NatWest chief ‘did not intend to underplay serious challenges in buying a home’

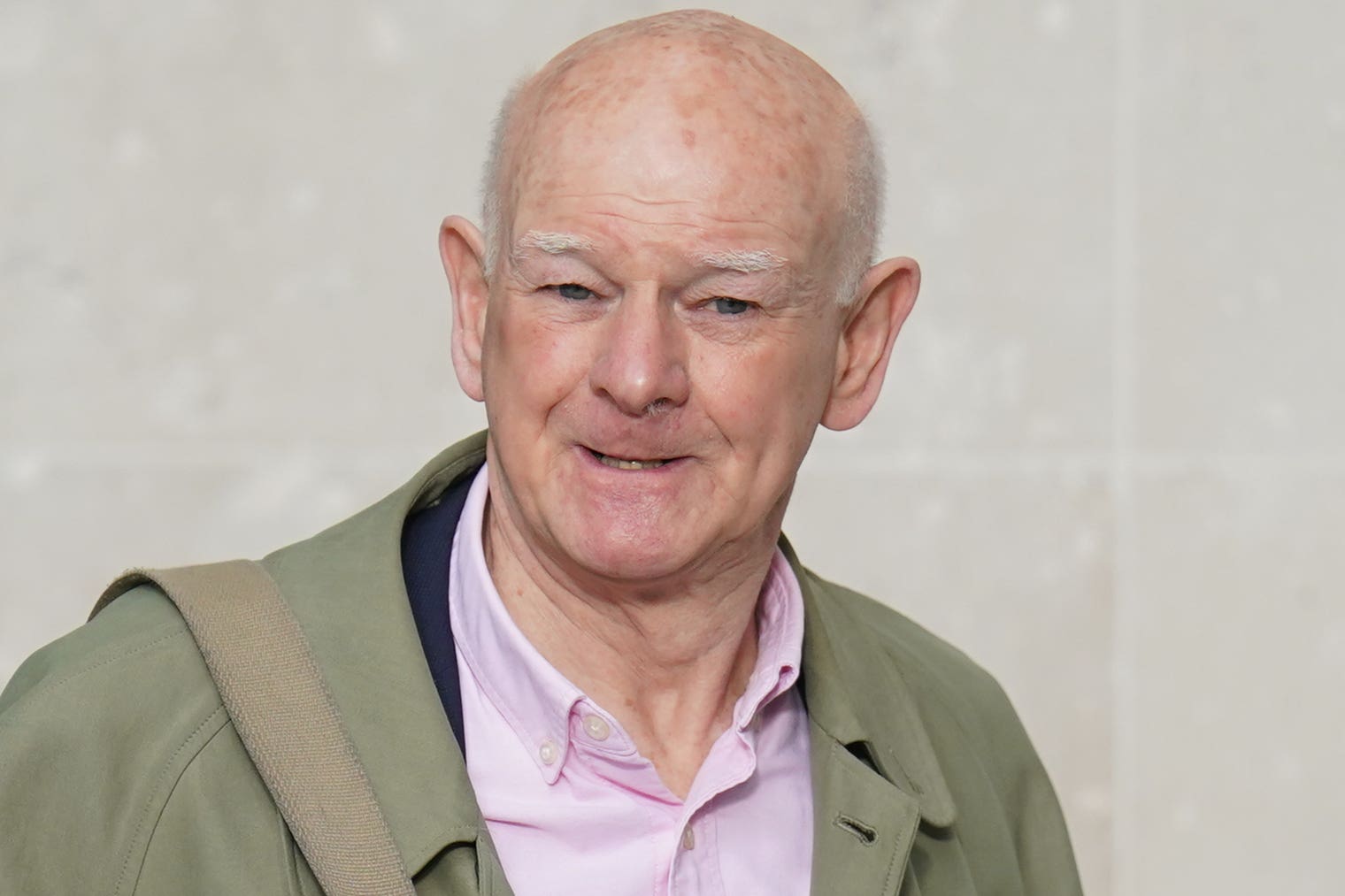

Sir Howard Davies had also said that prospective buyers have to save, and that ‘is the way it always used to be’.

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.NatWest Group chairman Sir Howard Davies has said he “did not intend to underplay the serious challenges” people face buying homes after suggesting in an interview that it was not “that difficult” to get on the property ladder.

The major retail bank chairman had also said that prospective buyers have to save, and that “is the way it always used to be” in an interview with BBC Radio 4’s Today programme.

It provoked outrage, including from campaign group Generation Rent, which said his claims showed he was out of touch with the reality faced by many people attempting to buy a home.

I do recognise how difficult it is for people buying a home and I did not intend to underplay the serious challenges they face.

Clarifying his remarks, Sir Howard said: “Given recent rate movements by lenders there are some early green shoots in mortgage pricing and while funding remains strong, my comment was meant to reflect that in this context access to mortgages is less difficult than it has been.

“I fully realise it did not come across in that way for listeners and as I said on the programme, I do recognise how difficult it is for people buying a home and I did not intend to underplay the serious challenges they face.

“People have to save much more than they did in the past and that is tough for first-time buyers.

“The role for banks in today’s environment is to lend responsibly and support customers to build a savings habit and move towards home ownership.”

Sir Howard had been asked by the BBC when it will be easier for people in the UK to get on the property ladder, and he replied: “I don’t think it is that difficult at the moment.”

Pressed about this claim, he added: “You have to save and that is the way it always used to be.”

He pointed to safeguards introduced after the 2008 financial crisis which prevented people from being able to borrow 100% mortgages, adding: “There were dangers in very easy access to mortgage credit.

“I totally recognise that there are people who are finding it very difficult to start the process, they will have to save more, but that is, I think, inherent in the change in the financial system as a result of the mistakes that were made in the last global financial crisis.”

Ben Twomey, chief executive of campaign group Generation Rent, responded to Sir Howard’s original claims, saying: “What planet does he live on? This is astounding to hear from a senior banker.

“We are in a cost-of-renting crisis that is making it incredibly hard for people to buy a home as we hand a third of our wages every month over to our landlord.

“Interest rates have increased but house prices have yet to correct, meaning we still need to save for a huge deposit, but also would need a high income to afford monthly mortgage repayments.”

Figures from the Office for National Statistics (ONS) show how much house prices have grown over the last decade.

Full-time employees in England could expect to spend around 8.3 times their annual earnings buying a home in 2022, according the ONS.

A decade earlier, the figure was 6.8, while 25 years ago, in 1997, it was 3.5.

The trend is similar in Wales, though the affordability gap is not quite as large, standing at 6.2 times annual earnings in 2022, up from 5.6 in 2012 and 3.0 in 1997.

Across England and Wales, while average earnings doubled between 1997 and 2022, average house prices increased by four and a half times.

“Over the last 25 years, housing affordability has worsened in every local authority, especially in London or surrounding areas,” the ONS added.