What was in the Budget and what does it mean for you?

The Chancellor announced significant changes to Universal Credit and alcohol duty during his speech.

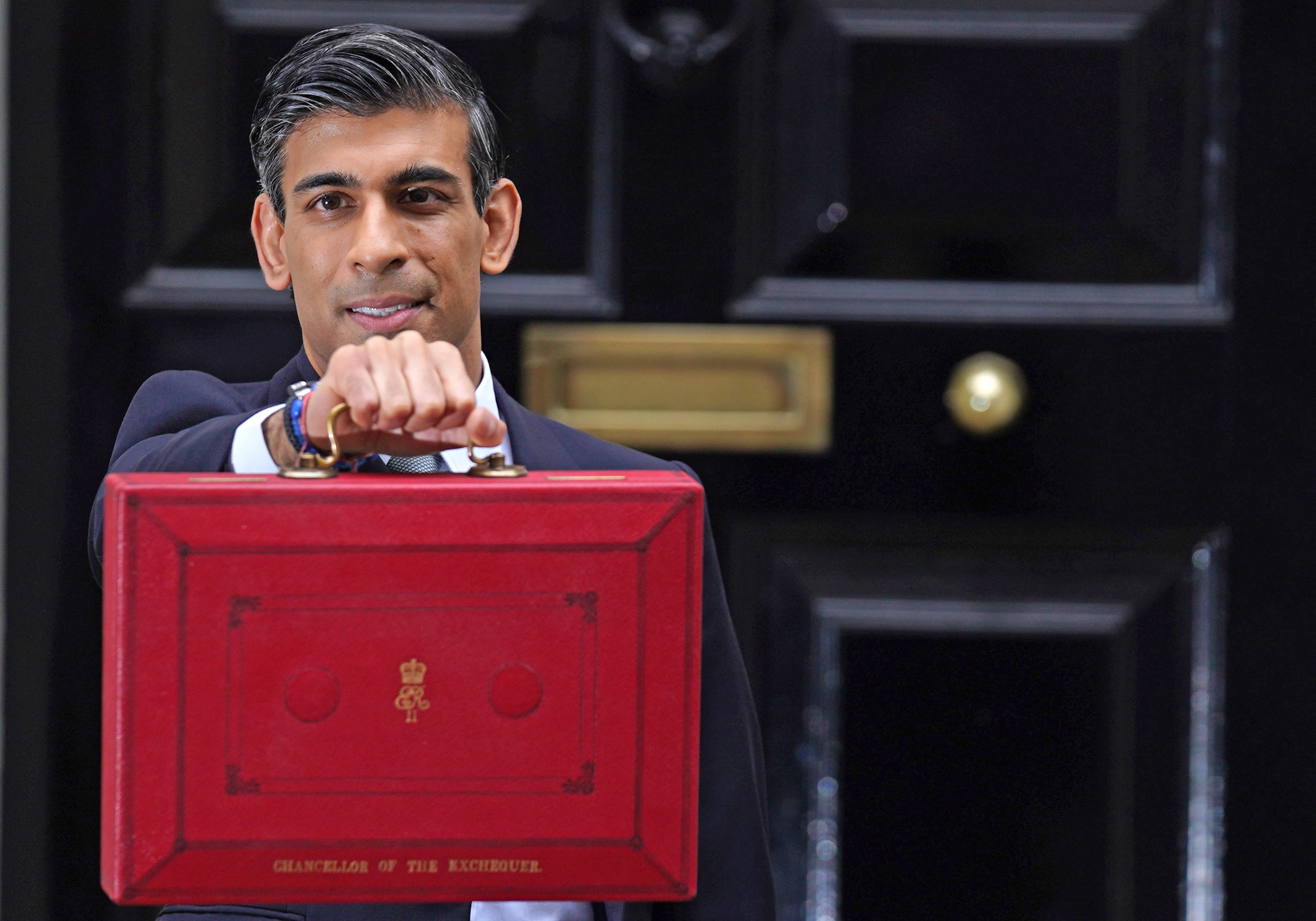

Rishi Sunak has delivered his autumn Budget and Spending Review to the House of Commons.

Here is what was in it and what the headline announcements mean.

– Did we not already know most of what was in the Budget beforehand?

A good deal of policies were pre-briefed and the Chancellor received a scolding before his fiscal statement at the hands of Deputy Commons Speaker Dame Eleanor Laing as a result.

The rise in the minimum wage to £9.50 for those aged 23 and over, and the lifting of the public sector pay freeze were announced before Wednesday but there were other significant policy announcements in the speech.

– So what is new then?

Benefit claimants who work will be able to pocket more of their earnings thanks to the rate their support payments decrease being slashed, pub beer prices are being cut and a planned rise in fuel duty has been scrapped.

– What is this benefit change about?

The Universal Credit taper rate took on a new found prominence as the debate raged over the Government’s decision to remove the £20 weekly uplift that it brought in during the coronavirus pandemic.

Ministers, who scrapped the additional payment this month, argued claimants could replace the money by taking on extra hours of employment.

But it was pointed out that, for every £1 extra earned by UC beneficiaries, the taper rate meant their welfare was reduced by 63%, meaning they effectively take home just 37p in every pound.

Mr Sunak called it a “tax on work – and a high rate of tax at that” as he announced he would be lowering the taper rate to 55%, a drop of 8% that he said would be worth more than £2 billion when the change comes in no later than December 1.

– Can you tell us more about this cheaper booze the Chancellor mentioned?

Drinkers could well be cheering a Brexit boon after Mr Sunak said he was able to simplify alcohol duty rules due to leaving the European Union.

The Chancellor told MPs he was “radically” simplifying alcohol duty by introducing a system designed around the principle of “the stronger the drink, the higher the rate”.

The move is bad news for high-strength cider guzzlers, but will prove a saver for those partial to a glass of rose wine or lower strength beers.

Pubs were not left out either, with a 5% draught relief applied to pints of cider and beer poured out of containers over 40 litres. Mr Sunak, who is teetotal, said it would bring about a permanent 3p reduction in the cost of a pint.

The planned increase in duty on spirits, wine, cider and beer will also be cancelled immediately, while the wider duty reforms will come into effect by 2023.

– What were the other headlines?

Other announcements include cheaper domestic flights between airports within the UK due to a lower rate of Air Passenger Duty from April 2023 and business rate reforms, including a one year 50% discount for retail, hospitality, and leisure firms.

Overseas aid will go back up to 0.7% of national income in 2024-25 after it was reduced this year to 0.5% after the Government cited coronavirus budget pressures.

The UK’s devolved administrations will all receive increases to their Budgets, as will every Whitehall department following the Spending Review.

Local areas across the country are also set to benefit from the first batch of so-called “levelling up” funding, with £1.7 billion to invest in the “infrastructure of everyday life”.

– What happened to the economy being in dire straits – where is all this money coming from?

Mr Sunak was handed some welcome news from the independent forecaster the Office for Budget Responsibility (OBR) that the UK economy is bouncing back from Covid much quicker than it had predicted in the spring.

The OBR has revised its growth forecast for this year from 4% to 6.5% which is set to give the Treasury billions of extra pounds to splash.

The body has also scaled down its assumption of the scarring effect of Covid-19 on the economy from 3% to 2%, while the unemployment peak is expected to hit 5.2%, much lower than the 12% originally predicted.

Borrowing as a percentage of GDP is forecast to fall, from 7.9% this year to 3.3% next year, and tumbling further in the years ahead.

– So was there any pain dished out?

It would not be a Budget if there was not a bit of giving with one hand, taking with the other.

Mr Sunak has said inflation was “likely to rise further” from its position of 3.1% in September due to pressures caused by supply chains and energy prices, meaning further strain on household purses.

And the Cabinet minister suggested the Government would be reluctant to take an interventionist approach to support failing businesses or to counter market forces, telling the Commons: “Government should have limits.”

The comment comes on the back of record fuel prices, National Insurance Contributions for workers being increased by 1.25 percentage points from April to help pay for the NHS and social care, and the end of the £20-a-week Universal Credit uplift.

Property developers also face a new tax to pay for the removal of unsafe cladding, with Mr Sunak confirming a levy on firms with profits over £25 million at a rate of 4% to help create a £5 billion fund.

Bookmark popover

Removed from bookmarks