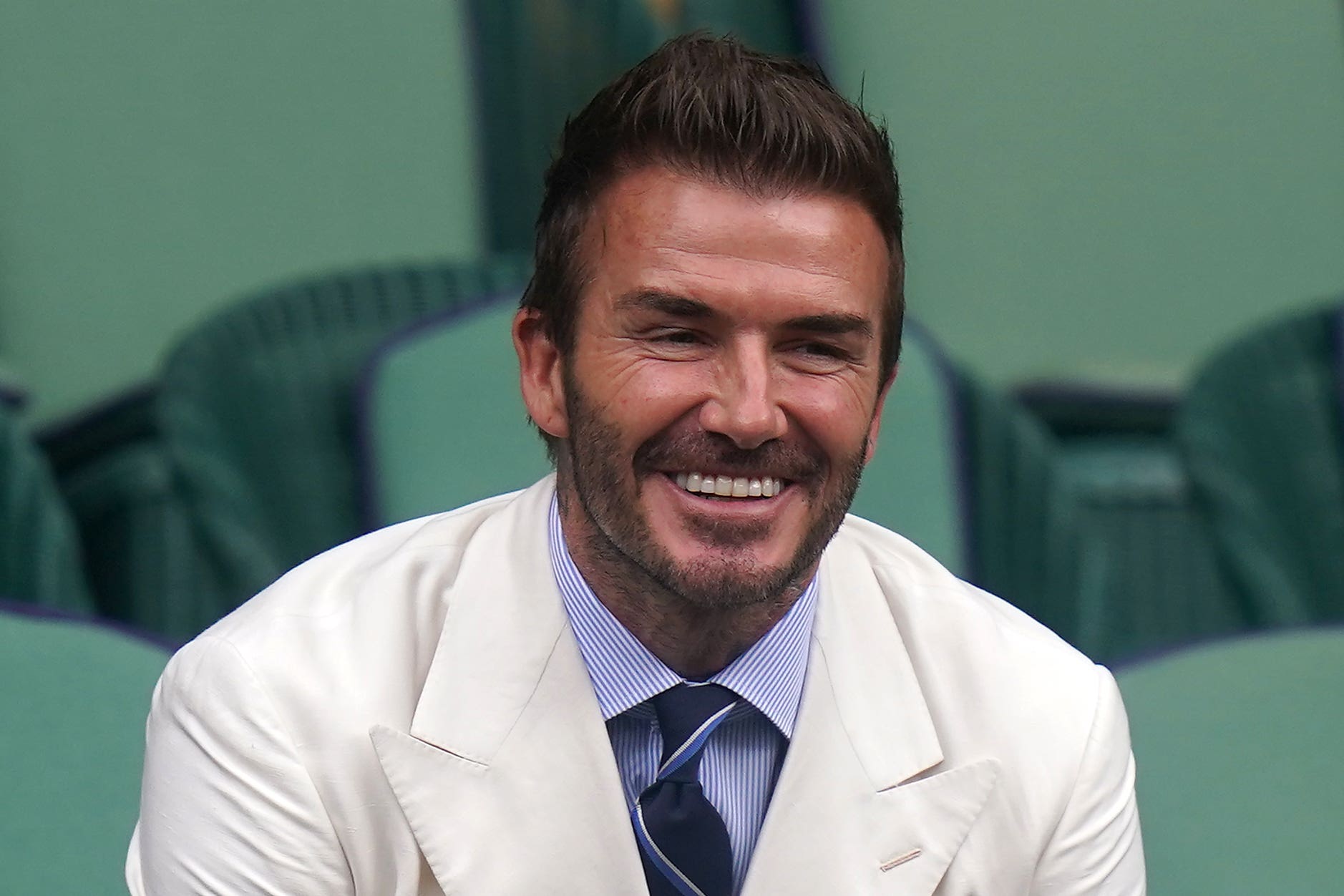

David Beckham-backed cannabinoid firm Cellular Goods slumps to almost £6m loss

Shares in Cellular Goods, which is developing skincare products using cannabis-derived chemicals, fell in early trading.

David Beckham-backed cannabinoid business Cellular Goods has posted widening losses for the past year after the firm witnessed delays to growth.

Shares in the company, which is developing skincare products using cannabis-derived chemicals, fell in early trading after it posted a £5.99 million pre-tax loss for the year to August 31, growing from a £3.33 million loss last year.

It said the loss was driven by higher costs as it ramped up commercial operations, and invested more in marketing and growing its brand.

The firm also recorded “slower than expected” product sales, blaming “challenging industry and regulatory conditions”.

Cellular Goods only delivered £28,904 of revenues for the year after new product launches and increased production were pushed back.

We are also in negotiations for an acquisition to provide greater scale in a highly fragmented market, accelerate growth and generate long-term value for shareholders

The release of its ingestible products was held up by regulators earlier this year.

The group told shareholders that trading over the three months since the end of August “improved significantly”, as bosses highlighted “cautious optimism”.

David Beckham owns a roughly 5% stake in the company, which raised £13 million when it launched on the stock market early last year amid growing fanfare about the cannabinoid sector.

Cellular Goods also recently announced its intention to acquire rival Cannaray Brands in a reverse takeover deal.

Darcy Taylor, chairman of the business, said: “Despite achieving major operational milestones during the year, significant investment in new products and a broad-scale marketing campaign that meaningfully boosted our brand awareness, it did not translate to our revenue growth expectations due to a challenging market and regulatory environment that is affecting the growth of both the industry and the company.

“In response, we have halved our annual cost base and continue to look for further cost optimisation as we invest in the business to position it for a significant turnaround when trading conditions normalise.

“We are also in negotiations for an acquisition to provide greater scale in a highly fragmented market, accelerate growth and generate long-term value for shareholders.”

Bookmark popover

Removed from bookmarks