asset that is highly appreciated and accepted internationally.

Having partnered with some of the largest refineries and mints globally (including Royal Mint and Valcambi), Tavex Bullion offers fair prices, direct supply and mint quality, as well as genuity of the bullion. It also offers VAT-free and CGT-exempt gold bullion coins, helping you make the most of your wealth by investing in precious metals.

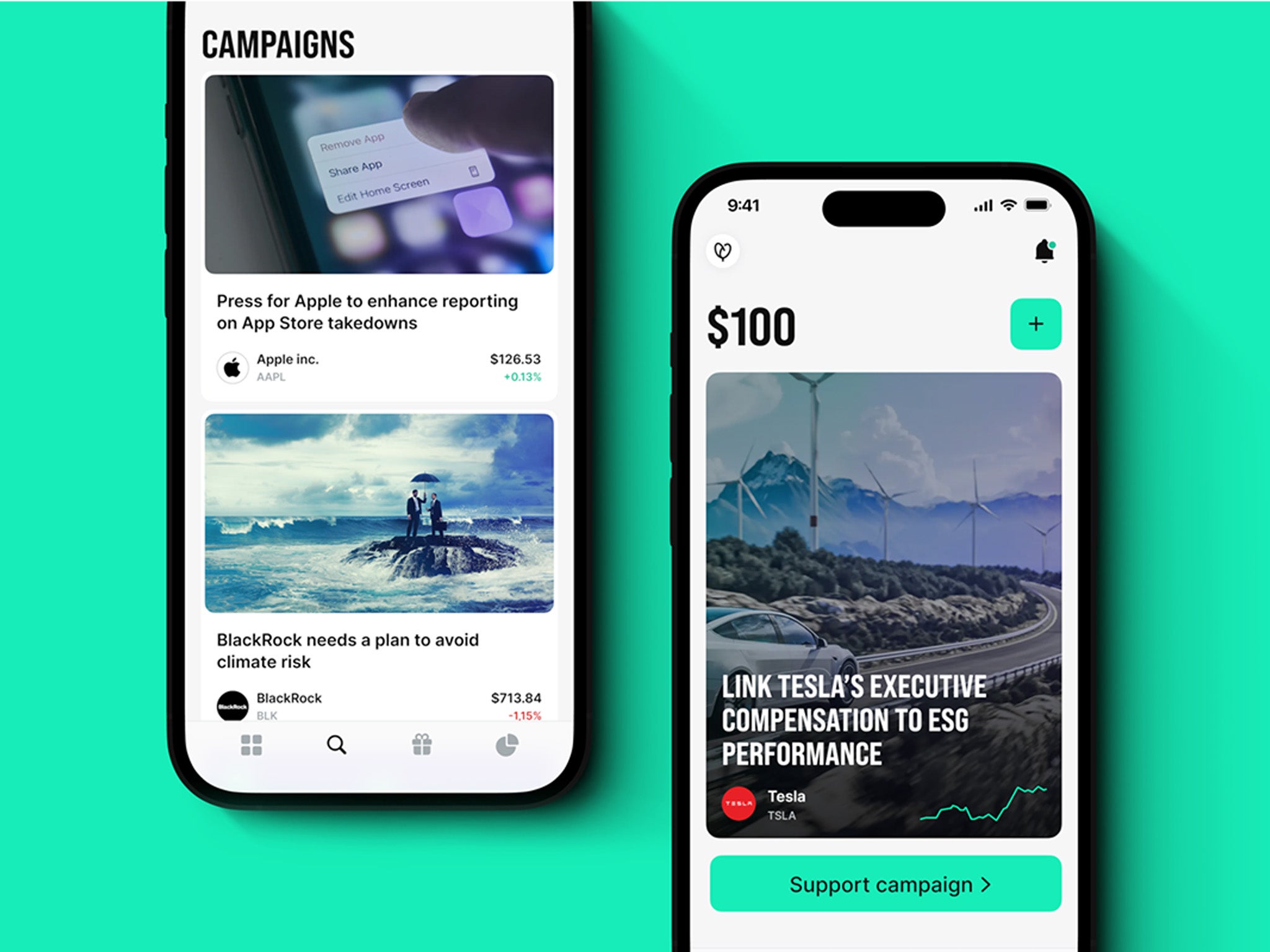

Become an activist investor without limiting your potential

Care to build a better future for your finances as well as the planet? Ethical investment app Tulipshare will show you how to invest in environmental and ethical campaigns by making companies more sustainable and grow their values overtime. You’ll get the chance to engage with public companies to push for change, ideally generating the long-term growth of your capital by prioritising sustainability, all the while growing your portfolio of Fortune 500 companies.

Not only will you be investing in green companies, you’ll be using your shareholder power to make your investments greener. Download the app at Tulipshare.com to learn how to become an informed investor and grow your capital through impactful change.

The value of investments can go down as well as up. Capital at risk.

Find out more at Tulipshare.com now

Pay off your credit card with an easy-to-use app

If you’re looking to easily manage all your credit cards in one place, the free Cardeo app could be just the thing for you. The platform gathers a user’s accounts together, showing overall borrowing, spending and limits. Its intuitive calculator works out the cheapest, fastest way to pay off credit card borrowing; once you’ve set a target, you can make a single monthly payment through Cardeo, which distributes the money to your cards.

Credit card users could save up to £90 a year in interest and fees, but that saving could rise to as much as £525 a year with Cardeo Credit, a flexible, lower-rate credit line offered within the app. Eligible customers can refinance their card borrowing at a lower rate, while keeping their credit cards for their perks.

Control your driving costs with pay-per-mile insurance

In the UK, drivers tend to drive less than 7,000 miles a year, so paying for your insurance by the mile could be a great way to get your driving costs down. Ticker offers pay-per-mile car insurance designed for low-mileage drivers. It works with a small device that you plug into your car, so all you need to do is make one payment to protect your parked car from theft or damage, then a fixed cost per mile for the miles you drive. The Ticker app lets you track your journeys and monthly bills to control your driving costs, just like you’d manage your heating with a smart meter. No miles? No charge. See if you could save with Ticker’s pay-per-mile insurance at Ticker.co.uk.

Ticker is a trading name of Ticker Limited, which is an appointed representative of Davies MGA Services Limited, a company authorised and regulated by the Financial Conduct Authority under firm reference number 597301 to carry on insurance distribution activities.

Recover your money from mis-sold business energy deals

Much like domestic customers, businesses are facing torrid times due to the rising cost of energy. SME owners tend to employ third-party intermediaries to find their business the best energy deal, however brokers often fail to fully disclose the details of their commission, which may lead to an unfair relationship with their client.

Information about extra charges – on deals worth tens of thousands of pounds that clients may have tied themselves into for years – isn’t even in the small print. Worry not, as law firm Barings Law will thoroughly examine the circumstances of the energy deal purchase and whether the broker signed you up to the best contract for your business, aiming to recover any lost money.

Find out more at Energy.baringsforbusiness.com

Try car leasing with a favourable deal

In need of a new car but don’t have the funds to buy it? The team at Moneyshake can help you out with car leasing, comparing deals from a panel of providers to find the best one for you. Leasing is essentially the long-term rental of a brand-new car, requiring you to make an upfront payment, followed by fixed, monthly payments to drive the car of your choice for between two and four years. Unlike other types of financing, you don’t own the vehicle, so monthly payments are typically lower.

All lease deals come with a full manufacturer’s warranty, road tax and free UK mainland delivery, while you can also add a maintenance package for a small, additional monthly fee, to enjoy hassle-free motoring. Payments are fixed for the duration of the agreement.

Find out more at Moneyshake.com now

Calculate your taxable income from crypto with a smart tool

Crypto investors may find it difficult to figure out what they owe in taxes – cryptocurrency is taxed in the UK, with both capital gains and income tax liable under HMRC guidance. Koinly aims to save crypto investors from paying too much tax. The tax calculator connects to over 700 crypto exchanges, including Binance and Coinbase, importing your transactions and using AI to calculate your taxable income from crypto.

Koinly also scans and cross-references each transaction with the blockchain to ensure your records are accurate, and correctly determine whether a transaction was a capital gain, a capital loss, income or a non-taxable event.

Save 30% on your HMRC crypto report at Koinly.io with code “3E9A6565”. Offer valid until 28th February 2023.

Invest in repurposed commercial buildings with the help of experts

Got an eye on a property you’d like to invest in, but don’t know how to make it fully functional and profitable? Savoys Properties provides clients with fully integrated end-to-end solutions, first acting as a consultant and advisor and then as designer and developer. The company can help you generate income by converting unloved buildings into habitable units for professional occupiers.

It assists with common issues associated with completing HMO (house in multiple occupation), or commercial to residential development. The partners at Savoys Properties have been at the forefront of implementing planning changes in recent years. Their services include planning, project management, designing and building, property sourcing, commercial conversions and HMOs.

Find out more at Savoysproperties.co.uk

Make the right property-related choices

According to Mark Homer, co-founder of award-winning property education company Progressive Property, 2023 could usher in some of the biggest changes to the UK property market since 2008. With property prices likely to fall by 10 per cent or more and rents likely to rise by a similar margin, yields are almost certain to see excellent growth.

National licensing schemes alongside increased CGT and dividend tax aimed at private residential landlords are likely to see more of them leaving the PRS (private rented sector); this could reduce the supply of private rental properties in the UK and potentially push rents higher. Landlords could make their best purchases in 2023/2024, providing they can manage further increases in interest rates. For help on how to navigate the current property landscape, head to Progressive Property.

Find out more at Progressiveproperty.co.uk

This content is brought to you by Living360, a new digital lifestyle destination keeping you up to date with health and fitness, food and drink, homes and gardens, beauty, travel, finance trends and more.

Bookmark popover

Removed from bookmarks