Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

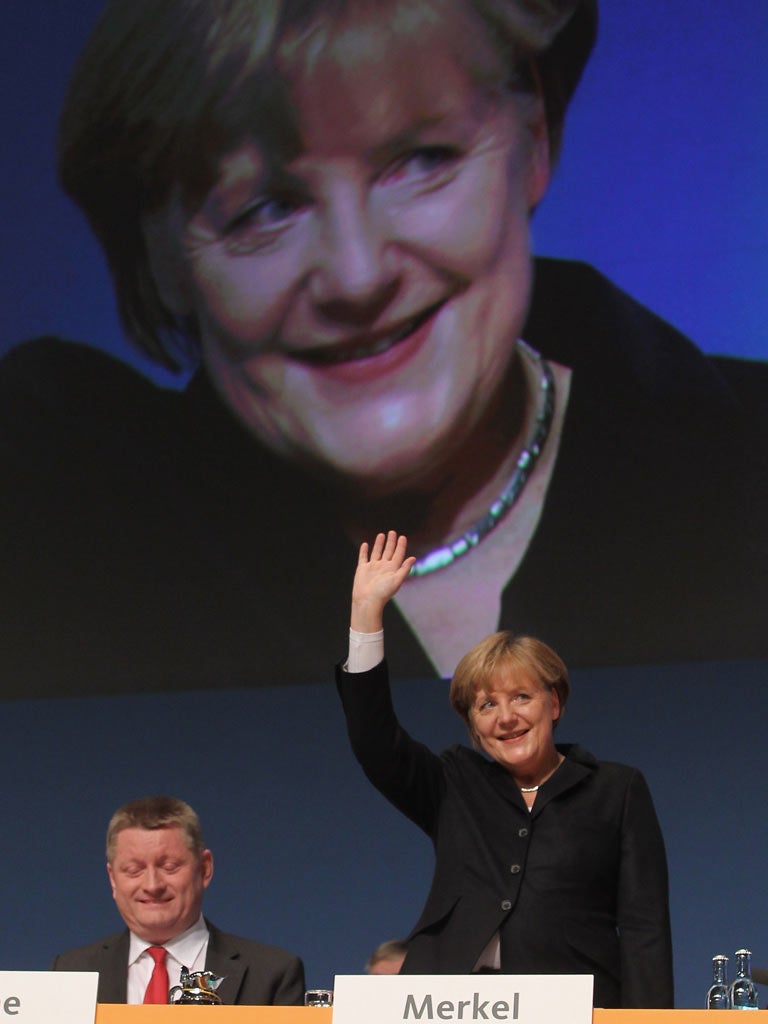

Your support makes all the difference.Chancellor Angela Merkel told political supporters yesterday that the eurozone debt crisis presents Europe with its toughest challenge since the Second World War, and insisted that closer political union and tough fiscal sanctions offered the best hope of weathering the storm.

In an uncharacteristically emotional speech to the annual congress of her ruling conservative Christian Democratic Party in Leipzig, Ms Merkel said that Europe should focus more than ever on forming a "political union" that could underpin the euro and enable the union to emerge strengthened from the crisis.

"Europe faces one of its toughest, perhaps the toughest hour since the Second World War," Ms Merkel told her supporters, "if the euro fails, then Europe fails. We want to prevent this and we will prevent this. This is what we are working for because it is such a huge historical project," she insisted. The German leader defended the setting up of the €440bn rescue fund, which had been opposed by several MPs in her own party, and reiterated German calls for "better budgetary control" throughout the bloc. However, she rejected guaranteed euro-denominated bonds as a solution to the debt crisis.

Ms Merkel said that changes needed to be made to EU treaties to make fiscal discipline enforceable and that automatic sanctions were necessary for countries that flaunted debt ceilings. She also called for the introduction of a financial transaction tax throughout the EU – a measure strongly opposed by the UK Government.

Her demands, which were contained in a resolution her party is expected to approve, are likely to cause concern in Paris and London. France is opposed to the idea of automatic sanctions. David Cameron's Conservative-led Government takes a dim view of greater European integration and is worried that eurozone financial regulation could lead to a two-speed Europe that would endanger the single market. Ms Merkel, along with ECB policymakers, has firmly rejected the idea. She has also let it be known that she does not enjoy being "lectured" by non-eurozone leaders.

European shares recovered slightly yesterday, following the appointment of former financial experts Lucas Papademos and Mario Monti as the new prime ministers of Greece and Italy. The "troika" of inspectors from the International Monetary Fund, ECB and EU began arriving in Athens yesterday to assess whether Greece could qualify for its second €130bn bailout and a €8bn tranche from an earlier bailout.

Elsewhere, in a sign that financial contagion is not over, yields on Spanish government debt rose above 6 per cent for the first time since August. Spanish debt is now trading at its highest level since the European Central Bank intervened in the summer.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments