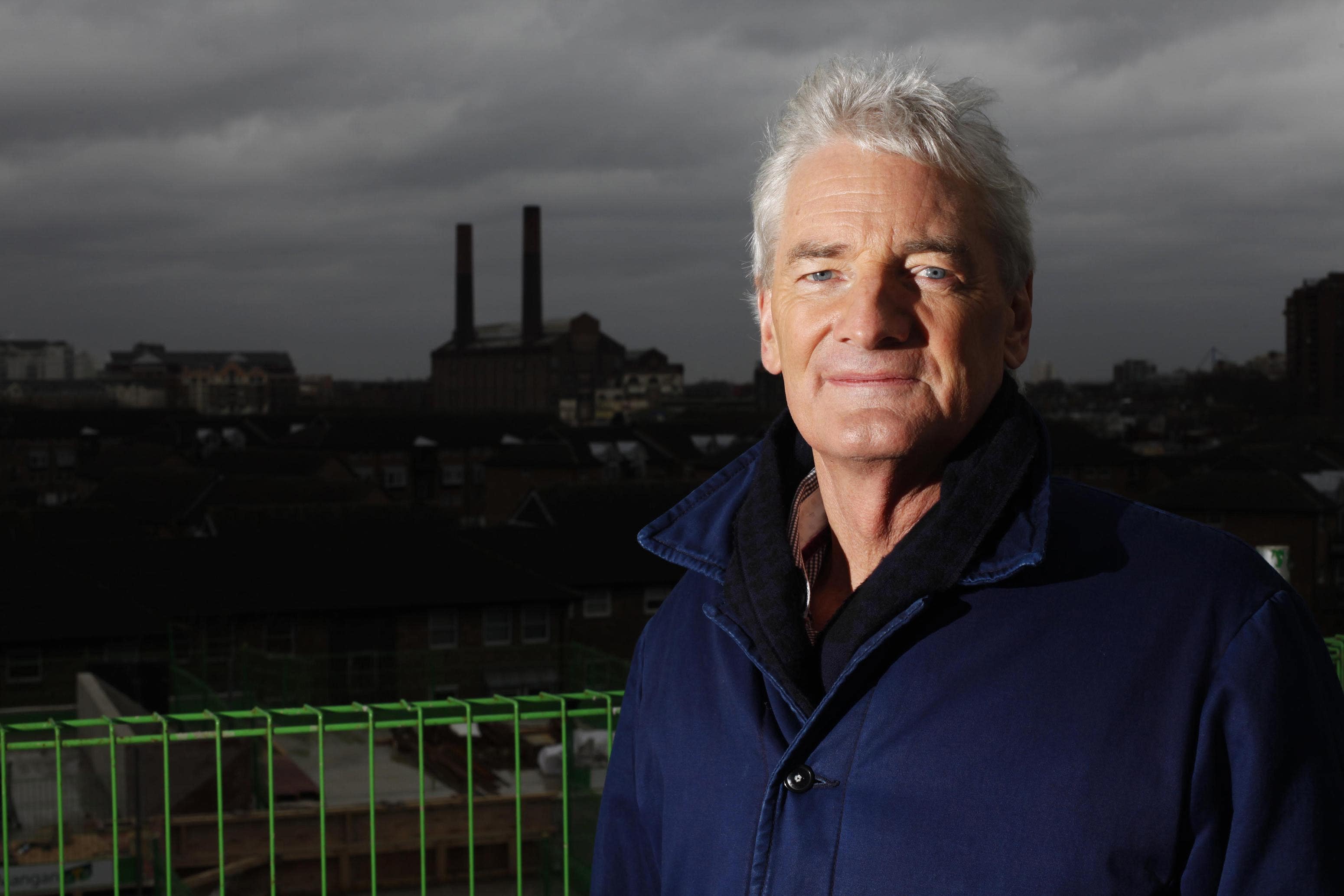

Sir James Dyson says Labour ‘killing off family businesses’ with inheritance tax

The businessman warned that small firms and start-ups will ‘suffer’, while private equity and public companies escape the taxation.

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Billionaire inventor Sir James Dyson has taken a swipe at the Government for “eviscerating” UK family businesses with the inheritance tax measures announced in last week’s Budget.

The businessman warned that small firms and start-ups will “suffer”, while private equity and public companies escape the taxation.

Chancellor Rachel Reeves used her first Budget to make changes to inheritance tax, including reducing reliefs for agricultural and business property from April 2026 in a bid to raise more funds for the public sector.

For assets over £1 million, inheritance tax will apply with an effective rate of 20% – half the standard 40% rate.

The very fabric of our economy is being ripped apart. No business can survive Reeves’s 20% tax grab. It will be the death of entrepreneurship

But the measure has faced a backlash from those across the agriculture sector who say the levy will affect farms being passed down from one generation to the next.

Sir James, who, as well as founding technology firm Dyson, owns a commercial farming business, expressed his frustrations with the new Chancellor’s tax changes.

He wrote in The Times: “Make no mistake, the very fabric of our economy is being ripped apart.

“No business can survive Reeves’s 20% tax grab. It will be the death of entrepreneurship.”

He added: “Every business expects to pay tax, but for Labour to kill off homegrown family businesses is a tragedy.

“In particular, I have huge empathy for the small businesses and start-ups that will suffer.”

Meanwhile, companies owned by overseas families, and private equity-owned and publicly-listed firms that are “about maximising short-term profit” will not pay the same taxes, he said.

Sir James is a major landowner and his business, Dyson Farming, produces crops on 36,000 acres across the UK.

The entrepreneur and his family have a fortune of about £20.8 billion, according to the latest Sunday Times Rich List.

Ms Reeves has defended the proposed reforms to inheritance tax by claiming it is not “affordable” to keep the current system.

She has said “only a very small number of agricultural properties will be affected” by the changes, with Budget documents stating the Government wants to restrict the “generosity” of tax relief for the “wealthiest estates”.