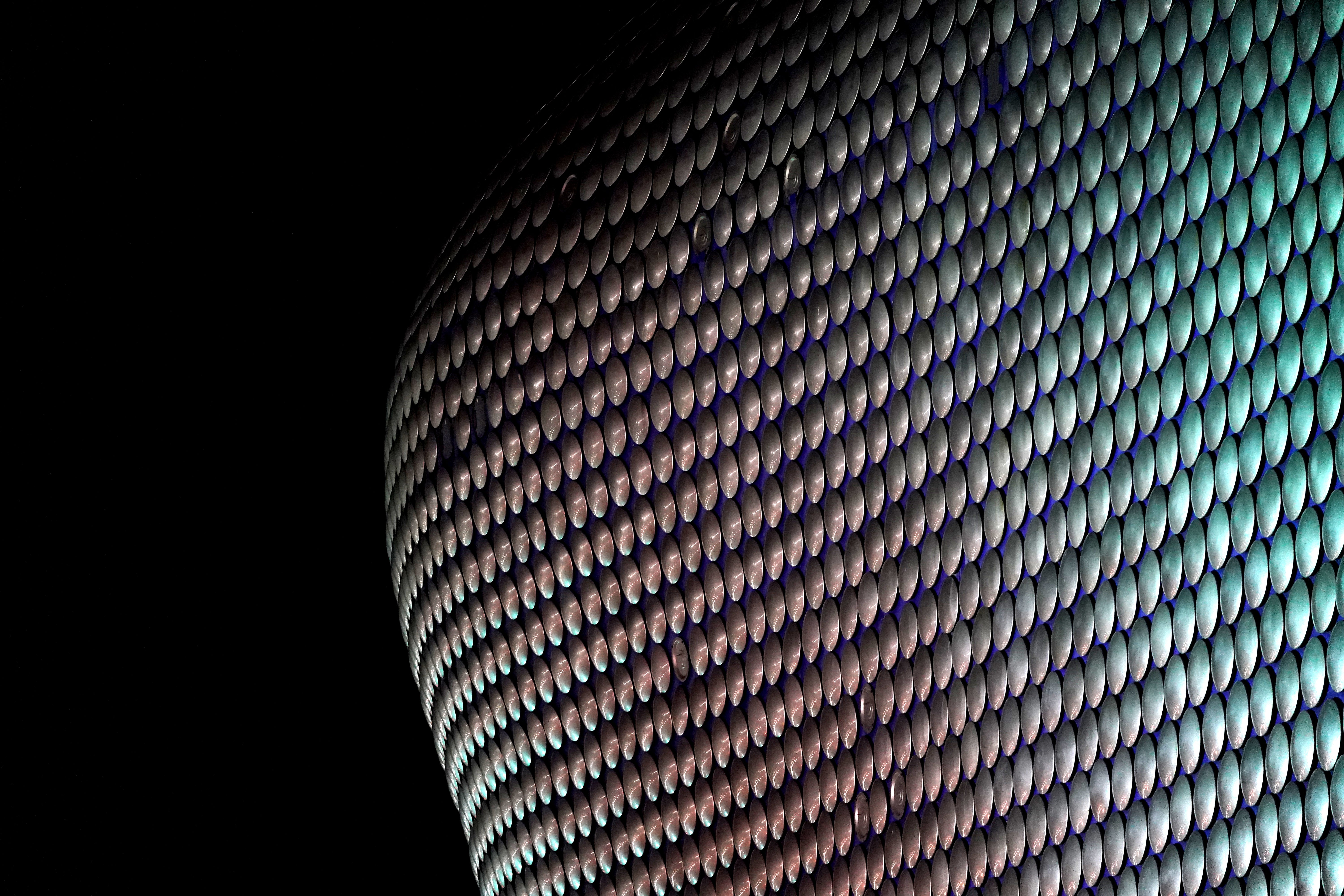

Hammerson bosses to transform empty retail space into hotels, offices and homes

The firm said it also saw a 6.4% decrease in the value of its portfolio to around £5.5 billion.

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.The new boss of Birmingham Bullring landlord Hammerson has laid out a new growth strategy which will see the group seek more opportunities away from retail.

The property giant said on Thursday that it plans to “reinvigorate” its assets and drive growth filling empty retail units with a variety of offers in a bid to improve footfall.

Rita-Rose Gagne, who joined the London-listed firm late last year, said this could include food halls, events spaces and roof-top theatres to boost trade in the short term.

However, she said the firm will repurpose some void retail spaces for alternative uses such as homes, hotels and office space.

Hammerson said it sees a particularly strong opportunity to pursue this shake-up across its current department store pace, where it has more than 800,000 sq ft of empty space or short-term leases.

“As we emerge from a unique moment in time, I see a pathway to create sustainable value as we transform the business to become more agile and able to anticipate and respond to this change,” said Ms Gagne.

“We own flagship destinations around which we can curate and reshape entire neighbourhoods and city centre spaces for generations to come.”

The group, which also owns the Brent Cross shopping complex, updated investors as it posted a pre-tax loss of £354 million for the six months to June.

Hammerson said it also saw a 6.4% decrease in the value of its portfolio to around £5.5 billion.

The firm suggested it is on the path to recovery following the pandemic but highlighted that it will continue to feel the impact of the rent moratorium for tenants, which was recent extended until March.

The policy, which bans landlords taking tenants to court over unpaid rent, “has led to some retail businesses openly ignoring their rental obligations when they have the means to pay”, the company said.

It said that the Government “continues to undermine the attractiveness of the sector and its investment case” through the extension while it also called for a major overhaul of business rates.

Shares in the company were 1.6% lower at 36.9p in early trading.