S4 Capital predicts robust demand despite economic slowdown

The company saw shares move higher on Monday morning after a jump in profits and revenues.

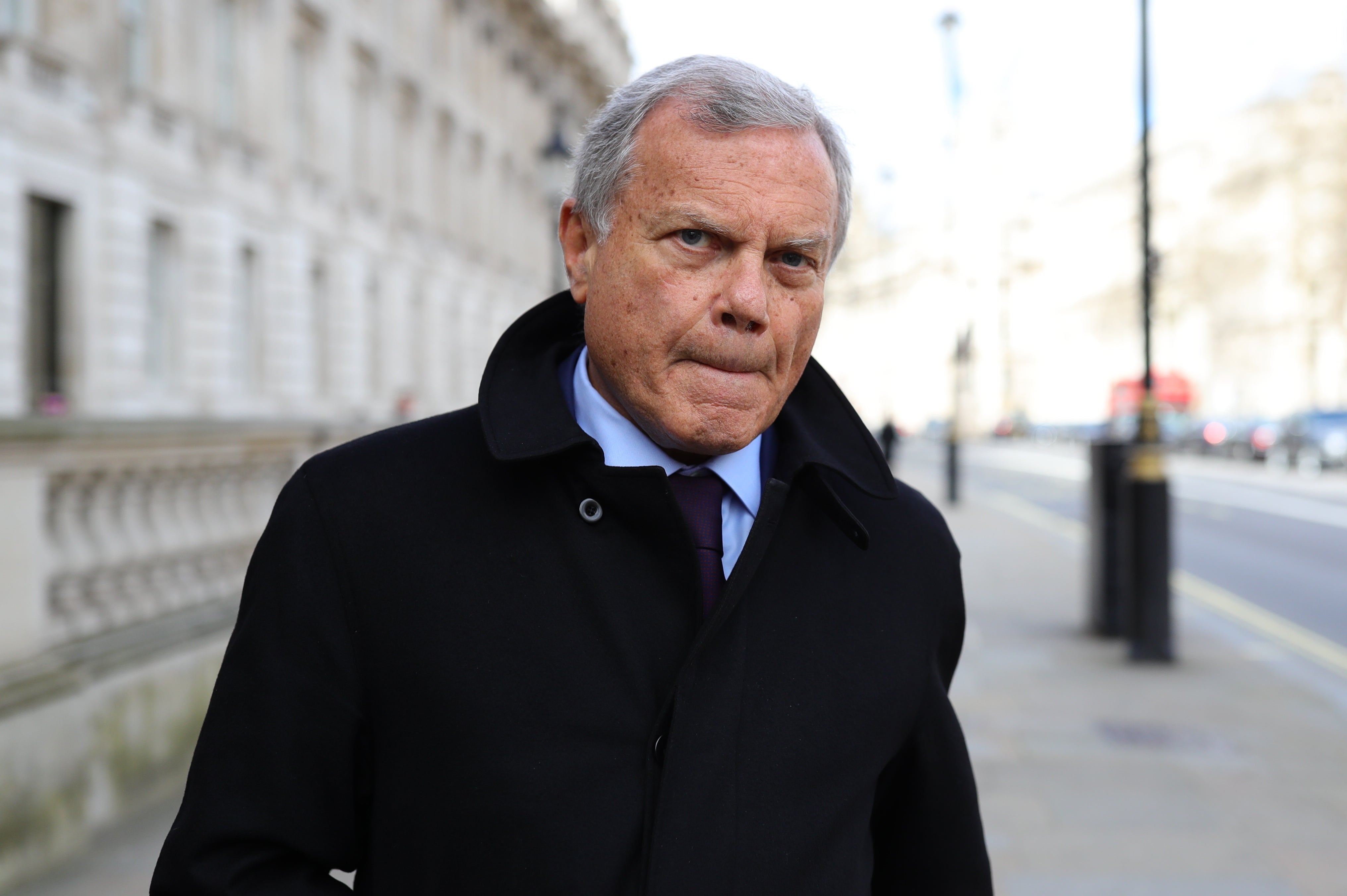

Sir Martin Sorrell’s digital advertising firm S4 Capital said it grew ahead of forecasts over the past quarter and it expects robust demand despite a slowdown in economic growth.

The company saw shares move higher on Monday morning after a jump in profits and revenues.

It reported that trading over the three months to the end of March was “ahead of market guidance”.

Total revenues increased by 70.1% to £206.8 million over the quarter, against the same period last year, as it was boosted by acquisitions.

The chickens may well come home to roost in 2023, as interest rates rise further this year to counter the inflation surge

S4 said it also posted 40.6% like-for-like growth as it won new work for clients including BrewDog, TikTok, Diageo and Booking.com.

The company also reported a 34.5% rise in gross profit for the quarter as it held firm on its projections for the rest of the year.

Sir Martin said client demand for digital marketing services has intensified despite slowing GDP growth in economies across the world.

“Given all this, we remain optimistic about our prospects for this year, particularly as consumer and corporate balance sheets remain strong, cushioned by the Covid stimulus,” he said.

“The chickens may well come home to roost in 2023, as interest rates rise further this year to counter the inflation surge.

“But, digital marketing expenditure remains robust, even in a recession, as, for example, our results in 2020 demonstrated, given its secular growth trend.”

Earlier this month, S4 Capital confirmed that profits doubled in 2021 to £687 million, as the founder criticised an “unacceptable and embarrassing” delay in its results announcement.

Shares were 2% higher in early trading on Monday.

Bookmark popover

Removed from bookmarks