25 years of Disney: How Darth Vader, Iron Man, Elsa and Pixar's geniuses helped the company conquer the world (again)

Disney is set to dominate the big film releases this year - how did the once ailing filmmaker turn around its fortunes? Steve Rose investigates

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

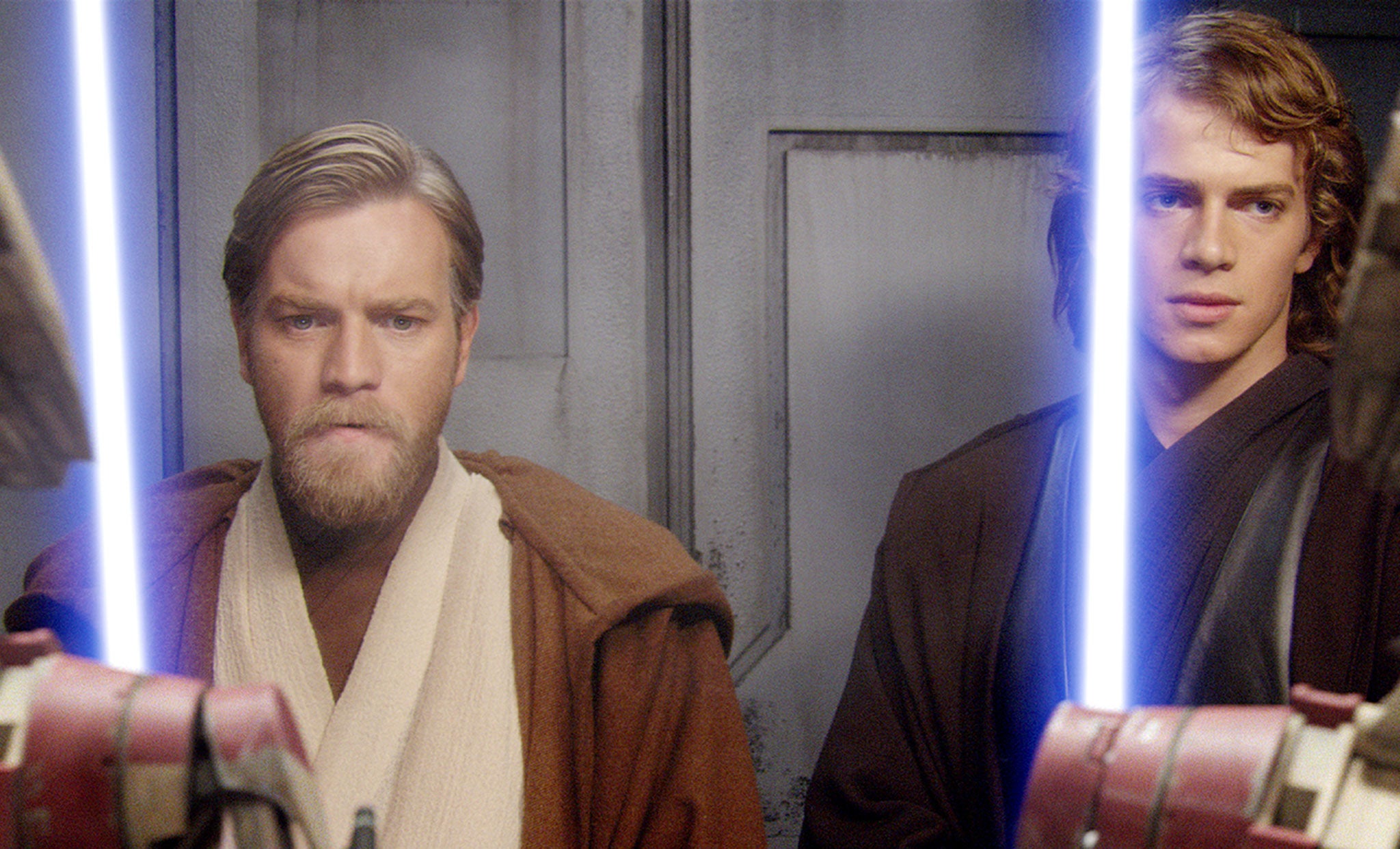

Your support makes all the difference.We're only a month into 2015 but already the competition for the year's biggest movie looks like a two-horse race. Will it be Avengers: Age Of Ultron, the second assembly of Marvel's all-star superhero team? Or will it be Star Wars: The Force Awakens, the hugely anticipated third coming of George Lucas's space gospel? Both movies are expected to break a billion dollars at the box office, but one major player doesn't much care which one wins the race: the Walt Disney Company. Technically, both movies are theirs.

As is Big Hero 6, this weekend's big new family animation. So are the two new Pixar movies coming this year, plus a new live-action Cinderella, and a few other surprises. When it comes to the question of which studio is going to dominate 2015, it's looking like a one-horse race.

This doesn't happen very often. For decades, the movies have been dominated by a handful of Hollywood players: Fox, Warner Brothers, Paramount, Universal, Sony and Disney. Last year, these six studios accounted for over 70 per cent of revenues, as they do most years, but no studio ever takes more than 20 per cent of the pie, and none of them has consistently bettered the others. Now, though, the others are looking at Disney's release slate and wondering what will be left for them.

How did this happen? On the face of it, the answer is simple: the Mouse House has deep pockets. Its movies have put more than $4bn into those pockets in each of the past two years, but in relative terms, that's small change. The Walt Disney Company took nearly $50bn in 2014, and the lion's share came from its TV holdings (it owns the ABC network and sports colossus ESPN), merchandising, and its theme parks. But the movies are the magic beans. Without them, there are no characters to lure families to the theme parks, or to watch on Disney's TV channels, or to play in new video games, or to put on T-shirts and backpacks and toothbrushes. And about a decade ago, Disney realised it was running out of beans. Yes, it had good old Mickey Mouse and Donald Duck and its harem of fairytale princesses, but they had not had a homemade animated blockbuster hit since The Lion King back in 1994.

So Disney went shopping. First, in 2006, the company acquired its partner, and potential usurper, Pixar for $7.4bn. Then, in 2009, it acquired Marvel, the comic-book company whose own forays into movie production were surpassing all expectations. That set them back another $4bn. Then, in the biggest surprise of all, George Lucas sold the entire Star Wars universe to Disney in 2013, for another $4bn. Alongside Donald, Mickey and the princesses in those theme-park ads, Disney could now put Woody and Buzz, Captain America and Spider-Man, Han Solo and Darth Vader, all merrily waving together, or possibly thumbing their noses at their Hollywood rivals.

Part of the story of Disney's transformation is explained in Creativity, Inc, a recent book by Ed Catmull. Catmull was one of Pixar's co-founders, with John Lasseter and Apple supremo Steve Jobs. Together, they had grown Pixar into a producer of consistently innovative, Oscar-winning, blockbuster animations – like Disney used to make. They had done so in partnership with Disney from the start. Under their three-picture deal, Pixar made the movies and Disney financed, distributed and owned them.

By October 2005, the deal was due for renewal but relations between the two companies were at an all-time low. Pixar wanted to develop more pioneering film ideas; Disney wanted profitable sequels. Michael Eisner, Disney's chairman and CEO at the time, had halted discussions. Pixar were looking at other prospective partners. Eisner even set up a new Disney animation division which was making a start on Toy Story 3 without Pixar. "For John [Lasseter], it was almost as if Eisner were trying to kidnap his children," Catmull writes. "He loved Woody, Buzz, Slinky Dog, Rex and the rest like he loved his own five sons and was heartbroken at the thought that he couldn't protect them."

Catmull and Lasseter were somewhat stunned, therefore, when Steve Jobs suggested they sell Pixar to Disney. Pixar was like a yacht, Jobs explained, "A merger will put us on a giant ocean liner, where big waves and poor weather won't affect us as much. We'll be protected." Before they made up their minds, Jobs pleaded with them, "Get to know Bob Iger".

Iger was Disney's new CEO. Things had not been going well for Michael Eisner, who had been in charge of Disney since 1984. It was Eisner who initially revived Disney's animation fortunes, creating hits such as The Little Mermaid, Beauty and the Beast and Aladdin and The Lion King. But his magic touch seemed to be deserting him, as did his allies. In 2003, Roy E Disney, Walt's nephew and the last surviving family member involved in the company, resigned in protest at Eisner's management. An unprecedented 45 per cent of shareholders voted against Eisner at the next annual meeting. Worse still, in 2004, rival media conglomerate Comcast launched a $66bn takeover bid for Disney. Eisner was out.

Iger was not initially seen as a promising replacement. Where Eisner was a genuine Hollywood heavyweight, Iger was described as a "bland, scripted CEO". A former weatherman from upstate New York, he had come to Disney via ABC television, which Disney acquired in 1995, and had been Eisner's number two since 2000. But when Ed Catmull followed Steve Jobs's advice and got to know Iger, he was surprised. Iger asked questions rather than holding forth. He was humble and curious. "For the first time in all the years that Pixar and Disney had worked together, someone from Disney was asking what we were doing that made our company different," says Catmull. Even more surprisingly, Iger said he didn't want Disney to take over Pixar, he wanted Pixar to take over Disney.

Three weeks after Iger took charge, that's effectively what happened. Pixar sold up, and Lasseter and Catmull were put in charge of both Pixar and Disney's animation studios (Jobs, then Disney's largest shareholder, became a board member). It seems to have paid off, most conspicuously with Frozen, the highest-grossing animated movie of all time, and a cultural phenomenon like Disney used to manufacture. Throw in the critical and commercial hits Wreck-It Ralph and now Big Hero 6, and Disney's own animation now looks to be eclipsing Pixar's.

Roy Conli, one of Big Hero 6's producers and a Disney veteran of 20 years, credits Iger and Lasseter with bringing about a cultural transformation in the company. "We had gone through an amazingly fruitful period in the Lion King days, when we were very much artist-driven," he says. "But then we went into a period when we became much more executive-driven. One of the things I think Bob is so amazing at is he's not a micro-manager. He looks for the best people for the role and then he trusts those people. Immediately when he and John came in, we were back to an artist-driven studio. And I can tell you, that's the only way to run a studio."

Iger has taken a similarly hands-off approach with Disney's other big acquisitions. Shortly after the Marvel takeover, he promised fans, "There will be no Disneyfication of Marvel," and he's been true to his word. Then again, nothing exactly needed fixing. Since Marvel began financing their own movies in 2004, under studio head Kevin Fiege, pretty much everything they've touched has turned into a blockbuster. Marvel's multi-movie masterplan building up to the first Avengers movie – with Iron Man, Hulk, Thor, and Captain America – looked > impossibly ambitious, but it has paid off handsomely. Avengers Assemble was the highest-grossing movie of 2012, taking over $1.5bn worldwide. The year after, Iron Man 3 took another $1.2bn (only Frozen did better in 2013). Even Guardians of the Galaxy surpassed all expectations, becoming last year's highest earner in the US and the third highest worldwide – not bad for a knockabout space adventure starring a tree and a talking raccoon.

It was a slightly different story with Lucasfilm. Iger's reassurances of continuity also persuaded George Lucas to relinquish control of his precious Star Wars universe. Disney immediately mitigated the disturbance in the Force by hiring Lost/Star Trek supremo JJ Abrams – the fans' top choice – to direct the next three sequels. According to Lucas, Disney and Abrams have ignored his outlines for the sequels and gone their own way, though after seeing what Lucas did to Star Wars with his own trilogy (Episodes I to III), few fans have complained.

The culture Iger seems to have created at Disney appears to be the exact opposite of the one Walt Disney imposed on the company. Walt himself was very much the boss – autocratic, paternalistic, surrounded by yes-men and liable to take all the credit himself. Now Disney feels like a collection of mini-studios, each being allowed to do their own thing. To use a Star Wars analogy, more of a rebel alliance than an evil empire.

But there are other, more Death Star-like ways in which Disney is unique, though. It's a beast that needs feeding, and the bigger it gets, the hungrier it gets. Disney is also the world's largest theme-park operator. Last year, it hosted 132 million visitors. The corporation employs 180,000 people. All this requires a never-ending supply of those magic beans. Disney's recent manoeuvres should keep it satisfied – the Star Wars universe has a database of 17,000 characters, the Marvel universe over 40,000 – but nobody believes Disney's concerns are solely artistic.

"Disney like to own what they have 100 per cent," says Marc Graser, a senior editor at Variety and longtime Disney-watcher. "It gets messy financially if you have to split revenues. So with Pixar, even though they had the distribution deal, they waited to integrate the characters into their theme parks until they owned the company outright. It's the same thing with Star Wars. They had the Star Tours ride, but they weren't going to do anything more till they owned all the films. Now they do, they have giant plans for it." Late last year, Iger promised a much larger Star Wars presence in Disney theme parks globally, with attractions based on the new movies. "Why not?" he said. "We bought the thing. We can do that now."

China, in particular, is Disney's focus. Having sorted out the movie side, Iger's current preoccupation is said to be the new Shanghai Disneyland, set to open next year. It's Disney's biggest yet, a huge investment of $5.5bn. As well as the traditional 'Magic Kingdom'-style theme park, centred on the biggest Disney castle yet, Shanghai Disneyland will feature six themed lands. It's not just an attraction, it's a seed for spreading the Disney brand even further. "It has the potential ... to build a foundation for our brand in China that could pay off for generations to come," Iger told Chief Executive magazine. "The movies that we make – Marvel, Pixar, Disney, Star Wars – are not only valuable brands in China, but these franchises will all have a presence eventually in this park. It certainly sets up our movie business better in what will be the number one movie market in the world."

When you look at Disney's movie output, it's pretty much all geared towards feeding the beast. In the past, the company made quality live-action movies, too, either through its own Touchstone Pictures or through Miramax Films, which it acquired in 1993. In previous decades, Disney produced or co-produced scores of classics, from Splash to Pulp Fiction, Good Will Hunting to The Royal Tenenbaums. Looking at the Disney slate now, though, it's all tentpole movies and franchises: superhero movies, family animations, sequels and remakes.

In fact, looking towards the end of the decade, the line-up is wearyingly repetitive. Marvel's plans till 2019 include new Thor and Captain America movies, a two-part Avengers sequel, a Guardians of the Galaxy sequel and new solo movies for characters like Ant-Man, Doctor Strange and Black Panther. After Big Hero 6, Disney has another two animated features lined up for next year, plus a live-action Jungle Book to follow Kenneth Branagh's Cinderella. Pixar has a Finding Nemo sequel. And there'll be at least one new Star Wars movie a year, between the three sequels, and the spin-off Star Wars movies on individual characters, such as Han Solo or Yoda.

It's not just Disney, though. In her recent book, Blockbusters: Hit-Making, Risk-Taking and the Big Business of Entertainment, Anita Elberse, a Harvard Business School professor, argues that the trend across movie studios (and elsewhere) has been away from small and mid-sized dramas and towards big bets, big marketing and big hits. "The highest-performing entertainment businesses take their chances on a small group of titles and turn those choices into successes by investing heavily in their development, supporting them with a high level of promotional spending, often well in advance of their release into the marketplace ('Coming soon to a theatre near you'), and distributing them as widely as possible," she writes. "It may not look anything like the way products in other sectors of the economy are introduced, but it works." The risks appear to be bigger, but the returns for, say, a $200m blockbuster can be far higher than those of four $50m movies, so ironically blockbusters are a safer bet.

Which means every other studio is playing the same game as Disney. Warner Brothers, which pioneered the modern blockbuster strategy with its Harry Potter, Lord of the Rings and Batman franchises, is currently preparing its own comic-book movie assault. It owns the characters of Marvel's rival, DC comics – including Batman, Superman and Wonder Woman – and is planning to roll out 10 superhero movies before 2020.

Also expect the return of the X-Men, Spider-Man, Fantastic Four, not to mention James Bond, Terminator, Planet of the Apes, Pirates of the Caribbean, Jurassic Park, Madagascar, Despicable Me, Ice Age, How to Train Your Dragon. And let's not forget James Cameron's three Avatar sequels. Franchise fatigue sets in just listing these titles, but when it comes to the box office, audiences are still lapping it all up – so far. The losers in this game are the quality dramas, all things edgy, arty, serious – grown-up. Looking at this year's Oscar nominees, they are almost all independently financed: Birdman, Boyhood, The Theory of Everything, The Grand Budapest Hotel. The only studio-funded Best Picture nominee is Warners' American Sniper.

The only hope is that studios occasionally divert some of their surplus blockbuster cash into new, risk-taking ventures. Warner Brothers did it with Gravity – a $100m gamble that paid off commercially and critically. When Disney has tried it in recent years, it's gotten its fingers burnt – with ill-fated Mars odyssey, John Carter and Johnny Depp's Lone Ranger reboot. The only fresh Disney prospect on the horizon is George Clooney-led sci-fi adventure Tomorrowland, due out in May. If it is a success, the good news is, there's already an area of Disneyland named after it, so they won't need to build a new theme park. Either way, resistance against Disney appears to be futile. The Empire has struck back.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments