Debt management office given around 10 days’ warning pre mini-budget, boss says

Robert Stheeman said that his office was not fully briefed before the controversial fiscal plan was unveiled last month.

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.The head of the UK’s debt management office has said that it was given around 10 days to determine how much cash it needed to raise ahead of the former chancellor’s mini-budget.

Robert Stheeman, who is in charge of overseeing the UK’s £2.1 trillion Government bond market, echoed recent comments from the Bank of England that it was not fully briefed before the controversial fiscal plan was unveiled last month.

Mr Stheeman told the Treasury Committee that his office was given around 10 days to a fortnight to come up with a number for debt financing amid the then-chancellor’s sweeping tax-cutting plans.

He said: “We normally have more warning before fiscal events. There are normally discussions between the Treasury and the Office for Budget Responsibility (OBR) to work out exactly what the costings of any measures are, and the number that we are given derives from those discussions.

“In this case, we were given a specific number, but the entire timetable to design a significantly different remit was compressed.”

He said that the office’s overall financing requirement increased from just over £160 billion to £234 billion, which he admitted was “not an insubstantial amount”.

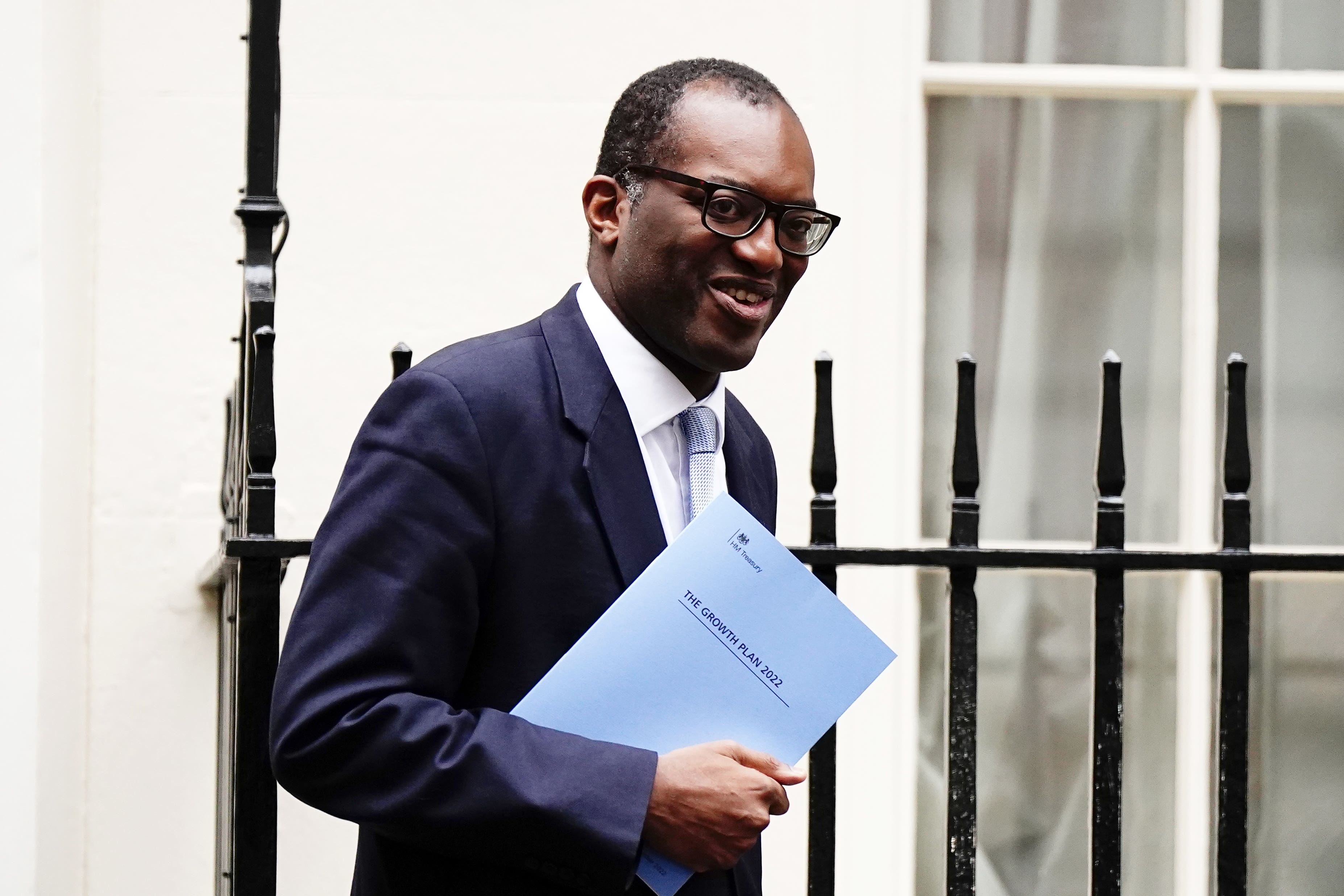

Despite the majority of former chancellor Kwasi Kwarteng’s fiscal policies being sharply reversed by new Chancellor Jeremy Hunt, Mr Stheeman confirmed that his office’s current finance requirements are “still very much that which was announced on September 23.”

He said: “I am confident that we will meet that. But I am not saying that it is going to be easy.

“The market is clearly stressed, and I don’t think we should pretend otherwise.”

Last month, the deputy governor of the Bank of England, Jon Cunliffe, admitted that there was a clear UK-specific element to recent market volatility, rather than tying it up with a downturn across global economies.

And Mr Stheeman echoed the sentiment on Wednesday, confirming that the gilt market turbulence, which sparked a costly intervention from the Bank of England, was an issue that started at home.

He said: “We have to acknowledge that quite clearly UK influences were prevalent, without a shadow of doubt.

“We saw that because the volatility in yields exceeded by a very large margin the volatility that you would have seen in the US treasury market or the European bond market.

“I do want to be very clear that what we saw in the gilt market was clearly the impact of a UK-specific situation.”