Chancellor faces choice between borrowing or huge hit to households, say experts

Teachers and other public sector workers could see hundreds of pounds effectively wiped from their incomes due to soaring prices

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.The Chancellor faces a “huge judgment call” on whether to borrow billions more or allow households to face what could be the biggest hit since the 1970s, experts have said.

The cost of living is set to soar this year, not least due to the rising price of energy, which has been pushed up by Russia’s invasion of Ukraine.

Without intervention, public sector workers face an average real-terms pay cut of around £1,750 due to inflation, while many households will struggle to keep up with bills.

While he had little choice over big state action through the pandemic, his response to this crisis will tell us more about how he sees the limits of government in protecting citizens from buffeting by external forces

There are three massive choices facing the Chancellor on what was originally meant to be a fairly uneventful Spring Statement this month, the Institute for Fiscal Studies (IFS) said.

Either he will have to borrow billions or risk the worst hit to households for decades.

He will also have to impose severe real-term pay cuts on teachers, nurses and others in the public sector, borrow even more to pay them better or cut back spending on other public services.

As war rages in eastern Europe the Chancellor will also have to decide whether to allow defence spending to fall over the next three years, or again borrow to boost it.

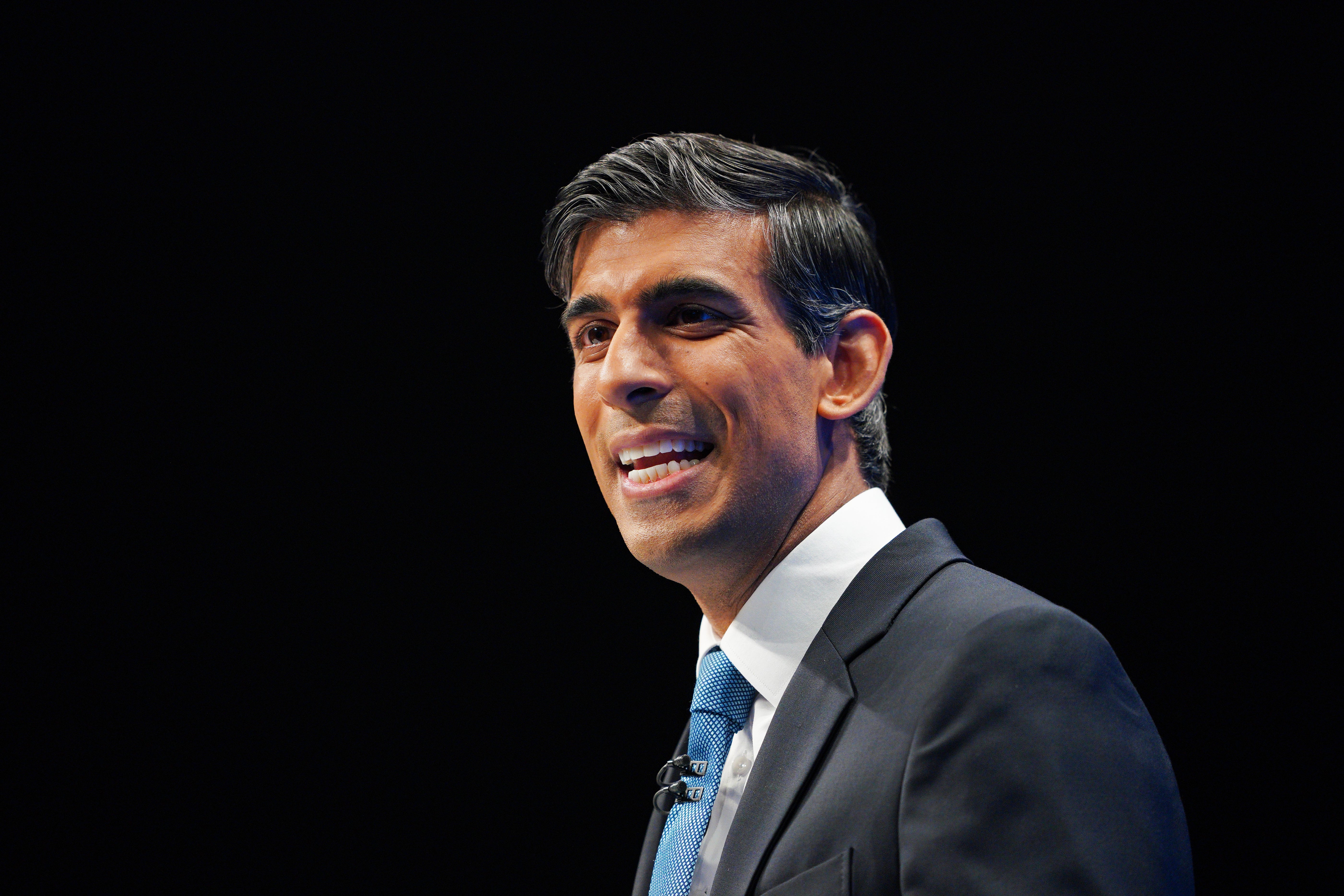

“At the Spring Statement Rishi Sunak has to make a huge judgment call,” said IFS director Paul Johnson.

“Will he do more to protect households from the effects of energy prices which have risen even further in the last two weeks?

“If he doesn’t then many on moderate incomes will face the biggest hit to their living standards since at least the financial crisis.

“If he does, then there will be another big hit to the public finances.

“While he had little choice over big state action through the pandemic, his response to this crisis will tell us more about how he sees the limits of government in protecting citizens from buffeting by external forces.”

The jump in energy prices since Russia launched a full-scale invasion of Ukraine is likely to add to already high household energy bills.

In all, energy prices are set to add around £43 billion to households’ costs, meaning that the Chancellor’s £9 billion package will offset only around one fifth of the rise.

If Mr Sunak wants to achieve the same level of protection as he announced earlier this year, soaring prices will need around £12.5 billion on top of the £9 billion already committed, the IFS said.

According to forecasts, someone on a median salary of £27,500 is likely to be around £800 worse off, that’s £300 more than earlier forecasts.