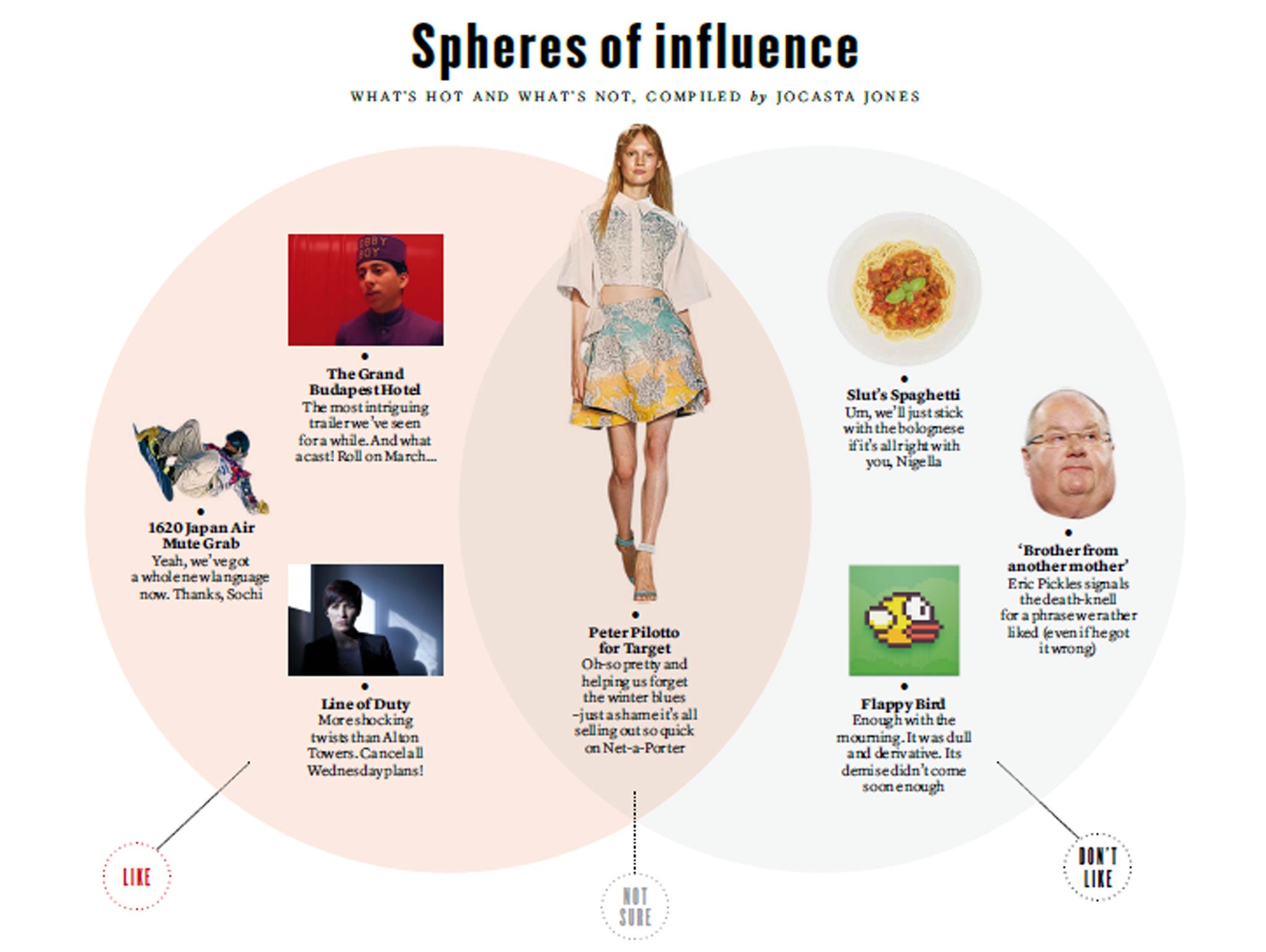

On the agenda: The Grand Budapest Hotel; Line of Duty; Peter Pilotto for Target; Flappy Bird; Slut's Spaghetti; pensions

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Middle-class problems: Pensions

By Mike Higgins

There are many scary websites, but none more so than the pension calculator sites. You enter the annual pension you'd like for a "comfortable retirement", then what you can afford to put away each month. The site then informs you that you're going to need to save three times your pay packet. You sit at the kitchen table and have a cry. And forget about your pension for another couple of years.

Except now you can't. As of this month, most employees have been automatically enrolled into a "workplace pension" scheme. Not one of those ones your Uncle Brian's golfing partner Gary has – a suitcase bursting with cash and diamonds delivered each month ad infinitum and dignified by the term "final-salary pension". No, yours is probably a "defined contribution" scheme, which is financial-adviser speak for "Hmm, good luck with that."

You put a bit in, your employer does the same, you get some "tax relief", and it all ends with a fat-fingered fund manager who takes an almighty 25-year punt on the stock market. Great.

You can opt out of this Government scheme, and indeed all private pensions. That way, you will dodge the various scandals that tend to drag around after the word "pension": ruinously low annuity rates, for instance, or mis-selling. But how do you provide for your old age?

How about this: a) crank up the mortgage; b) buy that doer-upper; c) pray to god that mortgage rates stay at 0.00008 per cent; d) pray to some other god that the property bubble lasts for 20 years; e) then flog; f) kerching.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments