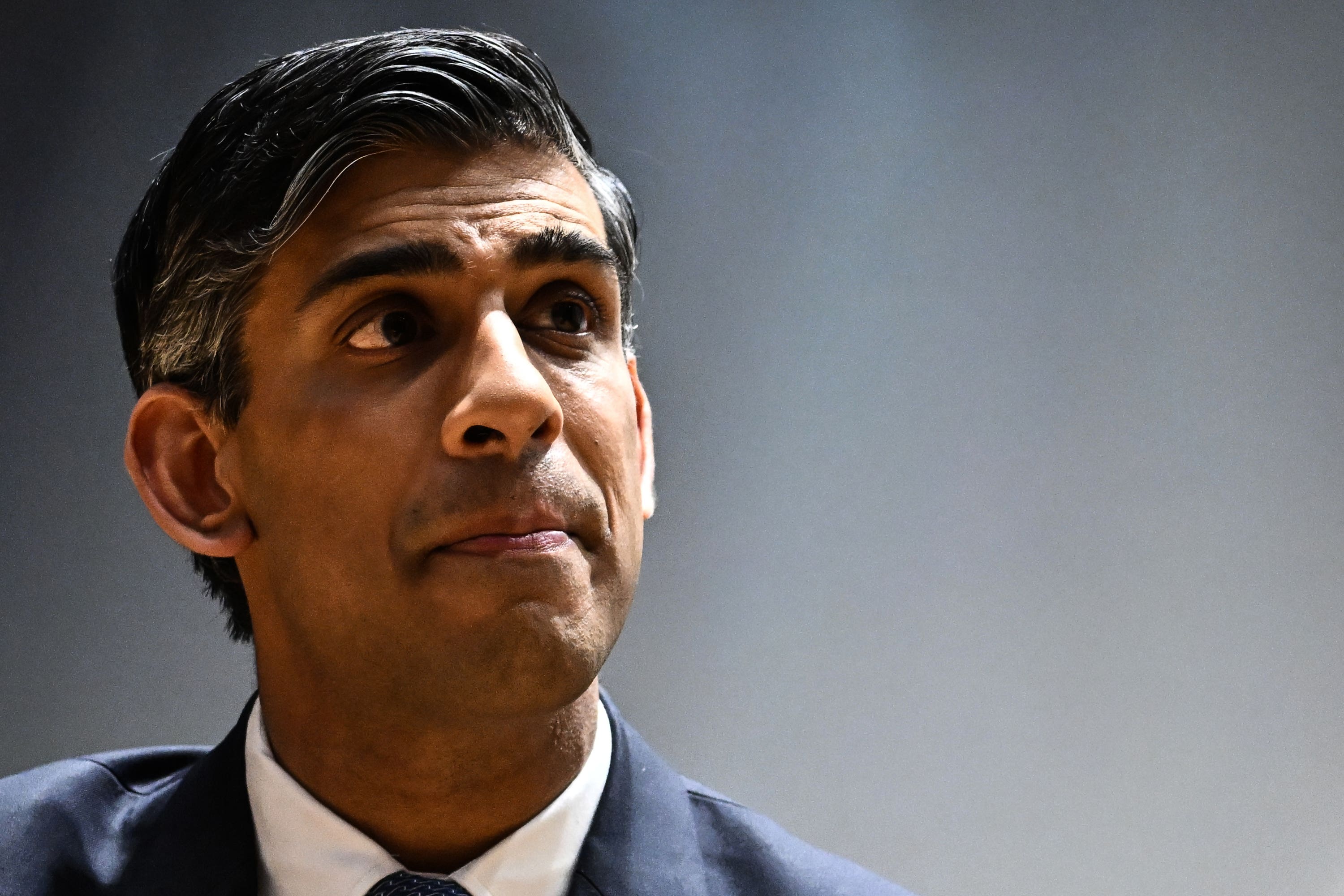

Rishi Sunak believes ‘light at end of the tunnel’ on inflation

The rate needs to be around 5% or lower by the end of the year for Mr Sunak to meet his pledge to halve inflation this year.

Rishi Sunak said inflation is not falling as fast as he would like, but believes people can “see light at the end of the tunnel”.

The Prime Minister made it his Government’s top priority to halve inflation – a measure of how much prices for goods and services have increased over time – in 2023.

The rate needs to be around 5% or lower by the end of the year for Mr Sunak to meet his pledge, with Consumer Prices Index inflation at 7.9% in June – down from 8.7% in May and the lowest rate since March 2022.

It's inflation that's causing everyone problems with their bills, it's inflation which means the Bank of England is having to put up interest rates.

Mr Sunak told LBC’s Nick Ferrari: “I know families are struggling with the cost of living and that’s why I set it out as my first priority to halve inflation, and we’re making progress.

“Is that as fast as I’d like? No. Is it as fast as anyone would like? No. But the numbers most recently that we had show that we’re heading in the right direction, inflation is coming down, and I think people can see light at the end of the tunnel.

“But, look, we’ve got to stick to the plan, it’s not easy to bring down inflation. It requires me to make difficult but responsible decisions on behalf of the country.

“They’re not easy, I get flak for them, but I’m going to do them because they’re the right thing for everybody in the long-term, and I’m determined to stick to the course and bring down inflation for everyone.”

Interest rates have risen to 5% in the battle to control inflation, resulting in mortgage costs recently surging to highs not seen for 15 years.

After hearing from a caller about their mortgage situation, Mr Sunak said: “It’s inflation that’s causing everyone problems with their bills, it’s inflation which means the Bank of England is having to put up interest rates.

“And the quicker we get inflation down, the quicker we can ease some of these pressures, and that’s why you’ve got to trust me, you’ve seen me do it during the pandemic, I know how to manage the economy for everyone, I will bring inflation down, I will make the decisions that are necessary – which are not easy – but you can trust me to do that on your behalf and everyone else’s.

“Because the quicker we bring inflation down, the quicker we can start bringing interest rates down and ease that pressure for homeowners like you.”

Bookmark popover

Removed from bookmarks